Guest blog, Sol Picciotto Even the Daily Mail has been outraged by how little tax Amazon is paying in the UK. But none of the comments so far, even by tax experts wheeled out by the media, have pointed to the central reason. It’s clear that the profits attributed to the UK are low compared to … [Read more...]

Archives for 2018

Links August 9

Global Witness launches Finding The Missing Millions – a new tool for exposing corruption in the extractive industries Goldman Sachs Is Said to Be Under U.S. Scrutiny in Malaysian Inquiry The New York Times 'The investigation centers on the disappearance of about $4 billion from a giant … [Read more...]

Public Services and Economic Injustice in Tax Break Ireland

The reality of ill-health leaves little time to dwell on rights and justice, or on what might turn out to be empty promises - as the Irish Examiner reports. And while the experience of living with ill health might be said to be something of a leveller, it is not. There is no ‘level playing field’ if … [Read more...]

Links August 3

The missing profits of nations Vox EU Mauritius offers to return Kenyans’ hidden billions Vikenya UK: Law firm Mishcon de Reya complains about anti-tax evasion measures The Guardian This is the same law firm threatening libel action in the UK against murdered journalist Daphne Caruana … [Read more...]

Edition 7 of the Tax Justice Network Arabic monthly podcast/radio show الجباية ببساطة

Here’s the seventh edition of our new monthly Arabic podcast/radio show Taxes Simply الجباية ببساطة contributing to tax justice public debate around the world. (In Arabic below) Taxes Simply الجباية ببساطة is produced and presented by Walid Ben Rhouma and Osama Diab of the Egyptian Initiative for … [Read more...]

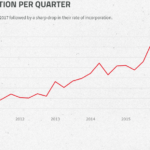

The abuse of Limited Partnerships in the UK: predicting the future with the Financial Secrecy Index

The Tax Justice Network’s Financial Secrecy Index assesses jurisdictions on their transparency levels in their legal framework by looking into 20 different indicators including banking secrecy, beneficial ownership registration, anti-money laundering, etc. One of the key principles of the index … [Read more...]

Register for the 4th International Conference on Beneficial Ownership Registries, Argentina

The 4th International Conference on Beneficial Ownership Registries will take place in Buenos Aires on August 8th-9th at Argentina’s Attorney General’s Office (Ministerio Público Fiscal). It is co-hosted by Tax Justice Network with Fundacion SES, Argentina’s Anti-Money Laundering Prosecutor … [Read more...]

Blacklist, whitewashed: How the OECD bent its rules to help tax haven USA

We’ve criticised for years the farcical nature of ‘tax haven’ blacklists, whether EU or OECD ones. They all turn out to be politicised, misleading and ineffective. If you want an objectively verifiable ranking you need look no further than the Tax Justice Network’s Financial Secrecy Index. But … [Read more...]

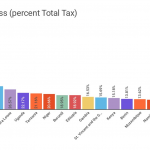

OECD stretches the truth to give the US a better transparency rating than Ghana

It's baffling but the OECD’s Global Forum has awarded the US a “largely compliant” rating on its transparency in exchanging tax information with the international community despite the US being one of the most secretive countries in terms of company ownership. Troublingly, the US, which ranks in … [Read more...]

A firewall to protect EU citizens from the Big Four accountancy firms and the tax avoidance lobby: the Tax Justice Network’s July 2018 podcast

In the July 2918 Taxcast: we look at a proposal for a firewall to protect EU citizens from the Big Four accountancy firms and the tax avoidance lobby: we look at a new report from the Corporate Europe Observatory we discuss UN Special Rapporteur on Extreme Poverty and Human Rights Professor … [Read more...]

Progress on global profit shifting: no more hiding for jurisdictions that sell profit shifting at the expense of others

The world's largest economic actors are also the least transparent. Multinational companies and their big four advisers have been so effective in lobbying for opacity that their reporting requirements are actually less than is required from even small and medium-sized, purely domestic businesses. … [Read more...]

UK to introduce 5th Anti-Money Laundering Directive: eyes turn to Crown Dependencies and Overseas Territories

The UK government has confirmed to campaigning MP Margaret Hodge that, Brexit notwithstanding, the UK will introduce the major tax transparency measures in the European Union's 5th anti money laundering directive. As the Guardian highlights, these include the following crucial measures: Public … [Read more...]

More open data, greater transparency and layout changes added to the Financial Secrecy Index

The Tax Justice Network published today an updated layout version of the Financial Secrecy Index’s database reports. The Financial Secrecy Index (FSI), which ranks jurisdictions according to their secrecy and the scale of their offshore financial activities, is a transparent living document that we … [Read more...]

Country by country reports: why “automatic” is no replacement for “public”

A critical battle is currently being waged in the international tax policy arena over the implementation of country by country reporting, a reporting process that deters and detects tax avoidance by multinational companies, among other things, by requiring companies to provide a global picture of … [Read more...]

Who funds you? Transparency and think tanks: we score the maximum, again

The organisation Transparify provides the first-ever global rating on the financial transparency of major think tanks. Today they release their 2018 rankings. It's vital that people know who's funding organisations that shape the news and the narratives on key things like the economy, public … [Read more...]