The European Commission has just published its proposals for rules for tax advisers and related intermediaries which will require advance disclosure to national tax authorities and cross-border automatic information exchange of any tax scheme that might be deemed potentially aggressive. … [Read more...]

AllEurope

Newly launched Tax Justice UK assesses party manifestos in UK’s ‘snap’ general election

We'd like to share with you a press release from the newly launched Tax Justice UK for immediate release: … [Read more...]

Do you want to know how much tax multinational companies pay?

Yes, so would we... And now there's an action today on twitter which we can all take to help this become reality. All EU banks have been obliged to report their profits and tax paid on a country by country basis since 2015. And not just to tax authorities behind closed doors, but publicly. Because … [Read more...]

TJN calls on EC to investigate all of the UK’s secret tax deals

Here is the text of a letter of complaint that TJN will be handing in to the European Commission at its office in London this afternoon. On 23rd January 2016 the UK Chancellor of the Exchequer, George Osborne, tweeted from Davos that the UK Government had struck a deal with Google over its past … [Read more...]

New website shows European countries that facilitate tax cheating

PRESS RELEASE FROM SOMO: Mapping Tax-free investments New interactive website shows which European countries facilitate tax dodging through mailbox companies. Today, the Centre for Research on Multinational Corporations (SOMO) launches a new interactive website that visualises bilateral … [Read more...]

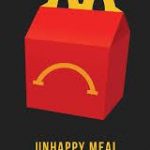

European Commission to probe McDonald’s tax deal with Luxembourg

The European Commission has just announced a formal investigation of the tax agreement struck between McDonald's and Luxembourg. Read the full press release here, also read the Unhappy Meals report on McDonald's tax avoidance schemes. There are many reasons to boycott McDonalds; add tax avoidance … [Read more...]

UK Prime Minister Cameron told: stop Jersey-registered shell company suing Romania in ‘corporate court’

A letter (see below) to the UK prime minister signed by TJN and other global justice campaign organisations, calls on David Cameron to stop a Canadian mining company using a Jersey ‘subsidiary’ to sue Romania for halting toxic gold mine, and warns that such cases will balloon under the proposed … [Read more...]

European Commission half measures will exacerbate profit shifting

17th June 2015 - for immediate release European Commission half measures will exacerbate profit shifting Today’s Action Plan on Fairer Taxation sees the European Commission stall on transparency while giving tax sweeteners to multinational companies … [Read more...]

European Trade Unions Congress on tackling tax evasion, avoidance and tax havens

The European Trade Union Confederation (ETUC) was established in 1973 to represent workers and their national affiliates at the European level. It has just adopted the following resolution on tackling tax evasion, avoidance and tax havens. … [Read more...]

Luxembourg Leaks: EU Parliament Inquiry Committee a matter of political will

The following press release was posted this afternoon by Sven Giegold MEP: … [Read more...]

Luxembourg, Amazon, and the State aid connection

Earlier this month Bloomberg reported that the European Union had stated that: "Luxembourg hastily approved a “cosmetic” tax deal with Amazon.com Inc. in 11 days, allowing the company to shift profits to a tax-free unit. The EU told Luxembourg officials in a letter that the deal, based on a … [Read more...]

Juncker fails to endorse demands for public registries of ownership

From the blog of the Bureau of Investigative Journalism: Jean-Claude Juncker appears to have distanced himself from making registers setting out the true owners of companies and other legal entities accessible to journalists and NGOs. The EU Commission president’s carefully worded position is … [Read more...]

Dear Bundesfinanzminister Schäuble – please don’t block public registries

European transparency and anti-corruption campaigning organisations have sent the following letter to German finance minister Wolfgang Schäuble requesting that his government should support demands by the European Parliament that information about the ultimate beneficial owners (the true, … [Read more...]

European Parliament must set up a committee of inquiry on tax avoidance

In the wake of the "Luxembourg Leaks" scandal, more than 30 organisations from the Tax Justice Europe network have written to members of the European Parliament strongly supporting a proposal from Green MEPs to set up a stand-alone investigative committee of the European Parliament to tackle … [Read more...]

Did Messi hide behind offshore structures in UK, Switzerland, Uruguay and Belize?

Last week our German colleagues reported on the investigations into Lionel Messi's complex offshore web (German version here, English here). Now Global Witness has issued the following: According to a Spanish prosecutor’s document, Lionel Messi’s alleged multi-million euro tax evasion scheme … [Read more...]