Yes, we can build an open and transparent tax system that works fairly for everyone. Do you know how multinationals shift their profits to dodge their taxes and how we can stop them? Our beautifully illustrated new videos tell you how, narrated in five different languages by our tax justice podcast … [Read more...]

Country by Country

Take action to stop corporate tax cheating in Europe

* SIGN THE PETITION ON CORPORATE TAX TRANSPARENCY NOW * Every year, corporate tax avoidance costs countries around the world an estimated US$ 500 billion or more. One reason for these losses is that companies are able to hide their financial affairs: from tax authorities, and from the public. … [Read more...]

A response to the European court’s bad Apple ruling

Today’s Apple decision confirms that the European Union’s rules against state aid are not up to the job of preventing EU member states operating as tax havens. Powerful tax justice reforms are needed, rather than broader application of state aid rules. Neither the EU nor any other countries will be … [Read more...]

Moving beyond poverty begins with tax justice

The former United Nations Special Rapporteur on Extreme Poverty and Human Rights Professor Philip Alston has concluded his missions to observe the state of human rights in various countries, with strong condemnation of the failures to eradicate poverty. And he begins and concludes his final … [Read more...]

Tax, reparations and ‘Plan B’ for the UK’s tax haven web

The killing of George Floyd by US police in Minnesota, on 25 May 2020, has sparked a public response both more powerful and more international than almost any of the previous cases in a very long line - including Breonna Taylor in Kentucky, 13 March 2020. The demands for justice extend far beyond … [Read more...]

Tax Justice Network Portuguese podcast #13: Pandemia: como acertar no socorro às empresas?

Em meio à crise econômica e sanitária, o governo brasileiro anunciou uma injeção de mais de US$ 185 bilhões para ajudar o setor financeiro — cerca de dez vezes o orçamento do Ministério da Saúde. Enquanto isso, 87% das micro e pequenas indústrias do Estado de São Paulo, por exemplo, não conseguem … [Read more...]

When the factory gates are bolted shut, women need country by country reporting

In recent days a number of sudden and dramatic changes have happened in the labour market in already fragile economies, as the Business and Human Rights Resource Centre has shown. Many workers who are poorly paid and in precarious relationships [read zero or no contracts] with ‘absent’ … [Read more...]

Investors demand OECD tax transparency

Investors responsible for trillions of dollars of assets have called on the OECD to ensure that the country by country reporting of multinational companies is made public. With leading experts, standard setters and civil society groups fully in agreement, the only remaining opposition to this most … [Read more...]

Austrian parliament seizes opportunity for public country-by-country reporting

Just two weeks ago, a resolution on country-by-country reporting at the EU Competitiveness Council missed the qualified majority needed by just one vote. Among those who voted against the resolution was Austria's Minister of Economic Affairs, Elisabeth Udolf-Strobl. But only a few days later the … [Read more...]

Taxing wealth – how to triumph over injustice: Tax Justice Network October 2019 podcast

In this month's episode we speak to Gabriel Zucman about his new book with co-author Emmanuel Saez - The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay. Plus, as Extinction Rebellion holds protests around the world over the climate emergency, we point the finger at the … [Read more...]

We asked our stakeholders to challenge us on our work

Should we at the Tax Justice Network be doing more to engage with organisations in the global south? Should we be focusing more on high-level advocacy or talking more about progressive taxes instead of tax avoidance? These questions and more were put to us at our organisational retreat this spring … [Read more...]

Country by country reporting for the Sustainable Development Goals

I had the honour this week of addressing ISAR35, the 35th annual session of the UN’s Intergovernmental Working Group of Experts on International Standards of Accounting and Reporting (all presentations are available here; my slides are also below). The focus was on developing a framework to carry … [Read more...]

UNCTAD journal highlights tax thought leadership

We're delighted to share a guest blog from Bruno Casella of UNCTAD (the UN Conference on Trade and Development), highlighting the newest edition of their journal Transnational Corporations, which we heartily recommend (and our paper on the history and use of Country-by-Country Reporting will be … [Read more...]

A firewall to protect EU citizens from the Big Four accountancy firms and the tax avoidance lobby: the Tax Justice Network’s July 2018 podcast

In the July 2918 Taxcast: we look at a proposal for a firewall to protect EU citizens from the Big Four accountancy firms and the tax avoidance lobby: we look at a new report from the Corporate Europe Observatory we discuss UN Special Rapporteur on Extreme Poverty and Human Rights Professor … [Read more...]

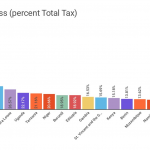

Progress on global profit shifting: no more hiding for jurisdictions that sell profit shifting at the expense of others

The world's largest economic actors are also the least transparent. Multinational companies and their big four advisers have been so effective in lobbying for opacity that their reporting requirements are actually less than is required from even small and medium-sized, purely domestic businesses. … [Read more...]