Tax evasion controversy shifts east swissinfo See also our blog on the failed Swiss "Rubik" deals. … [Read more...]

Blog

Foreign investment – smaller than you might believe

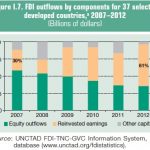

From Jesse Griffiths, Eurodad, with permission. Foreign investment – much smaller than you might believe You may have seen that foreign direct investment (FDI) was judged last month to have finally regained pre-crisis levels, and that a record percentage of all FDI – 52% - went to developing … [Read more...]

Australian tax office forced to pay Murdoch $880m over offshore scheme

From the Brisbane Times: "An $880 million payout to Rupert Murdoch's News Corporation has reignited the debate over whether global companies pay their fair share of tax in Australia. … [Read more...]

Swiss “Rubik” secrecy deal – let’s make sure those nails stay in that coffin

A nice article from the UK's Independent newspaper: "On Tuesday I had breakfast with a top team from the Swiss Bankers Association, who talked about what had happened since the signing of an agreement with Britain … [Read more...]

Links Feb 17

Tax havens: 'Why do we tolerate this?' devex Interview with Eva Joly, chair of the Committee on Development at the European Parliament … [Read more...]

The offshore wrapper: a week in tax justice

Welcome to this week’s Offshore Wrapper, by George Turner: a look back over the last week in tax justice. … [Read more...]

The UK Gold film: now available online

From Brass Moustache productions: "Where is the gold buried when crisis is looming and society begins to demand its share? With eloquence and polite mutual support, the British business establishment elegantly winds its way out of society's demands of accountability and community, and vast … [Read more...]

Links Feb 14

Tackling tax evasion: First Standard Automatic The Economist See also: Global tax standard attracts 42 countries Financial Times (paywall) - reports cite TJN's response to the new OECD report on automatic information exchange … [Read more...]

Swiss reject OECD’s new transparency project

Switzerland, it seems, has rejected the OECD's new project on automatic information exchange, out of hand. … [Read more...]

Tax Justice Focus – now fully available

We have finally completed the full upload to our website of all our past editions of Tax Justice Focus, our inaugural newsletter. Please take a look. … [Read more...]

New TJN briefing: OECD’s BEPS project for developing countries

TJN is pleased to publish a new briefing paper looking at the implications for developing countries of the OECD's widely referenced Base Erosion and Profit Shifting (BEPS) project, which is designed to find ways to tackle the deficiencies in the international tax system. It is available in English … [Read more...]

Should donors boost aid to Pakistan if it won’t tax its élites?

The U.S.-based Tax Analysts has just published a fascinating article with the bland title Should Donor Countries Push Tax Reform? The answer, we think, is generally 'yes' - though it depends, of course, what we mean by 'reform.' The article notes: … [Read more...]

France’s CAC 40: over 1500 tax haven affiliates

From Le Monde: "The corporations in the CAC 40 [France's benchmark stock exchange index of the 40 biggest French stocks] have over 1,500 affiliates in tax havens, according to a study published on Thursday by the journal Project . . . cross-checked with authoritative studies data (the work of the … [Read more...]

Links Feb 13

OECD takes aim at tax anomalies across borders Irish Examiner OECD head Ángel Gurría said: "... the options are simple: If you cannot tax the big guys you are left with the little guys and middle class to tax, and even if you tax them up to their noses, it won’t be enough. And then politics … [Read more...]

BVI tax haven floats 20 years in prison for whistleblowers

From the ICIJ: "The British Virgin Islands have never been accused of taking financial secrecy lightly. But last week, members of the BVI legislature took a step toward raising the territory’s noted secrecy protections to new heights. … [Read more...]