Guest blog By Leyla Ates Altinbas University in Turkey The European Council has taken important steps to enhance the exchange of information between tax administrations in order to promote tax transparency and fair tax systems in EU countries. This in turn creates a deeper and fairer single … [Read more...]

Blog

The G20 and the OECD disappoint again

We recently published an optimistic blog post about the advances made at the OECD’s annual Global Forum meeting that took place on 22 November 2018. Now, less than 10 days later, the OECD has submitted a report to the G20 and the G20 have issued a Communiqué that together bear some disappointing … [Read more...]

Tax justice pushes forward at OECD’s Global Forum

The OECD’s Global Forum held its annual meeting in Uruguay on 22 November 2018 where more of the Tax Justice Network’s proposals and those of our allies on automatic exchange of information have been incorporated into Global Forum policies and remarks - albeit some watering down. Momentum for tax … [Read more...]

Comparing financial secrecy in Israel to other OECD countries

This week, Tax Justice Network Israel released a report in collaboration with the Friedrich-Ebert-Stiftung Israel comparing financial secrecy in Israel to that of other OECD countries. Based on the Financial Secrecy Index 2018 results, the report analyses Israel according to each one of the 20 … [Read more...]

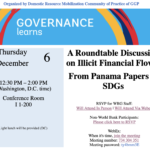

World Bank roundtable: illicit financial flows

Alex Cobham, Chief Executive of the Tax Justice Network, will be taking part in a roundtable discussion at the World Bank in Washington DC on 6 December about illicit financial flows. Details are above. Participants from outside the World Bank are welcome to join by Webex (meeting number and … [Read more...]

Edition 11 of the Tax Justice Network Arabic monthly podcast/radio show, 11# الجباية ببساطة

Welcome to the eleventh edition of our monthly Arabic podcast/radio show Taxes Simply الجباية ببساطة contributing to tax justice public debate around the world. (In Arabic below) Taxes Simply الجباية ببساطة is produced and presented by Walid Ben Rhouma and Osama Diab of the Egyptian Initiative for … [Read more...]

The Spider’s Web documentary viewed over one million times on YouTube

Since it was uploaded to YouTube just ten weeks ago, Michael Oswald's seminal documentary film on Britain and its tax haven empire has gained over 1,000,000 views. “The Spider’s Web: Britain’s Second Empire” documents how British elites created a network of tax havens after World War II and the … [Read more...]

To tackle tax abuse and crime, we must take on the enablers

There is increasing public awareness worldwide of the level of malpractice by (and lack of accountability of) banks, law firms, the offshore magic circle, real estate agents, trust companies, large corporations and so on. Yet the 'enabler industry' is mounting a fightback against the modest … [Read more...]

Financial crime is a feature of our global financial system, not a bug: pioneering economist Susan Strange

We're sharing, with kind permission, the following article written by journalist Nat Dyer for independent global media platform Open Democracy. The global financial crime wave is no accident Financial crime is a feature of our global financial system not a bug, pioneering economist Susan Strange … [Read more...]

A Climate of Fairness: new study analyses environmental taxes from a tax justice perspective

Guest blog by Martina Neuwirth Vienna Institute for International Dialogue and Cooperation (VIDC) The Global Alliance for Tax Justice’s vision is a world where progressive tax policies support people to share in local and global prosperity, access public services and social protection, and … [Read more...]

Whistleblower protection, plutocrats and dark money: the Tax Justice Network’s November 2018 podcast

In the November 2018 Tax Justice Network monthly podcast/radio show, the Taxcast: we look at how governments can better protect, encourage and even incentivise whistleblowers. what do the latest Brexit developments tell us about dark money, the 'influence industry' and plutocracy? And, we … [Read more...]

New report on European tax administrations’ capacity in preventing fiscal fraud and tax avoidance

The Tax Justice Network released today a report on the capacity of tax administrations in the European Union to fight inequality by combating fiscal fraud and tax avoidance. The report analyses the results of a survey consisting of 71 questions that was sent by the Tax Justice Network to the tax … [Read more...]

Tax Justice Network’s November 2018 Spanish language podcast: Justicia ImPositiva, nuestro podcast, noviembre 2018

Welcome to this month’s latest podcast and radio programme in Spanish with Marcelo Justo and Marta Nuñez, free to download and broadcast on radio networks across Latin America and Spain. ¡Bienvenidos y bienvenidas a nuestro podcast y programa radiofónica! (abajo en Castellano). In this month’s … [Read more...]

Passports and residency for sale: the OECD is sitting on its hands. Here’s how to fix the problem…

Passports and residency issued by many tax havens and secrecy jurisdictions in exchange for money (promoted as “golden visas”), are not only “golden” because they are valuable, but because they are expensive. They aren’t meant for the typical refugee fleeing a civil war, but for the very rich who … [Read more...]

Links November 12

The impact of tax treaties on revenue collection: A case study of developing and least developed countries ActionAid EITI week in Dakar: Stepping up commitments at the Africa Beneficial Ownership Conference See also: Twenty-four EITI African countries deepen their commitments to practical steps … [Read more...]