The Tax Justice Network now speaks tax justice in five languages on radio stations and podcast platforms across the world, each with their own unique content and style – English, Spanish, French, Arabic and Portuguese. I produce the Taxcast, the Tax Justice Network's first monthly podcast in … [Read more...]

AllNorthAmerica

US half-shuts door to financial secrecy, opens new window

The US is the world’s second greatest contributor to global financial secrecy, according to the Tax Justice Network’s Financial Secrecy Index, only faring better than Switzerland in complicity in enabling financial secrecy schemes that foster tax abuse, money laundering and the financing of … [Read more...]

The Corporate Tax Haven Index: solving the world’s broken tax system in our monthly podcast, the Taxcast

In this month's June 2019 podcast we look at the new Corporate Tax Haven Index released by the Tax Justice Network. What does it tell us about the global economy and the international tax system? And how can we fix it? We also look at how India is pushing the G20 into action on global tax rules - if … [Read more...]

We asked our stakeholders to challenge us on our work

Should we at the Tax Justice Network be doing more to engage with organisations in the global south? Should we be focusing more on high-level advocacy or talking more about progressive taxes instead of tax avoidance? These questions and more were put to us at our organisational retreat this spring … [Read more...]

Transforming local economies: the Preston Model – a Taxcast special edition, May 2019

In this special extended edition of the May 2019 Taxcast we go to Preston in the North of England to see the Preston Model in action and how they're transforming their local economy and democratising wealth. Also: we discuss dark money and the European elections - the elite interests aligning … [Read more...]

The #LuxLeaks corporate tax deals – still no investigation? Plus financialisation of ‘aid’ in the Tax Justice Network February 2019 podcast

In Edition 86 of the February 2019 Tax Justice Network’s monthly podcast/radio show, the Taxcast (available on iTunes, Stitcher, Spotify and other podcast platforms): why hasn't the European Commission investigated any of the secret tax deals that were exposed by the LuxLeaks whistleblowers … [Read more...]

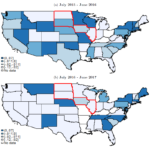

Blacklist, whitewashed: How the OECD bent its rules to help tax haven USA

We’ve criticised for years the farcical nature of ‘tax haven’ blacklists, whether EU or OECD ones. They all turn out to be politicised, misleading and ineffective. If you want an objectively verifiable ranking you need look no further than the Tax Justice Network’s Financial Secrecy Index. But … [Read more...]

A firewall to protect EU citizens from the Big Four accountancy firms and the tax avoidance lobby: the Tax Justice Network’s July 2018 podcast

In the July 2918 Taxcast: we look at a proposal for a firewall to protect EU citizens from the Big Four accountancy firms and the tax avoidance lobby: we look at a new report from the Corporate Europe Observatory we discuss UN Special Rapporteur on Extreme Poverty and Human Rights Professor … [Read more...]

Will the EU really blacklist the United States?

In our latest Financial Secrecy Index assessment, the United States moved up to second place. With its now unparalleled commitment to secrecy at scale, and its influence on international reforms, it has become the leading driver of tax abuse and corruption risk around the world. Years ago we … [Read more...]

New report: extreme poverty and human rights in the United States

The United Nations Special Rapporteur on extreme poverty and human rights Professor Philip Alston has recently released the results of his fact-finding mission to the United States, also ranked number 2 in our Financial Secrecy Index. You can read Professor Alston's full report here. As part of … [Read more...]

Guest blog: Depositors disciplining banks. What’s the impact of scandals?

We're pleased to share this guest blog from Mikael Homanen, a PhD Candidate at the Faculty of Finance at Cass Business School in the UK. Can depositor (or customer) activism make a real difference? New research presented at the Chicago Booth Stigler Center suggests that banks see significant … [Read more...]

Empowering rural women through tax justice policies: 62nd session of the UN Commission on the Status of Women

How do we empower rural women through tax justice policies? That’s what we at the Tax Justice Network were at the 62nd session of the UN Commission on the Status of Women to discuss recently at the UN Headquarters in New York City. This annual session is an opportunity for State delegations and … [Read more...]

The killing of the American Dream and Trump’s Tax Reform in our February 2018 podcast

In this month’s Taxcast: we look at the United States, Trump’s tax reforms and the killing of the American Dream. Plus: as we see yet another school shooting, should the powerful National Rifle Association continue to be a tax-exempt, non-profit organisation? Also, we discuss ongoing state-capture … [Read more...]

Secrecy, oligarchs and offshore psychology in our December 2017 podcast

In our December 2017 Taxcast: We speak with two time Pulitzer Prize winning author and journalist Jake Bernstein about his new book 'Secrecy World: Inside the Panama Papers Investigation of Illicit Money Networks and the Global Elite'. We ask what makes offshore players like Jurgen Mossack and … [Read more...]

US tax reform and conflicts with international law: guest blog

The US tax bill will be published on Friday 15th December 2017 and will be voted on by Congress early next week. Senior Policy Advisor Didier Jacobs at Oxfam America has written this blog: The Exceptionalist Tax Bill The United States Congress is about to adopt a major tax reform that reflects … [Read more...]