A while ago we wrote about efforts by French regions and councils to take action against tax havens. Other initiatives, elsewhere, have been bubbling up too. Now, from the newly created Tax Haven Free, an international network to encourage local governments to cut out tax havens from their … [Read more...]

Country by Country

Tax justice and modern-day colonialism: Areva vs. Niger

From Reuters, an excellent Special Report: "Niger has become the world's fourth-largest producer of the ore after Kazakhstan, Canada and Australia. But uranium has not enriched Niger. The former French colony remains one of the poorest countries on earth." … [Read more...]

Survey: the corporate tax debate is biting the corporations

From tax advisers Taxand, who have just conducted a global survey of corporate Chief Finance Officers (CFOs): 76% of survey respondents said that the exposure in the media of corporate tax planning activity has a detrimental impact on a company’s reputation 31% said that the intense media … [Read more...]

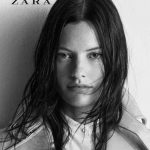

Fashion retailer’s tax dodges boost European inequality

Bloomberg tax star Jesse Drucker has another fine article out about the Spanish retailer Inditex, the parent of high street retail giant Zara. We would urge you to read it. Among many other things, it contains: "In the past five years, Inditex has shifted almost $2 billion in profits to a tiny … [Read more...]

Report: the Sorry State of U.S. Corporate Taxes, 2008-2012

A major new report from the indefatigable Citizens for Tax Justice in the U.S. The Executive Summary begins: The Sorry State of Corporate Taxes What Fortune 500 Firms Pay (or Don’t Pay) in the USA And What they Pay Abroad — 2008 to 2012 … [Read more...]

The Fair Tax Mark – coming to the UK

Richard Murphy and Ethical Consumer today launch the Fair Tax Mark: "The world’s first independent accreditation scheme to address the issue of responsible tax." … [Read more...]

New TJN briefing: OECD’s BEPS project for developing countries

TJN is pleased to publish a new briefing paper looking at the implications for developing countries of the OECD's widely referenced Base Erosion and Profit Shifting (BEPS) project, which is designed to find ways to tackle the deficiencies in the international tax system. It is available in English … [Read more...]

France’s CAC 40: over 1500 tax haven affiliates

From Le Monde: "The corporations in the CAC 40 [France's benchmark stock exchange index of the 40 biggest French stocks] have over 1,500 affiliates in tax havens, according to a study published on Thursday by the journal Project . . . cross-checked with authoritative studies data (the work of the … [Read more...]

Three fifths of multinational CEOs want country by country reporting

From Christian Aid: "Two-thirds (66 per cent) of the CEOs of large UK firms surveyed agreed that ‘multinationals should be required to publish the revenues, profits and taxes paid for each territory where they operate’. PwC’s research, which involved 1,344 interviews with CEOs in 68 countries, … [Read more...]

Links Feb 7

Delayed European Parliament vote crucial for corporate transparency Eurodad See also: Time for action on financial transparency euobserver Bankers take fight over U.S. anti-tax dodge rules to appeals court Reuters … [Read more...]

Links Feb 6

Global version of FATCA could be a reality in a few years, say industry officials Thomson Reuters / Compliance Complete See also: No more delays for FATCA, says IRS STEP Greek-Swiss tax deal remains elusive Reuters Is Switzerland retreating on Rubik? … [Read more...]

Norway moves on Country by Country reporting

From Sigrid Klæboe Jacobsen, Director of TJN - Norge In December, the Norwegian Parliament voted in favour of implementing country-by-country reporting. The Ministry of Finance has now announced the new regulations which tells us exactly what we’ve got, and what we haven’t got. … [Read more...]

Towards Unitary Taxation of Transnational Corporations, by Sol Picciotto

Towards Unitary Taxation of transnational corporations, Prof. Sol Picciotto, Dec 2012. Original link here. … [Read more...]