In the July 2918 Taxcast: we look at a proposal for a firewall to protect EU citizens from the Big Four accountancy firms and the tax avoidance lobby: we look at a new report from the Corporate Europe Observatory we discuss UN Special Rapporteur on Extreme Poverty and Human Rights Professor … [Read more...]

AllEurope

M5S – Lega Nord tax plans would be a disaster for Italy

The leader of Italy's far right Lega Nord has described the potential coalition with the populist five star movement (M5S) as a 'bomb' for Italy's political establishment. It certainly will be a bomb for tax justice, Italy's public services and economic and social equality in Italy. Two of the … [Read more...]

Yes, Britain is closing its tax havens. But let’s not forget it created them in the first place

This post is jointly authored by Anthea Lawson and John Christensen Tax justice campaigners celebrated this week as a nifty cross-party move from British Members of Parliament Margaret Hodge and Andrew Mitchell forced the UK’s Overseas Territories – many of them in the Caribbean – to stop hiding … [Read more...]

Continuing the work of murdered journalist #DaphneCaruanaGalizia, 6 months on

We'd like to draw attention to the Daphne Project, announced by the OCCRP and Forbidden Stories which honours the life and courageous work of murdered Maltese investigative journalist Daphne Caruana Galizia. The project begins today, marking six months since her brutal assassination. Malta is ranked … [Read more...]

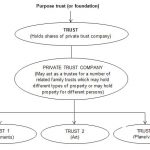

The EU’s latest agreement on amending the anti-money laundering directive: at the vanguard of trust transparency, but still further to go

Our view on the EU’s latest agreement on amending the anti-money laundering directive is that it's at the vanguard of trust transparency, but there's still further to go... The EU Parliament and Council recently reached an agreement on an amendment to the 4th Anti-Money Laundering (AML) Directive … [Read more...]

Empowering rural women through tax justice policies: 62nd session of the UN Commission on the Status of Women

How do we empower rural women through tax justice policies? That’s what we at the Tax Justice Network were at the 62nd session of the UN Commission on the Status of Women to discuss recently at the UN Headquarters in New York City. This annual session is an opportunity for State delegations and … [Read more...]

New report: German-African research linking illicit and criminal financial flows with global poverty

The Tax Justice & Poverty research project is a co-operative effort between three institutions run by the Jesuit Order of the Catholic Church: the Jesuitenmission based in Nuremberg (Germany), the Jesuit Centre for Theological Reflection in Lusaka (Zambia) and the Jesuit Hakimani Centre in … [Read more...]

The killing of the American Dream and Trump’s Tax Reform in our February 2018 podcast

In this month’s Taxcast: we look at the United States, Trump’s tax reforms and the killing of the American Dream. Plus: as we see yet another school shooting, should the powerful National Rifle Association continue to be a tax-exempt, non-profit organisation? Also, we discuss ongoing state-capture … [Read more...]

Exciting news for tax justice in the UK: the battle is on…

We're pleased to be introducing Robert Palmer, the new Executive Director of Tax Justice UK, a sister organisation of the Tax Justice Network: For the last ten years public spending in the UK has been squeezed, while the government has cut taxes. The UK aspires to Scandinavian levels of public … [Read more...]

Secrecy, oligarchs and offshore psychology in our December 2017 podcast

In our December 2017 Taxcast: We speak with two time Pulitzer Prize winning author and journalist Jake Bernstein about his new book 'Secrecy World: Inside the Panama Papers Investigation of Illicit Money Networks and the Global Elite'. We ask what makes offshore players like Jurgen Mossack and … [Read more...]

The EU Tax Haven Blacklist – a toothless whitewash

Continuing our coverage of the EU Tax Haven Blacklist, we are reposting this article which first appeared in Public Finance International. The original can be found here: http://www.publicfinanceinternational.org/opinion/2017/12/eu-tax-blacklist-whitewash … [Read more...]

Result: European Commission to investigate UK tax treatment of MNCs

On 23rd January 2016, the then Chancellor of the UK Exchequer (finance minister) George Osborne announced (via twitter) that he had negotiated a tax settlement with Google. On examination we decided that this deal was shockingly poor value for UK taxpayers and, worse, almost certainly contravened … [Read more...]

Our paper “Trusts: Weapons of Mass Injustice?” – now available in Spanish

Our paper "Trusts: Weapons of Mass Injustice?" which we released and blogged about earlier this year is now available in Spanish. The English version of the paper is available here. The paper provoked critical attention from practitioners and from tax havens. Our response to their critiques is here … [Read more...]

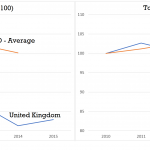

The Dutch government cuts its corporate tax rate…

The new Dutch government is to announce that it will cut its corporate tax rate according to leaked details of the current round of coalition talks. This move is the equivalent to the country jumping into the race to the bottom pool with both feet. We've always highlighted the false narrative … [Read more...]

The Brexit tax haven threat – rescinded?

Back in January, the UK Chancellor of the Exchequer (the finance minister), Philip Hammond, used an interview with the German newspaper Welt am Sonntag to raise what has become known as the Brexit tax haven threat: if the EU doesn't give the UK a good deal, the UK will lead a race to the bottom to … [Read more...]