In this episode of the Tax Justice Network’s monthly podcast, the Taxcast, we go on a reparational justice journey and speak to the Council for World Mission about their Legacies of Slavery project. Plus: austerity's out, public investment is now in?! We discuss the IMF's hypocritical turn around … [Read more...]

AllAsia

Raising the voices of communities from Asia

Cancel Public Debt, Build Just Tax Systems and End Financial Support for Fossil Fuels in Response to Multiple Crises. In solidarity with our fellow activists and advocates in the Asian People’s Movement on Debt and Development (APMDD) we post here their press release regarding the open letter … [Read more...]

India: an economy under siege from IFFs?

Blog by Neeti Biyani, Centre for Budget and Governance Accountability, New Delhi Geopolitically, India is one of the most significant countries on the planet, with a GDP of almost $3 trillion and the fifth largest economy in the world. It is surprising, then, that the tiny island nation of … [Read more...]

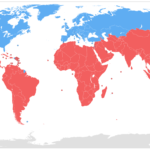

It’s got to be automatic: Trillions of dollars offshore revealed by Tax Justice Network policy success

This is a moment, in these strange times, to celebrate an ongoing success in the history of the tax justice movement. Automatic, multilateral exchange of information on financial accounts is the A of our ABC of tax transparency. It has been a campaign aim since our inception in the early 2000s, as … [Read more...]

Fossil Fuel Subsidies and Taxation: Two Sides of the Same Carbon Coin

We recently published a two part Tax Justice Focus special on climate crisis and tax justice. This blog reproduces the article by Laura Merrill, in which she outlines how massive direct and indirect state subsidies have overwhelmingly distorted energy markets to favour fossil-fuel consumption, … [Read more...]

Global Day of Action: digging the dirt on extractives

As global capitalism continues to lurch from one crisis to the next, massive levels of tax abuse and avoidance are robbing governments of the resources they need to provide basic social services while also contributing to economic instability, fuelling gender inequalities and undermining human … [Read more...]

The Corporate Tax Haven Index: solving the world’s broken tax system in our monthly podcast, the Taxcast

In this month's June 2019 podcast we look at the new Corporate Tax Haven Index released by the Tax Justice Network. What does it tell us about the global economy and the international tax system? And how can we fix it? We also look at how India is pushing the G20 into action on global tax rules - if … [Read more...]

We asked our stakeholders to challenge us on our work

Should we at the Tax Justice Network be doing more to engage with organisations in the global south? Should we be focusing more on high-level advocacy or talking more about progressive taxes instead of tax avoidance? These questions and more were put to us at our organisational retreat this spring … [Read more...]

India and the renegotiation of its double tax agreement with Mauritius: an update

A few years ago we featured a guest blog by award winning essay writer and legislative aide to a Member of Parliament in India Abdul Muheet Chowdhary. He wrote here about the Double Taxation Avoidance Agreement with Mauritius, a favourite tax haven for Indians, which we're sharing in full below, … [Read more...]

Guest blog: Illicit Financial Flows: Damaging the foundations of justice

We're very pleased to share the views of Sakshi Rai, the Programme Consultant at the Centre for Budget and Governance Accountability (CBGA) in New Delhi. In this guest blog Sakshi Rai introduces two new explainer briefs: The problem of illicit financial flows poses the greatest development … [Read more...]

Empowering rural women through tax justice policies: 62nd session of the UN Commission on the Status of Women

How do we empower rural women through tax justice policies? That’s what we at the Tax Justice Network were at the 62nd session of the UN Commission on the Status of Women to discuss recently at the UN Headquarters in New York City. This annual session is an opportunity for State delegations and … [Read more...]

How come Mauritius is the biggest foreign investor in India?

We’re pleased to share a new study by Suraj Jaiswal for the Centre for Budget and Governance Accountability on Foreign Direct Investment in India and the role of tax havens. As their summary of this study says: Governments across the world are trying to attract Foreign Direct Investment (FDI) as a … [Read more...]

Indian cess taxes: A call for accountability (Guest blog)

This piece is about cess taxes levied by the current government in India written for us by Ashrita Prasad Kotha, Assistant Professor at Jindal Global Law School whose work on ‘Cesses in the Indian Tax Regime: A Historical Analysis’ has been published as a book chapter in Studies in the History of … [Read more...]

New release of global tax data

If you were working on tax as a development issue in the early 2000s, not only were you a lonely figure but you were also faced with some of the most pathetic cross-country data imaginable. For a 2005 paper (which introduced the 4 Rs of tax, inter alia), I tried to put together a comprehensive … [Read more...]

Worst fears realised? Jersey shares ‘old’ records of trusts and foundations

Life's full of surprises, some pleasant, some not so much. Imagine you had undeclared offshore assets when the global financial crisis struck, and you've nervously watched the world move towards TJN 's proposal for multilateral, automatic information exchange. Until now you've probably felt ok, and … [Read more...]