Our colleagues in Belgium have decided to celebrate the fourth of January as the day when billionaires in Belgium will have earned sufficient to pay their tax bill for the whole of 2019. In an era of preposterous inequality, social fragmentation and political crisis, what's not to celebrate? … [Read more...]

Archives for 2018

Landmark moments for tax justice from 2018 worth celebrating

From conference fringe talks to top of global agendas, tax justice issues have come along way since the turn of the millennium. Progress made in recent years, including the milestones reached in 2017, was held and built upon in 2018, cementing tax justice as more than just a fad –it’s a wholesale … [Read more...]

How to assess the effectiveness of automatic exchange of banking information?

In December 2018 the OECD’s Global Forum published the new terms of reference to assess compliance with the OECD’s Common Reporting Standard (CRS) for automatic exchange of information. Two weeks later, the EU Commission published a report about automatic exchange of information within the EU. Both … [Read more...]

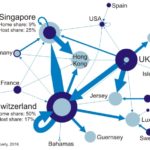

The UK must face up to the gender inequality it enables internationally

Co-written by the Tax Justice Network and Oxfam GB The United Kingdom is currently being reviewed by the United Nations (UN) on how well it is meeting its commitments on women's gender equality rights guaranteed by the Convention on the Elimination of All Forms of Discrimination against Women … [Read more...]

Research fellow in financial secrecy, for new research grant

We're delighted to announce the start of a 'Does Transparency bring Cleanliness? Offshore Financial Secrecy Reform and Corruption Controlnew', a Global Integrity-DFID Anti-Corruption Evidence (GI-DFID-ACE) research project with Dr Daniel Haberly of the University of Sussex. And that means we're … [Read more...]

The gilets jaunes and how NOT to implement an environmental tax: the Tax Justice Network’s December 2018 podcast

In edition 84 of the December 2018 Tax Justice Network's monthly podcast/radio show, the Taxcast: time's running out to tackle the climate crisis facing us all. We look at environmental taxes and making them fair, speaking to the authors of new report A Climate of Fairness: Environmental Taxation … [Read more...]

Unbelievable! The Ethical Failure at the Heart of Corporate Tax Avoidance

In this year-end guest blog, Tristan Shirley explores the belief system that underpins tax avoidance by multinational corporations and reflects on the ethical failures revealed by their unbelievable behaviour. Almost every commuter on the train is reading the free paper. There is a surprised … [Read more...]

GRI invites feedback on its first global tax transparency standard

A new draft Standard on tax and payments to governments was published today by the GRI, the global standard setter for sustainability reporting. This is the first global standard designed to help organisations understand and communicate the impact of their tax strategies on the economies and … [Read more...]

The Tax Justice Network’s December 2018 Spanish language podcast: Justicia ImPositiva, nuestro podcast, diciembre 2018

Welcome to this month’s latest podcast and radio programme in Spanish with Marcelo Justo and Marta Nuñez, free to download and broadcast on radio networks across Latin America and Spain. ¡Bienvenidos y bienvenidas a nuestro podcast y programa radiofónica! (abajo en Castellano). In this month’s … [Read more...]

The US can be blacklisted under the OECD’s new rules due to a forgotten commitment

We recently criticised the report the OECD sent this month to the G20 which hinted that 15 (mostly small) jurisdictions are at risk of being blacklisted. We reiterated our concerns over the new OECD criteria to identify tax havens, particularly because of one arbitrary caveat, which looks like it … [Read more...]

More transparency rules, less tax avoidance

Guest blog By Leyla Ates Altinbas University in Turkey The European Council has taken important steps to enhance the exchange of information between tax administrations in order to promote tax transparency and fair tax systems in EU countries. This in turn creates a deeper and fairer single … [Read more...]

The G20 and the OECD disappoint again

We recently published an optimistic blog post about the advances made at the OECD’s annual Global Forum meeting that took place on 22 November 2018. Now, less than 10 days later, the OECD has submitted a report to the G20 and the G20 have issued a Communiqué that together bear some disappointing … [Read more...]

Tax justice pushes forward at OECD’s Global Forum

The OECD’s Global Forum held its annual meeting in Uruguay on 22 November 2018 where more of the Tax Justice Network’s proposals and those of our allies on automatic exchange of information have been incorporated into Global Forum policies and remarks - albeit some watering down. Momentum for tax … [Read more...]

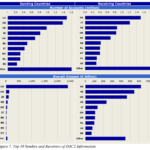

Comparing financial secrecy in Israel to other OECD countries

This week, Tax Justice Network Israel released a report in collaboration with the Friedrich-Ebert-Stiftung Israel comparing financial secrecy in Israel to that of other OECD countries. Based on the Financial Secrecy Index 2018 results, the report analyses Israel according to each one of the 20 … [Read more...]

World Bank roundtable: illicit financial flows

Alex Cobham, Chief Executive of the Tax Justice Network, will be taking part in a roundtable discussion at the World Bank in Washington DC on 6 December about illicit financial flows. Details are above. Participants from outside the World Bank are welcome to join by Webex (meeting number and … [Read more...]