The International Advisor magazine has just reported: "Guernsey chief minister Peter Harwood resigned today, in the wake of publication of a critical article in the current issue of the British satirical and investigative publication, Private Eye." This refers to an excellent report entitled … [Read more...]

Blog

Fashion retailer’s tax dodges boost European inequality

Bloomberg tax star Jesse Drucker has another fine article out about the Spanish retailer Inditex, the parent of high street retail giant Zara. We would urge you to read it. Among many other things, it contains: "In the past five years, Inditex has shifted almost $2 billion in profits to a tiny … [Read more...]

Report: the Sorry State of U.S. Corporate Taxes, 2008-2012

A major new report from the indefatigable Citizens for Tax Justice in the U.S. The Executive Summary begins: The Sorry State of Corporate Taxes What Fortune 500 Firms Pay (or Don’t Pay) in the USA And What they Pay Abroad — 2008 to 2012 … [Read more...]

Ernst & Young: why Dubai’s first conflict gold audit was silenced

We have remarked before on Dubai's role as a particularly egregious and recalcitrant secrecy jurisdiction, harbouring some of the world's worst scoundrels and their money: the likes of Indian master criminal Dawood Ibrahim, the arms dealer Viktor Bout, and many others. Dubai ranks 16th in our … [Read more...]

Local innovators lament the City of London’s failure

Cross-posted from the Treasure Islands blog: From the Financial Times, a short video entitled Bright Future for British Engineering? It looks at some promising stuff going on in the Advanced Manufacturing Research Park, a collaboration between the University of Sheffield and Boeing Corp. The … [Read more...]

Automatic info exchange: will Europe’s spoilers soon play ball?

Recently we explored the welcome (if imperfect) news that the OECD had presented its report on a new global standard for countries and tax havens to exchange information with each other automatically: a brand new tool for fighting tax evasion. And a few days ago we reported on a European … [Read more...]

The Trans Pacific Partnership, economists, bozos and bamboozlement

We've been sent a nice cartoon about the Trans-Pacific Partnership trade agreement - which, while not an issue we're working on directly, is interesting. … [Read more...]

The offshore wrapper: a week in tax justice

Welcome to this week's Offshore Wrapper by George Turner: a look back over the past week in tax justice European Parliament backs crackdown on money laundering On Thursday the European Parliament took an important step towards ending financial secrecy and dodgy shell companies when a … [Read more...]

Links Feb 24

G20 Committed To 'Global Response' To BEPS Tax-News See also: G20 Agrees on Automatic Tax Data Sharing, OECD Says Bloomberg, and Multinationals unfazed by G20 tax crackdown The Conversation … [Read more...]

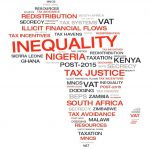

New report: Growth in Africa fails to curb soaring inequality

From TJN-Africa and Christian Aid: February 24 2014 GROWTH IN AFRICA FAILS TO CURB SOARING INEQUALITY, SAYS NEW REPORT Unprecedented economic growth in a number of African countries is going hand in hand with soaring inequality, which national tax systems are failing to address, according … [Read more...]

Links Feb 21

Members of the European Parliament take their first step to curb corporate secrecy and phantom firms Eurodad See also: MEPs vote to name trust beneficiaries in public registries STEP … [Read more...]

Links Feb 20

What Russian money sloshing back to Cyprus teaches us about tax havens Quartz "Building a financial system to serve foreign clients first doesn’t necessarily improve a country’s fiscal condition, as fiscal collapses in places like the Caymans have shown before." See also this months Taxcast … [Read more...]

The Fair Tax Mark – coming to the UK

Richard Murphy and Ethical Consumer today launch the Fair Tax Mark: "The world’s first independent accreditation scheme to address the issue of responsible tax." … [Read more...]

European Parliament votes to end anonymous shell companies

From Global Witness, via email: European Parliament votes to end anonymous shell companies … [Read more...]

The February Taxcast: Bahamas and more

In the February 2014 Taxcast: Are European tax havens getting 'illegal state subsidies'? The European Union's Competition Commissioner thinks they may be. Are the world's tax havens really going to become more transparent? We analyse the OECD's automatic information exchange proposal, warts and all. … [Read more...]