By Alex Cobham There are now a range of estimates of the global scale of tax avoidance. These include: the $600 billion annual tax loss estimated by IMF researchers Crivelli et al. (2015; 2016), which divides roughly into $400 billion of OECD losses and $200 billion elsewhere; the $100 … [Read more...]

Blog

New estimates reveal the extent of tax avoidance by multinationals

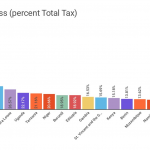

New figures published today by the Tax Justice Network provide a country-level breakdown of the estimated tax losses to profit shifting by multinational companies. Applying a methodology developed by researchers at the International Monetary Fund to an improved dataset, the results indicate global … [Read more...]

Our March 2017 Spanish language Podcast: Justicia ImPositiva, nuestro podcast de marzo 2017

Welcome to this month’s podcast and radio programme in Spanish with Marcelo Justo and Marta Nuñez, downloaded and broadcast on radio networks across Latin America and Spain. ¡Bienvenidos y bienvenidas a nuestro podcast y programa radiofónica! (abajo en castellano). In this month’s programme: … [Read more...]

Links Mar 17

The problems with measuring tax systems SPERI 'In debates about tax policy we need to de-emphasise the role of economics and measurement and rekindle the politics'. Blog by TJN's Nicholas Shaxson, author of Treasure Islands: Tax Havens and the Men Who Stole the World. Re-framing tax spillover … [Read more...]

#LuxLeaks appeal verdict: tax justice heroes convicted again

The #LuxLeaks whistleblowers appeal verdict is in and once again it demonstrates what an upside down world we're living in, when whistleblowers on the frontline of tax justice find themselves convicted for a second time for exposing information that was so clearly in the public interest. Disclosure … [Read more...]

Banking Secrecy in China, its related territories and Taiwan

Foreword. The Tax Justice Network is a non partisan network of experts working towards transparency, so we do not take any position about countries’ territorial and political claims. However, we do expect countries with a de jure (legal) or de facto (in practice) influence over other territories, … [Read more...]

Links Mar 13

Corporate taxation key to protecting human rights in the global economy CESR UN urges US to not exploit American Samoa The Guam Daily Post 'The United Nations has "strongly urged" the United States to refrain from using American Samoa as, among other things, a tax haven'. A significant shift? … [Read more...]

New Report – Delivering a level playing field for offshore bank accounts

The Automatic Exchange of Banking Information, which is due to start this year requires nation states to implement domestic legislation to participate in the scheme. The OECD’s Global Forum conducted a (confidential) first-stage evaluation of the laws of countries that want to participate in the … [Read more...]

Links Mar 10

Public Beneficial Ownership Registries- A Shot In The Arm In The Fight Against Illicit Financial Flows Financial Transparency Coalition European Parliament takes on financial crime with tough proposals Sven Giegold More evidence in the case against Luxembourg FT Alphaville … [Read more...]

Links Mar 9

Taxes & Women's Rights? Global Alliance for Tax Justice See also: Happy International Women’s Day wrapup We managed tax transparency in Pakistan. Why not everywhere else?The Guardian By Umar Cheema. See Politicians and their tax returns: a new project from Finance Uncovered MEPs vote to … [Read more...]

Launch of the African Platform to Protect Whistleblowers

Today the Plateforme de Protection des Lanceurs d’Alerte en Afrique (PPLAAF) will be officially launched during a press conference in Dakar. We're sharing the details with you here: … [Read more...]

The OECD – penalising developing countries for trying to tackle tax avoidance

The OECD’s new terms of reference to assess the implementation by countries of BEPS Action 13 related to Country-by-Country Reports (CbCR) may penalise countries, especially developing ones, that try to obtain by their own means the CbCR’s valuable data needed to tackle multinational tax … [Read more...]

Good news from Slovakia: light cast onto shell companies

Second time lucky? About a year ago in Slovakia some opposition politicians pushed hard for a promising law to shed light onto anonymous ownership through shell companies. The Tax Justice Network supported their efforts by writing a letter to the Prime Minster at the time. Despite widespread public … [Read more...]

Links Mar 3

Trusting the Process Kleptocracy Initiative KleptoCast interview with TJN's Andres Knobel about how trusts became the next frontier in dodging taxes and shielding assets Panama Papers: European Parliament tax avoidance fact-finding mission in Luxembourg Luxemburger Wort See also: MEPs’ mission to … [Read more...]

Politicians and their tax returns: a new project from Finance Uncovered

We're pleased to share this information on a very important new project - the Tax Disclosure Project - just launched by our friends at Finance Uncovered, a project originally set up by the Tax Justice Network. The project is requesting that politicians around the world disclose their tax returns, … [Read more...]