We're pleased to share this blog from Senior Policy Advisor at Oxfam Novib, Francis Weyzig, originally published here on how tax havens continue to undermine the OECD’s Common Reporting Standard, an information standard for the automatic exchange of tax and financial information on a global level. … [Read more...]

Blog

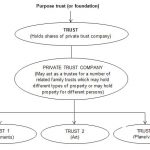

“Trusts: Weapons of Mass Injustice?” A response to the critics

On February 13th, 2017 TJN published a paper titled "Trusts: Weapons of Mass Injustice?", which has attracted critical attention from practitioners and tax havens. This is our response. Our paper, “Trusts: Weapons of Mass Injustice?”[1] asks some deep and searching questions about the role trusts … [Read more...]

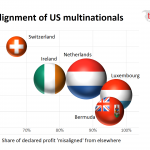

Beginning of the end for the arm’s length principle?

The European Commission has released a statement which could well signal the beginning of the end for the OECD’s international tax rules, and the arm's length principle on which they are based. The current rules, which date to decisions taken at the League of Nations in the inter-war years, are … [Read more...]

Hurricanes, disaster capitalism, bitcoin and over-reliance on unhelpful economic measures: our Sept 2017 podcast

In edition 69 of our monthly podcast, the September 2017 Taxcast we look at our over-reliance on unhelpful economic measures like Gross Domestic Product and how it constrains us. Also: we discuss hurricanes, tax havens and disaster capitalism the bitcoin bubble - China may be closing its … [Read more...]

Highlights of TJN’s 2016 Annual Report

Tax Justice Network’s (TJN) 2016 Annual Report and audited accounts are available to view here. More than any other year they record a year of extraordinary achievement and an significant moment of transition as John Christensen, TJN’s founding director, steps into a new research role and hands on … [Read more...]

Links Sep 21

Nobel-prize winning economist Joseph Stiglitz on how to stop inequality and tax avoidance The Sydney Morning Herald 'The first tax reform we need is to get a global agreement to end the tax competition race to the bottom and make sure that there isn't massive tax avoidance" Ghana announces … [Read more...]

The Spider’s Web film wins ARFF Global Award

We're delighted that Michael Oswald's documentary film The Spider's Web: Britain's Second Empire has won the monthly Global Award from the Berlin Around International Film Festival (ARFF). The Spider's Web, which was co-produced by TJN's John Christensen, draws inspiration from Nicholas Shaxson's … [Read more...]

4 million Canadians form a new Coalition for Tax Fairness

Campaigns for tax justice are gathering pace around the world. Tax consciousness is taking its place at the heart of political debate, where it belongs. We're pleased to share this week's news of the newly formed Coalition for Tax Fairness, which is made up of groups representing over 4 million … [Read more...]

The City of London: Capital of an Invisible Empire

In July 2017 director Michael Oswald’s latest film, The Spider’s Web: Britain’s Second Empire was premiered at the Frontline Club in London. It has since had several screenings in London and public screenings can be organised from November onwards. This fascinating interview just published in … [Read more...]

KPMG and the false objectivity of the ‘Big Four’

This is cross-posted from Huffington Post, South Africa. It's time to recognise the big four firms for what they are - or we'll continue getting stung, says economist and Chief Executive of the Tax Justice Network, Alex Cobham. And so another international firm providing 'professional services' … [Read more...]

Our September 2017 Spanish language Podcast: Justicia ImPositiva, nuestro podcast de septiembre 2017

Welcome to this month’s latest podcast and radio programme in Spanish with Marcelo Justo and Marta Nuñez, downloaded and broadcast on radio networks across Latin America and Spain. ¡Bienvenidos y bienvenidas a nuestro podcast y programa radiofónica! (abajo en castellano). In the September 2017 … [Read more...]

New UN tax handbook: Lower-income countries vs OECD BEPS

The UN has just released an updated edition of its United Nations Handbook on Selected Issues in Protecting the Tax Base of Developing Countries. While technical in style and cautious in approach, the UN tax handbook identifies a range of issues in which the OECD's Base Erosion and Profit Shifting … [Read more...]

DEADLINE EXTENDED Job opening – Head of Operations

THE DEADLINE TO APPLY FOR THIS VACANCY HAS BEEN EXTENDED TO 1 OCTOBER TJN is in a period of anticipated growth and significant transition. To assist us in our ambition we are recruiting to the key post of Head of Operations. The post holder will play a central role in helping us shape new capacity … [Read more...]

Podcast: #10YearsAfter the crash: time for new economics

Ten years after the financial crash, how do we learn from it and create a new, visionary kind of economics that works for everyone? In this Taxcast Extra special podcast Naomi Fowler talks to economist Henry Leveson-Gower of Promoting Economic Pluralism and editorial director of the Mint … [Read more...]

Access to Swiss banking information for developing countries hangs in the balance

The attack on the commitment by Switzerland to share data on bank accounts with some developing countries has failed, for now. However, the issue of which restrictions should be put in place in data sharing is still a live one, opening the door for Swiss politicians to curtail this vital measure to … [Read more...]