From the United Nations General Assembly, the fifth report of the Independent Expert on the promotion of a democratic and equitable international order. The summary goes like this: "The report focuses on impacts of taxation on human rights and explores the challenges posed to the international … [Read more...]

Country by Country

Report: the investor case for country by country reporting

From the FACT coalition: New Report: Investors at Risk by Lack of Corporate Tax Disclosures September 12, 2016 Shareholders Increasingly Stymied by Opaque Corporate Tax Practices as Authorities Crack Down, Finds New FACT Analysis Apple Tax Ruling “Just the Tip of the … [Read more...]

UK moves forward on Country by Country reporting

They said it would never happen - but here it comes. From the UK lower house of parliament, an amendment to legislation which looks like this: This is very welcome news, even though the amendment is far from perfect. … [Read more...]

New report from UK parliament: tax justice to the fore

The UK's All Party Parliamentary Group on Tax has published a report entitled A more responsible global tax system or a ‘sticking plaster’? An examination of the OECD’s Base Erosion and Profit Shifting (BEPS) process and recommendations. They consulted us (among many others) and the result is a … [Read more...]

Two new transparency advances, in UK and US

From Global Witness: "Information on who ultimately owns and controls British companies goes live for the first time today." That's good news, amid all the Brexit brouhaha (and idiotic and dangerous plans to privatise the UK's Land Registry.) Meanwhile, the FACT coalition in the United States … [Read more...]

Anti-corruption summit: UK climbdown, but momentum grows

The UK government has failed to deliver a decisive blow against financial secrecy at its Anti-Corruption Summit. David Cameron failed to convince or compel leaders of British overseas territories and crown dependencies to end their hidden ownership vehicles, despite having called for such a move … [Read more...]

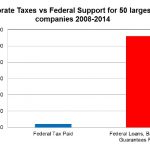

Graph of the day: the broken U.S. tax system

From Oxfam America's new report Broken at the Top: How America’s dysfunctional tax system costs billions in corporate tax dodging: Now read on. … [Read more...]

Press release: Tax Justice Network responds to European Commission proposals for public country-by-country reporting

The European Commission’s proposals mark one more step towards the global adoption of a crucial measure for international tax transparency and accountability – but they are so highly flawed that as things stand they would most likely be bad for European tax revenues, and provide no help at all to … [Read more...]

Take action to back corporate transparency in Europe

Update: see the report in The Guardian here; see Alex Cobham's mode detailed analysis of the failures of what's being proposed, here. We've been campaigning on so-called country by country reporting since 2003, and now world leaders, and many others, are beginning to introduce changes to bring … [Read more...]

The inexorable approach of public country-by-country reporting

The full publication of multinational companies' country-by-country reporting took a step closer today. A begrudging step, which as it stands would negate most of the benefits; but an important one nonetheless, because of the direction of travel. A long road travelled A little background. Public … [Read more...]

Following the Money: French Banks’ Activities in Tax Havens

Update: the English version is coming soon; the French version is here. The following press release is published by Oxfam France; CCFD-Terre Solidaire; and Secours Catholique-Caritas. The accompanying study uses the first fully available public Country-by-Country reporting data from French banks … [Read more...]

The Multinational Enterprises (Financial Transparency) Bill

From the UK parliament, a motion that we noted in our previous blog on Oxfam's new UK tax havens report, and which we strongly support: Multinational Enterprises (Financial Transparency): Ten Minute Rule Motion Caroline Flint That leave be given to bring in a Bill to require certain multinational … [Read more...]

Will the US Implement Country by Country Reporting?

The BEPS Monitoring Group, an expert body (backed by TJN and others) that works on international corporate tax issues, has published its comments on draft US Treasury Regulations on Country by Country Reporting (CbCR, for an explanation for newcomers, see here). Given the large number of … [Read more...]

Tax Justice Network vs. Tim Worstall: a debate on corporate tax

Tim Worstall, a British commentator who has launched a number of vitriolic and personalised public attacks on TJN and TJN staff members in the the past, has been in debate with TJN's Research Director, Alex Cobham, on the subject of corporate tax. (For a flavour of the extraordinary level of … [Read more...]

Europe’s Anti Tax Avoidance Package: adding fuel to the fire?

The European Commission has announced: "The European Commission has today opened up a new chapter in its campaign for fair, efficient and growth-friendly taxation in the EU with new proposals to tackle corporate tax avoidance. The Anti Tax Avoidance Package calls on Member States to take a … [Read more...]