Book Review: Capital Without Borders: Wealth Managers and the One Percent by Brooke Harrington LSE Blogs "... an important work for our increasingly unequal world". - Listen to an interview with Brooke Harrington in our December 2015 podcast MP's from Africa and Asia pledge to collaborate in … [Read more...]

Blog

An Alternative Approach to Taxing Multinational Companies: new book

We're pleased to announce this latest important book which you can download and read for free here. We're sharing here a blog written by Alex Cobham of the Tax Justice Network, originally published here by the International Centre for Tax and Development: … [Read more...]

A great day for tax justice: coming closer to ending anonymous ownership

Today will be remembered as a milestone for progress on tax justice. We'd like to think of it as the first steps into a true post-#PanamaPapers era when real, concrete action was taken by Members of the European Parliament towards achieving financial transparency in the public interest. Today we're … [Read more...]

New book: The Despot’s Guide to Wealth Management

There's a new book out that looks very interesting reading from Professor Jason Sharman with the rather catchy title: The Despot’s Guide to Wealth Management: On the International Campaign against Grand Corruption. It has been reviewed here in The Economist. We haven't read it yet, but this study … [Read more...]

Links Feb 27

Trusts – the hole in the EU’s response to the Panama Papers? Global Witness See also, our report Trusts – Weapons of Mass Injustice HSBC discloses tax evasion probes in India other countries Economic Times Probes in U.S., France, Belgium, Argentina ... See also: HSBC Sets Aside $773 Million for … [Read more...]

Tax justice annual conference: Call for papers and registration

GLOBAL TAX JUSTICE AT A CROSSROADS SOUTHERN LEADERSHIP AND THE CHALLENGE OF TRUMP AND BREXIT City University London, 5-6 July 2017 Tax justice stands at a crossroads. After a period of sustained but partial progress, 2017 brings with it a strong risk of deterioration. In this year’s annual … [Read more...]

Our February 2017 podcast: Financial transaction taxes to protect us from our finance sectors plus more

In the February 2017 Taxcast, our monthly podcast: how financial transaction taxes can protect us from finance sectors dragging our economies down. Plus: the Swiss referendum - taxpayers have refused to pick up the tab for corporate tax 'reforms'. What does that mean for one of the world's biggest … [Read more...]

Verdict on EU Finance Ministers’ blacklist: ‘whitewashing tax havens’

It's not all bad news coming out of the European Union this month. European Union rapporteurs have made some excellent proposals on the implementation of public country-by-country reporting for multinational companies which you can read about here and here. Now we hope the EU Commission will listen … [Read more...]

Links Feb 22

EU agrees new rules to tackle multinationals tax avoidance The Guardian Don't bank on the EU to create a reliable list of tax havens, TJN's Financial Secrecy Index is more credible. See also: EU finance minister meeting: Blacklist is whitewashing tax havens Sven Giegold Denmark would not oppose … [Read more...]

Event: The Brexit tax haven threat, assessed

As part of a series of seminars looking at the future of public services, the Public Services International Research Unit (PSIRU) and Tax Justice Network are organising a seminar entitled ‘The Brexit tax haven threat assessed’ to be held on Tuesday 14 March 2017, 2pm to 5 pm, HH103, University of … [Read more...]

Links Feb 17

Tackling Illicit Financial Flows - Can Africa Rise to the Challenge? United Nations Economic Commission for Africa / via allAfrica New Zealand to enact tighter foreign trust disclosure rules STEP See also: Trusts – Weapons of Mass Injustice: new Tax Justice Network report Ireland: Finance … [Read more...]

How could a global public database help to tackle corporate tax avoidance?

A new research report published today looks at the current state and future prospects of a global public database of corporate accounts. We are cross posting this OpenDemocracy article written by Jonathan Gray, with permission from our partners on the open data for tax justice project at Open … [Read more...]

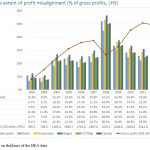

Open Data For Tax Justice: the creation of a public database of country-by-country reporting data

How much tax do multinational companies pay in your country? Leading tax justice campaigners (including the Tax Justice Network) and open data specialists are working on helping you find out with their open data for tax justice project. Today they're publishing a white paper entitled What Do They … [Read more...]

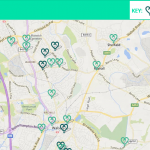

Find your local Fair Tax business: Launch of the Fair Tax Map

Our good friends at the Fair Tax Mark in the UK have been pioneering a means for businesses to demonstrate their commitment to tax transparency, and to paying the right amount of tax at the right time and in the right place. (And what business wouldn't want to do that?) Already the Fair Tax Mark … [Read more...]

Our February 2017 Spanish language Podcast: Justicia ImPositiva, nuestro podcast de febrero 2017

Welcome to this month’s podcast and radio programme in Spanish with Marcelo Justo and Marta Nuñez, downloaded and broadcast on radio networks across Latin America and Spain. ¡Bienvenidos y bienvenidas a nuestro podcast y programa radiofonica! (abajo en castellano). In this month's programme: … [Read more...]