In this month's Taxcast: We discuss why we can’t afford the rich and challenge ideas about wealth, entrepreneurialism and investment. Also: ten years ago the Tax Justice Network was told it’d never happen, but this month British Members of Parliament voted to stop secret ownership of companies in … [Read more...]

Archives for 2018

Guest blog: Depositors disciplining banks. What’s the impact of scandals?

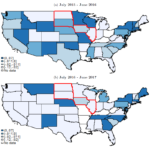

We're pleased to share this guest blog from Mikael Homanen, a PhD Candidate at the Faculty of Finance at Cass Business School in the UK. Can depositor (or customer) activism make a real difference? New research presented at the Chicago Booth Stigler Center suggests that banks see significant … [Read more...]

Guest blog: Illicit Financial Flows: Damaging the foundations of justice

We're very pleased to share the views of Sakshi Rai, the Programme Consultant at the Centre for Budget and Governance Accountability (CBGA) in New Delhi. In this guest blog Sakshi Rai introduces two new explainer briefs: The problem of illicit financial flows poses the greatest development … [Read more...]

Addressing profit shifting in the mining sector through excessive interest deductions: our advice

The Tax Justice Network has responded to the following call by the OECD’s Centre for Tax Policy and the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development: For many resource-rich developing countries, mineral resources present an unparalleled economic opportunity to … [Read more...]

West Africa Leaks project exposes new offshore scandals

In a new investigation published today, the International Consortium of Investigative Journalists has teamed up with 13 journalists to trawl though the Panama Papers and Paradise Papers to find untold stories of wealth extraction in West Africa. The outcome is being promoted under the hashtag … [Read more...]

Links May 17

Asia-Pacific: "The urgent need to curb Illicit Financial Flows" Global Alliance for Tax Justice See also: For Asia's Sustainable Development, Regional Governments Must Take Taxation Seriously The Diplomat Illegal movement of money out of Africa including tax avoidance now amounts to $100b a year … [Read more...]

M5S – Lega Nord tax plans would be a disaster for Italy

The leader of Italy's far right Lega Nord has described the potential coalition with the populist five star movement (M5S) as a 'bomb' for Italy's political establishment. It certainly will be a bomb for tax justice, Italy's public services and economic and social equality in Italy. Two of the … [Read more...]

#LuxLeaks verdict: hope for whistleblowers as Antoine Deltour is acquitted

We've always said that the #LuxLeaks whistleblowers Antoine Deltour, Raphaël Halet and investigative journalist Edouard Perrin should never have been charged because the disclosures they were involved in were so obviously in the public interest, helping to expose the industrial scale on which … [Read more...]

Links May 15

Nigeria: Unprecedented corporate bribery trial kicks off against Shell, Eni, CEO and executives Global Witness 1MDB Talks With Malaysia Should Start Quickly, Swiss Say Bloomberg ' ... investigating how billions of dollars was allegedly diverted from the Malaysian economic development fund, some … [Read more...]

Our May 2018 Spanish language podcast: Justicia ImPositiva, nuestro podcast, mayo 2018

Welcome to this month’s latest podcast and radio programme in Spanish with Marcelo Justo and Marta Nuñez, downloaded and broadcast on radio networks across Latin America and Spain. ¡Bienvenidos y bienvenidas a nuestro podcast y programa radiofónica! (abajo en Castellano). In this month’s … [Read more...]

Unhappy meal: tax avoidance still on the menu at McDonald’s

We're sharing this press release from EPSU, the European Public Service Union which comprises 8 million public service workers from over 265 trade unions. Here's their joint statement on their new research on McDonald’s, entitled Unhappy Meal report. Today we release a new report on McDonald’s … [Read more...]

TJN annual conference: Full programme and registration

We're delighted to present the full programme for the Tax Justice Network's annual conference - available to download now. The conference, jointly hosted this year with FES and Latindadd, in Lima on 13-14 June, will take place with Spanish, Portuguese and English interpreters. Registration is still … [Read more...]

TJN annual conference #tjn18: Full programme and registration

We're delighted to present the full programme for the Tax Justice Network's annual conference - available to download now. The conference, jointly hosted this year with FES and Latindadd, in Lima on 13-14 June, will take place with Spanish, Portuguese and English interpreters. Registration is still … [Read more...]

COFFERS tax course: Register now

We're delighted to announce that registration is now open for a short course in tax at the Copenhagen Business School, being run as part of the COFFERS project (Combating Financial Fraud and Empowering Regulators). The programme runs from 12-14 September 2018. It features many of the leading … [Read more...]

Guest blog: Tax incentives – common ground between business and civil society?

Tax incentives - common ground between business and civil society By Oliver Pearce, Oxfam Tax Policy Advisor Tax is a highly contested issue, but there is more common ground than might be thought. A new paper published by the Confederation of British Business (CBI) and development NGOs Action … [Read more...]