How not taxing the rich got Pakistan into another fiscal crisis Al Jazeera 'The elites don't want to tax themselves' Banker in middle of $1.2 billion Venezuelan money-laundering ring sentenced to 10 years Miami Herald See also: Former Julius Baer Banker Gets 10 Years for Venezuelan Plot … [Read more...]

Archives for 2018

Women continue to take the lions share of austerity

Ahead of the UK Autumn budget statement (29th October 2018) the UK Women’s Budget Group (WBG) provided an important analysis of why austerity isn’t over, especially for women living in the UK. It is a useful point to reflect on the role of tax and its gendered implications. … [Read more...]

Whistleblower Rudolf Elmer’s court victory: the long arm of Swiss secrecy law gets shorter

We've written many times about Swiss whistleblower Rudolf Elmer's (pictured above) long legal battles against Swiss banking secrecy here, here, here and here. He's endured 48 prosecutorial interrogations, 6 months in solitary confinement and 70 court rulings. Of one thing you can be sure - if the … [Read more...]

The case for supporting economic justice

The crisis of philanthropy “We live in an age that loves the solution. But a lot of problems are problems of justice rather than problems of tinkering with an engine. And when you have a problem of justice, you can’t just move forward. You have to evaluate the whodunit.” So says the author and … [Read more...]

How oversized finance sectors are making us poorer in the Tax Justice Network’s October 2018 podcast

In the October 2018 Tax Justice Network monthly podcast/radio show, the Taxcast: we speak to Nicholas Shaxson about his new book The Finance Curse: How Global Finance Is Making Us All Poorer released alongside new research from the Sheffield Political Economy Research Institute on the true … [Read more...]

Country by country reporting for the Sustainable Development Goals

I had the honour this week of addressing ISAR35, the 35th annual session of the UN’s Intergovernmental Working Group of Experts on International Standards of Accounting and Reporting (all presentations are available here; my slides are also below). The focus was on developing a framework to carry … [Read more...]

Links October 25

Transparency International EU: Corporate Tax Tracker. A tool to examine publicly available key financial data of the 20 largest European banks. Better tax collection can help tackle rising debt in Africa and the challenge of development finance Brookings See also: Mobilization of tax revenues … [Read more...]

Why the German government’s blockade of corporate transparency is harming all of us

The German government is currently blocking a measure to publish country-specific balance sheet data, known as country by country reporting, in Brussels. Citizens and European politicians could use this data to free themselves from the headlock of the world's most powerful lobbyists and tax … [Read more...]

How the UK can raise £2.5bn from tax-avoiding multinationals today

15 years ago the Tax Justice Network proposed that multinational companies be required to report publicly on their operations, profits and taxes paid in each country where they operate. Our aim was to bring the transparency of the world's biggest economic actors more in line with that of individual … [Read more...]

Links October 19

Short-Changed: How the IMF's tax policies are failing women ActionAid African Governments Are Paying for the World Bank’s Mauritius Miracle Foreign Policy ‘Ghost offices on the small island provide legal but questionable means of siphoning tax dollars away from poor countries and into the … [Read more...]

Desperate marketing: Jersey Finance trolls The Spider’s Web film

Viewers of Michael Oswald's seminal film on Britain's tax haven empire have been bemused in recent days by a pop-up ad put out by Jersey Finance, the finance industry lobby in tax haven Jersey. The ad, running under the title 'Reality Check - Dispelling the Tax Haven Myth', plays the usual tax … [Read more...]

Call for papers: Tax Justice Network annual conference #tjn19

CALL FOR PAPERS AND PANELS 2-3 July 2019 City, University of London Download PDF summary | Submit abstract or panel proposal The challenges of tax justice do not exist in a vacuum. It is not an accident that billions of dollars are lost worldwide each year to tax … [Read more...]

The European Union, tax evasion and closing loopholes: new report

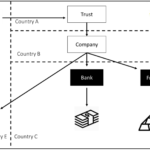

Today, a new report commissioned by the Greens/EFA group in the European Parliament and written by the Tax Justice Network's Andres Knobel demonstrates that despite progress in recent years on closing down opportunities for tax evasion, there are still significant loopholes for citizens and … [Read more...]

Tax Justice Network’s October 2018 Spanish language podcast: Justicia ImPositiva, nuestro podcast, octubre 2018

Welcome to this month’s latest podcast and radio programme in Spanish with Marcelo Justo and Marta Nuñez, free to download and broadcast on radio networks across Latin America and Spain. ¡Bienvenidos y bienvenidas a nuestro podcast y programa radiofónica! (abajo en Castellano). In this month’s … [Read more...]

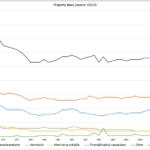

It’s time to tax wealth properly

Wealth taxes are now rising fast up the global political agenda. For OECD countries, taxes on "property" have declined as a share of all taxes, from close to eight percent of all taxes in the 1960s, to a little over five percent in 1980, a level at which they have stagnated ever since. … [Read more...]