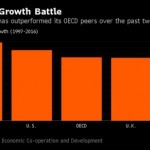

While recent elections in France, U.K. and the U.S.A. have shown the results of globalisation gone bad, Sweden has successfully adapted its development model to make globalisation work for the majority of its people. … [Read more...]

Archives for 2017

Forthcoming book: Tax Havens and International Human Rights Law

Tax havens cause enormous damage, not least because they block governments from fulfilling their human rights obligations. When rich people and powerful businesses evade paying taxes by using offshore tax havens they deprive states of the revenues they need to deliver on their commitments to … [Read more...]

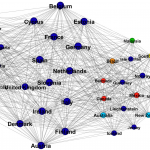

Developing countries’ access to CbCR: Guess who’s (not) coming to OECD dinner

It's said that if you're not at the table, you're on the menu. Well, the OECD has just made available the list of activated relationships to automatically exchange country-by-country reports between countries. They use big figures like 700 relationships, but don’t get fooled by those numbers - … [Read more...]

Paying a ‘Fair Share’: new brief on taxing multinational companies

In this new brief just published by the Sheffield Political Economics Research Institute authors John Mikler and Ainsley Elbra address the issue of global corporate tax avoidance and consider how multinational corporations can be made to pay their fair share of tax. … [Read more...]

Coming Soon: The Spider’s Web – a film about Britain’s tax haven empire

#RogueLondon Film maker Michael Oswald and TJN's John Christensen have co-produced a new film about Britain's tax haven empire. Titled The Spider's Web: Britain's Second Empire, the film is ready for release. It draws heavily on Nick Shaxson's ground-breaking book Treasure Islands and uses … [Read more...]

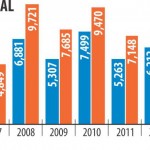

Estimates on illicit flows to and from developing countries

Our friends at Global Financial Integrity have released their latest report on what they estimate to be the latest figures from 150 countries on illicit financial flows to and from developing countries for the period 2005-2014. Most of these flows arise from fraudulent trade mis-invoicing which, as … [Read more...]

The Independent Commission for the Reform of International Corporate Taxation is hiring

The Independent Commission for the Reform of International Corporate Taxation is hiring. As part of the coalition that initiated ICRICT, we're sharing the details with you below. Please see the job description below for full details and if you want to apply, please send your CV and a covering … [Read more...]

Do you want to know how much tax multinational companies pay?

Yes, so would we... And now there's an action today on twitter which we can all take to help this become reality. All EU banks have been obliged to report their profits and tax paid on a country by country basis since 2015. And not just to tax authorities behind closed doors, but publicly. Because … [Read more...]

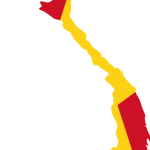

Research shows UK’s Finance Curse grip tightening in next five years

Britain's Trade Unions Congress has published projections showing the increasingly unbalanced growth of the UK economy. As you can see from this map, economic activity is skewed in the direction of England's south-east region, which includes London. It's forecast to produce 40.1 percent of the UK's … [Read more...]

Why taxation STILL isn’t theft…

It came to our attention recently that a blog written for us by Associate Professor of Philosophy at Central European University Philip Goff prompted extensive discussion. The blog was called No, it’s not your money: why taxation isn’t theft. This concept that taxes paid by individuals and … [Read more...]

President Trump visits La-La-Laffer Land

Taken as a whole, the tax plans just announced by US President Donald Trump, which include abolition of the inheritance tax, could represent the largest tax cut for billionaires and millionaires in US history. According to the President, this will stimulate growth and job creation. There's no … [Read more...]

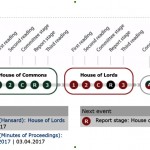

UK Parliament fails to tackle financial secrecy in its overseas territories

So near and yet so far… Hopes were riding high yesterday that UK parliamentarians might seize the opportunity to take historic action to end decades of financial secrecy in the UK’s Overseas Territories. We blogged about this yesterday highlighting the fact that a lot of ongoing Parliamentary … [Read more...]

Two days left to end financial secrecy in the UK’s Overseas Territories?

UK parliamentarians have the opportunity to take historic action over the next two days, ending decades of financial secrecy in the UK's Overseas Territories. As Parliament closes down before the General Election which will take place on the 8th June, a lot of ongoing business is now at risk. A … [Read more...]

Business leaders for a public registry of beneficial ownership in Germany

TJN proudly unveils today its first public call among business leaders in Germany in support of a fully public and effective register of beneficial ownership (BO, or the real owners of companies). So far 12 German businesses with a combined turnover of more than €500 million have signed the petition … [Read more...]

Vietnam legislates on country by country reporting

There's a good development in Vietnam we'd like to share with you via Policy Advisor Economic Inequality and Tax Justice Francis Weyzig of Oxfam Novib. He says, "Vietnam has introduced a legal requirement for domestic subsidiaries to provide a copy of the global Country By Country report directly … [Read more...]