Upcoming EU presidency faces whistleblows and calls for transparency Eurodad See also: Letter to Ambassador of Luxembourg in Denmark, on tax avoidance and whistleblowers Exposing South Africa's "Lettergate" Scandal World Policy Blog See also: recent TJN blog South Africa’s diamond companies: … [Read more...]

Blog

How to threaten politicians, the City of London way

This article is all about the language of financial lobbying. The consensus that an "oversized financial centre is indispensible" is strong and at times brutally in-your-face in many countries with oversized financial centres. But this consensus can also be sophisticated and subtle, when needs … [Read more...]

Do real investors chase corporate tax cuts?

Cross-posted with Fools' Gold. From the Financial Times, a report on a survey by the Tolley Tax Journal of businesses' responses to the UK's policy of savage cuts to the corporate income tax. It's about the UK, but it has wide international relevance. "More than six out of 10 respondents … [Read more...]

The Economist has noticed the Finance Curse

Regular readers will know that we have a permanent webpage entitled The Finance Curse explaining how countries with oversized financial sectors suffer a range of harms that are rather similar to a so-called Resource Curse that afflict resource-rich countries, and for a wide range of similar … [Read more...]

Links May 8

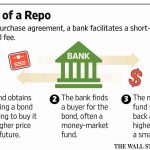

Turkish finance minister Mehmet ?imsek: World should fight against tax evasion like it fights against terror Daily Sabah Estimating illicit funds in global tax havens moneylife Taking on the banks: a conversation with Anat Admati The New Yorker Lawmakers Embrace Patent Tax Breaks The Wall … [Read more...]

Building the foundation for tax justice through human rights

Click here for a Spanish language version of the following statement, which comes out of the meeting between tax justice and human rights communities in Lima, Peru on 29th/30th April 2015. For years, the tax justice and human rights movements have worked along parallel paths to confront the … [Read more...]

Links May 7

Optimistic about the state: Martin Wolf’s searing attack on the Competitiveness Agenda Fools' Gold - rethinking competitiveness Tax probes frustrate EU competition chief EU Observer Unitary Taxation: Tax Base and the Role of Accounting International Centre for Tax and Development Former JP … [Read more...]

British tax havens fret about UK election

From the BVI Beacon, in the British Virgin Islands, a story about the UK's General Election taking place today: "The biggest election issue pertaining to overseas territories is whether they each will be required to compile a publicly searchable register listing the beneficial owners of companies … [Read more...]

Edouard Perrin, PwC and the Dodgy Duchy of Luxembourg

The investigative British magazine Private Eye is currently running a short, incisive piece about the Dodgy Duchy of Luxembourg and PwC, which, given its importance, bears repeating in full. It runs as follows: … [Read more...]

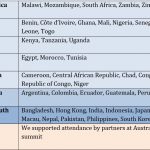

TJN Report and Accounts for year ended 31 December 2014

Our audited accounts and the Director's Report for year ended 31st December 2014 are available here. … [Read more...]

The Tax Justice Research Bulletin 1(4)

Corrected: the earlier version referring to a Banque de France Report said "$8bn revenue loss" when it should have referred to an $8bn loss in tax base. The Tax Justice Research Bulletin By Alex Cobham. TJN (April 2015) - The Tax Justice Research Bulletin is a monthly series dedicated to … [Read more...]

Jersey’s foundations law is fit for money launderers: scrap it

Foundations, like trusts and anonymous shell companies, are often used as secrecy vehicles for the purposes of money laundering, tax cheating, and much more. A while ago we pointed to an offshore promoter who had this to say about foundations: "Trusts are . . . tools of the rich used to stay rich … [Read more...]

Britain goes to the polls: the tax avoidance election

An interesting thing about the forthcoming UK election is that the subject of 'tax avoidance' has risen up the agenda so far and so fast. This guest blog briefly reviews the main parties' manifestos, with a look out for their uses of the term. [We should add, by the way, that 'tax avoidance' is a … [Read more...]

Why Gender Equality Requires More Tax Revenue

This is the third post this week on the topic of gender, and to celebrate our arrival in the modern world we have created a new topic page, where you will permanently be able to access news and analysis in this area. Now we're delighted to host a guest blog by Diane Elson, Chair of the UK … [Read more...]

The Celtic Tiger: the Irish banking inquiry and a tale of two booms

Cross-posted from Fools' Gold: One of our inaugural articles on this site was a post in March looking at the causes of the "Celtic Tiger" boom in Ireland. It contained a striking graph and a wealth of analysis suggesting strongly that what caused the boom was, above all, Ireland's accession to … [Read more...]