Yesterday the European Parliament held a crucial tax justice vote on making multinational companies with an annual net turnover of 750 million euros and above publicly report their activities, structures and tax payments on a country-by-country basis. That would mean no more secrecy around those … [Read more...]

Blog

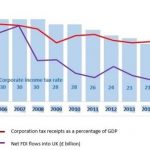

UK coalition government driven by corporation tax cutters

The minority UK government elected last week is scrambling to agree a 'confidence and supply' agreement with a tiny party from Northern Ireland called the DUP (originally the Democratic Unionist Party). The DUP has attracted considerable attention in the past 24 hours because of its Protestant … [Read more...]

Double-Layer Secrecy: add Lawyer Confidentiality to Banking Secrecy

Global automatic exchange of banking information is set to start among countries that have committed to implement the OECD’s Common Reporting Standard (CRS). Similar automatic exchanges have already started between the U.S. and some countries that have managed to sign a FATCA-related … [Read more...]

Links Jun 9

Illicit Financial Flows: Perspectives from Developing Asian Countries CBGA India Nigeria: Acting President Yemi Osinbajo calls for Sanction of financial institutions aiding illicit flow of funds Business Day New Zealand: New disclosure rules sees sharp drop in registered foreign trustsTVNZ Dutch … [Read more...]

Links Jun 8

Global South Calls for International Body to Fight Tax Havens Inter Press Service See also: World gathers at UN, but stymies UN’s role in tax and transparency Financial Transparency Coalition, and our recent blog Tax Justice Network warns at the UN against subversion of Sustainable Development … [Read more...]

New multilateral instrument to limit damage done by tax treaties

Today sees the signing ceremony of a new multilateral instrument (MLI) to limit the extent to which bilateral tax treaties create the conditions for large-scale multinational tax avoidance. The OECD's Pascal Saint-Amans told the Financial Times (£) that "treaty shopping will be killed". Treaty … [Read more...]

Women’s Rights and Tax Justice: Conference in Bogotá, Colombia

On June 13th, 14th, and 15th, 2017 the Tax Justice Network will be taking part in an important conference of people coming together in Bogotá to discuss the little-understood and under-reported impacts of political decisions on taxation and financial secrecy on women and girls around the … [Read more...]

Public country-by-country reporting: it’s not about costs or trade secrets

A guest blog authored by Matti Ylonen [University of Helsinki and Aalto University Business School]. The European Parliament is currently debating a proposal for public country-by-country reporting (CBCR), and the vote was recently postponed to later in June. Under the original proposal of the … [Read more...]

How Global Audit Firms Are Using Their Lobbying Clout to Dilute Sarbanes-Oxley Reforms

The dirty world of tax evasion and avoidance involves all sorts of unpleasant and anti-social characters, none more so than the professional enablers who devise avoidance schemes, market these schemes to their clients, lobby governments for special treatments and permissive laws, and generally play … [Read more...]

Whistleblower Ruedi Elmer vs. the Swiss ‘Justice’ System

We've regularly covered the battles of whistleblower Rudolf Elmer against the Swiss “justice” system. As we've said before, and as has so often been the case with those brave enough to risk all to challenge injustice and corruption, the bank was the criminal, not Rudolf Elmer. He wrote a guest blog … [Read more...]

Tax Justice Network warns at the UN against subversion of Sustainable Development Goals

Last week the Tax Justice Network director Alex Cobham was invited to the United Nations in New York to address the ECOSOC Financing for Development Forum. Here are his remarks, which highlight a major threat to the Sustainable Development Goals target to reduce illicit financial flows. And what's … [Read more...]

Technology and online beneficial ownership registries: 21st century transparency

At the Global Tax Transparency Summit meeting held in London in December 2016, a senior official from the tax haven of Jersey claimed that one of the reasons for not making their registry of company ownership available to public scrutiny was the lack of a global standard for public company … [Read more...]

Newly launched Tax Justice UK assesses party manifestos in UK’s ‘snap’ general election

We'd like to share with you a press release from the newly launched Tax Justice UK for immediate release: … [Read more...]

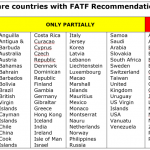

Do Anti-Money Laundering requirements solve ‘fake residency’ concerns?

Do Anti-Money Laundering (AML) requirements solve the Common Reporting Standard's “fake residency” concerns for automatic exchange of banking information? Short answer: we wish… Here's a longer answer: In response to our recent blog about the use of fake residencies to avoid the OECD’s Common … [Read more...]

Tax Justice Network annual conference, July 2017: Preliminary programme and registration

#tjn17 GLOBAL TAX JUSTICE AT A CROSSROADS SOUTHERN LEADERSHIP AND THE CHALLENGES OF TRUMP AND BREXIT City, University of London, 5-6 July 2017 Tax justice stands at a crossroads: after a period of sustained but partial progress, 2017 brings with it a strong risk of deterioration. This year’s … [Read more...]