PRESS RELEASE New OECD report on automatic information exchange: will developing countries be left out? … [Read more...]

Blog

Links Feb 12

BVI Considers Tough Prison Sentences For DataLeaks ICIJ Google Take Down Stuart Syvret Blogspot Rico Sorda "The Jersey oligarchs and their protectors in London think that they can do what no corrupt regime around the world had been able to do – and keep embarrassing exposures about them off the … [Read more...]

Your tax cuts at work

British prime minister David Cameron has announced that money is no object when it comes to tackling the floods now inundating towns to the west of London. … [Read more...]

Links Feb 11

Fragile States 2014: Domestic Revenue Mobilisation OECD A Solution for the Inequality Politics of Post-2015? Center for Global Development … [Read more...]

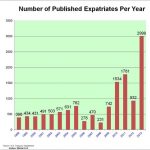

Number Renouncing US Citizenship rose 221% in 2013, in tax panic

That headline is at least what this contributor would have you take away from his latest column in Forbes. And of course the article speculates that it's all about tax, tax, and tax … [Read more...]

The Offshore Wrapper: the week in tax justice, Olympic edition

Welcome to the Olympic Edition of the Tax Justice Network’s Offshore Wrapper. … [Read more...]

London, the Great Sucking Sound, and the Finance Curse

From Aditya Chakrabortty in the UK's Guardian newspaper: some statistics that are classics of the "Finance Curse" analysis - where an oversized financial centre begins to weigh on the rest of an economy, rather than to support it. … [Read more...]

Why should tax havens insist on ‘reciprocity’ from poor countries?

One of the many devious ploys used by the Swiss financial centre to protect its often illicit gains is to insist on 'reciprocity' in the exchange of information. Along the lines of: "If we're going to share information with Nigeria, then they should share the same kind of information with us!" … [Read more...]

How Inequality Became THE Issue – Five Years of The Spirit Level

From the Equality Trust: How Inequality Became THE Issue - Five Years of The Spirit Level … [Read more...]

Three fifths of multinational CEOs want country by country reporting

From Christian Aid: "Two-thirds (66 per cent) of the CEOs of large UK firms surveyed agreed that ‘multinationals should be required to publish the revenues, profits and taxes paid for each territory where they operate’. PwC’s research, which involved 1,344 interviews with CEOs in 68 countries, … [Read more...]

Links Feb 7

Delayed European Parliament vote crucial for corporate transparency Eurodad See also: Time for action on financial transparency euobserver Bankers take fight over U.S. anti-tax dodge rules to appeals court Reuters … [Read more...]

Links Feb 6

Global version of FATCA could be a reality in a few years, say industry officials Thomson Reuters / Compliance Complete See also: No more delays for FATCA, says IRS STEP Greek-Swiss tax deal remains elusive Reuters Is Switzerland retreating on Rubik? … [Read more...]

Links Feb 5

Obama Tax Rhetoric on Offshore Profit Falls Shy of Action Bloomberg See also: U.S.: Has the Tax Code Been Used to Reduce Inequality During the Obama Years? Not Really. Citizens for Tax Justice … [Read more...]

Flipping the corruption myth

TJN has previously challenged the prevailing discourse on corruption; and we have taken particular issue with Transparency International's Corruption Perceptions Index (CPI), which looks at corruption through a highly distorted prism. … [Read more...]

GFI: $410bn illicit flows in or out of Philippines from 1960-2011

February 4, 2014 Philippine Economy Loses US2.9 Billion in Illicit Financial Outflows from Crime, Corruption, Tax Evasion over 52-Year Period; US7.6 Billion Transferred Illegally into the Philippines Smuggling through Trade Misinvoicing Cost Philippine Taxpayers at Least US$23 Billion in … [Read more...]