A while ago we explained how tax avoidance by multinational corporations is like refined sugar in the human body: empty financial calories with adverse long-term health effects. Now we have an article from Financial Times columnist John Gapper, who has looked at the tax-arbitrage nonsense … [Read more...]

Blog

Ethical shareholders call on Google to stop its tax abuses

The Domini Social Equity Fund and its partners have submitted a shareholder proposal to Google for its annual meeting on May 14th urging it to do something about its systematic tax abuses. We just blogged a petition in support of this proposal, which we'd urge readers to sign. The shareholder … [Read more...]

Links May 6

G20 to talk tax in Tokyo The Australian Swiss banks follow the money to Panama swissinfo Swiss bankers might have been motivated to come to Panama because it’s “where they believe they can better protect the confidentiality of their clients”.' … [Read more...]

The Offshore Wrapper: a week in tax justice

The Offshore Wrapper is written by George Turner Switzerland-India Dispute Last week we reported that India is getting tough with Cyprus and Mauritius on tax. This week it is Switzerland’s turn to feel Indian ire. … [Read more...]

How Glencore made its money

From an excellent new article in Foreign Affairs, by Ken Silverstein. It concerns the commodity trading giant Glencore, which Reuters once called "the biggest company you never heard of," and which went public in May 2011. "What the IPO filing did not make clear was just how Glencore, founded four … [Read more...]

Caffe Nero: your unpaid taxes would have helped pay for my father’s hospital care

A couple of years ago poet Steve Pottinger penned this eloquent reaction to the anger he felt about Starbucks' corporate tax avoidance. In similar vein he's now sent the following letter to the management of Caffe Nero. … [Read more...]

Singapore and Switzerland to engage in automatic info exchange?

From Le Monde: After intense diplomatic negotiations, [Switzerland and Singapore] are expected to sign an official declaration resolving to engage in automatic information exchange, alongside more than 40 other countries - including 34 OECD member states, but also G20 non-OECD member states, … [Read more...]

Petition: Google, pay your taxes!

A petition, with over 100,000 signatures so far, begins like this. "Google isn’t paying its taxes. The multi-billion dollar corporation has been under scrutiny for shifting using shell companies in Bermuda, Ireland and elsewhere to shelter at least $33 billion of revenue. … [Read more...]

Links May 2

The political capture of rich countries in the fight against tax havens Oxfam France (In French) Ahead of the OECD's annual Forum in Paris, launch of a new report Arrangements Between Friends: Flaws in the OECD's Plan of Action Against Tax Havens India: Finance Minister Chidambaram warns … [Read more...]

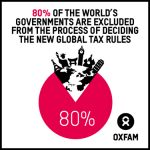

Report: better tax rules could boost developing country corporate tax revenues by 100%

A new report from Oxfam, entitled BUSINESS AMONG FRIENDS: Why corporate tax dodgers are not yet losing sleep over global tax reform. It begins like this: "Tax dodging by big corporations deprives governments of billions of dollars. This drives rapidly increasing inequality. Recent G20 and OECD … [Read more...]

Singapore punishment for tax dodgers: pound them with stone mallet

Oxfam's Duncan Green is in Singapore, where he's visited an exhibition of the mythical Chinese 'ten courts of hell', which he describes as an equivalent to Dante's Inferno. The punishments? Well, for misusing books, you get "‘Thrown onto tree of knives; body sawn into two’," while for corruption … [Read more...]

Zero hours contracts: how tax avoidance helps drive the abuses

There has been a lot of attention about a report in the UK summarised in today's Financial Times: "Unions and politicians have called for action to curb employment on a “zero-hours” basis after official data showed that UK employers are using about 1.4m contracts that do not guarantee a minimum … [Read more...]

Links May 1

Credit Suisse unit draws US tax scrutiny swissinfo "For years, Credit Suisse used a secondary Swiss banking brand, Clariden Leu, to woo clients who wanted a smaller, more personalised experience. Now, its decision to keep that little-noticed unit separate has become an issue in the long-running … [Read more...]

New Germany-UK tax treaty undermines OECD tax reforms

A little-noticed new protocol to the Germany-UK tax treaty needs dragging into the daylight, since it appears to be a sneaky effort to undermine reforms by the OECD, the club of rich countries that oversees the international tax system. … [Read more...]

Stop press: large U.S. multinational decides to pay some tax

As expert after expert - and citizen after citizen - agrees: the international tax system is broken. Multinational corporations run rings around even the most sophisticated and well-resourced tax authorities, producing democracy-killing results such as the fact that General Electric paid a minus 11 … [Read more...]