The Tax Justice Network now speaks tax justice in five languages on radio stations and podcast platforms across the world, each with their own unique content and style – English, Spanish, French, Arabic and Portuguese. I produce the Taxcast, the Tax Justice Network's first monthly podcast in … [Read more...]

AllEurope

Our June 2019 podcast in Portuguese: nosso podcast em português: Índice de Paraíso Fiscal Corporativo

The Tax Justice Network now speaks tax justice in five languages on radio stations and podcast platforms across the world, all with their own unique content and style – English, Spanish, French, Arabic and now Portuguese. So, welcome to our second monthly tax justice podcast/radio show in … [Read more...]

The Corporate Tax Haven Index: solving the world’s broken tax system in our monthly podcast, the Taxcast

In this month's June 2019 podcast we look at the new Corporate Tax Haven Index released by the Tax Justice Network. What does it tell us about the global economy and the international tax system? And how can we fix it? We also look at how India is pushing the G20 into action on global tax rules - if … [Read more...]

We asked our stakeholders to challenge us on our work

Should we at the Tax Justice Network be doing more to engage with organisations in the global south? Should we be focusing more on high-level advocacy or talking more about progressive taxes instead of tax avoidance? These questions and more were put to us at our organisational retreat this spring … [Read more...]

Our new tax justice monthly podcast in Portuguese: nosso novo podcast em português

The Tax Justice Network now speaks tax justice in five languages on radio stations and podcast platforms across the world, all with their own unique content and style - English, Spanish, French, Arabic and now Portuguese. So, welcome to our brand new monthly tax justice podcast/radio show in … [Read more...]

Transforming local economies: the Preston Model – a Taxcast special edition, May 2019

In this special extended edition of the May 2019 Taxcast we go to Preston in the North of England to see the Preston Model in action and how they're transforming their local economy and democratising wealth. Also: we discuss dark money and the European elections - the elite interests aligning … [Read more...]

Mainstream Media Misrepresentations of the Financial Crash in the Tax Justice Network March 2019 podcast

In Edition 87 of the March 2019 Tax Justice Network monthly podcast/radio show, the Taxcast (available on iTunes, Stitcher, Spotify and other podcast platforms): we discuss misleading reporting from the mainstream media on the financial crisis: it was overloaded with finance 'experts', fed us … [Read more...]

European Commission to Investigate Secret #LuxLeaks Tax Deal

The European Competition Commissioner Margrethe Vestager has announced she is now going to investigate what we hope is the first of many secret tax deals arranged between accountancy firm PwC and the Luxembourg tax authorities. We asked recently along with Simon Bowers of the International … [Read more...]

The #LuxLeaks corporate tax deals – still no investigation? Plus financialisation of ‘aid’ in the Tax Justice Network February 2019 podcast

In Edition 86 of the February 2019 Tax Justice Network’s monthly podcast/radio show, the Taxcast (available on iTunes, Stitcher, Spotify and other podcast platforms): why hasn't the European Commission investigated any of the secret tax deals that were exposed by the LuxLeaks whistleblowers … [Read more...]

Fair Tax Week in the UK

We're sharing this information below from our friends and colleagues at the Fair Tax Mark, who are doing so much great work to celebrate those many businesses which do pay their fair taxes by awarding them the Fair Tax Mark, moving towards a fairer economy for all. Their Fair Tax Week takes place … [Read more...]

Why has the European Commission not investigated #LuxLeaks tax deals?

Today Simon Bowers of the International Consortium of Investigative Journalists asks a very pertinent question, which you can read in full here. Some of the deals signed behind closed doors, brokered by accountancy firm PwC, known as “tax rulings” — meant some companies were able to pay less than 1 … [Read more...]

Brexit and the future of tax havens

This week the Tax Justice Network's John Christensen spoke at this event at the European Parliament organised by the European Free Alliance of the Greens on Brexit and the future of tax havens. Here's more information on the event and you can watch the whole thing here. John spoke on the impact of … [Read more...]

The European Union, tax evasion and closing loopholes: new report

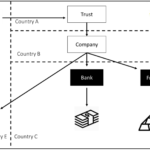

Today, a new report commissioned by the Greens/EFA group in the European Parliament and written by the Tax Justice Network's Andres Knobel demonstrates that despite progress in recent years on closing down opportunities for tax evasion, there are still significant loopholes for citizens and … [Read more...]

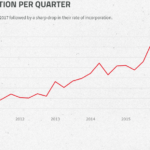

The abuse of Limited Partnerships in the UK: predicting the future with the Financial Secrecy Index

The Tax Justice Network’s Financial Secrecy Index assesses jurisdictions on their transparency levels in their legal framework by looking into 20 different indicators including banking secrecy, beneficial ownership registration, anti-money laundering, etc. One of the key principles of the index … [Read more...]

Blacklist, whitewashed: How the OECD bent its rules to help tax haven USA

We’ve criticised for years the farcical nature of ‘tax haven’ blacklists, whether EU or OECD ones. They all turn out to be politicised, misleading and ineffective. If you want an objectively verifiable ranking you need look no further than the Tax Justice Network’s Financial Secrecy Index. But … [Read more...]