We'd like to share with you a press release from the newly launched Tax Justice UK for immediate release: … [Read more...]

Archives for 2017

Do Anti-Money Laundering requirements solve ‘fake residency’ concerns?

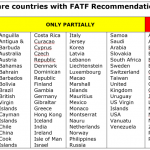

Do Anti-Money Laundering (AML) requirements solve the Common Reporting Standard's “fake residency” concerns for automatic exchange of banking information? Short answer: we wish… Here's a longer answer: In response to our recent blog about the use of fake residencies to avoid the OECD’s Common … [Read more...]

Tax Justice Network annual conference, July 2017: Preliminary programme and registration

#tjn17 GLOBAL TAX JUSTICE AT A CROSSROADS SOUTHERN LEADERSHIP AND THE CHALLENGES OF TRUMP AND BREXIT City, University of London, 5-6 July 2017 Tax justice stands at a crossroads: after a period of sustained but partial progress, 2017 brings with it a strong risk of deterioration. This year’s … [Read more...]

Britain’s Second Empire: our May 2017 Tax Justice Network Podcast

In the May 2017 Taxcast: We talk to film director Michael Oswald about his new film The Spider’s Web: Britain’s Second Empire. Listen for details on how you can see the film. Also, we discuss booming Sweden’s ‘reverse-Trumpism’: its economy grew almost twice as fast as the US last year – and it … [Read more...]

Africa subsidises the rest of the world by over $40 billion in one year, according to new research

Global Justice Now press release: Download the report Much more wealth is leaving the world’s most impoverished continent than is entering it, according to new research into total financial flows into and out of Africa. The study finds that African countries receive $161.6 billion in resources … [Read more...]

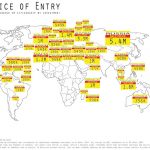

The Price of Entry: residence and citizenship by investment around the world

Many thousands of people a year risk their lives to cross borders into what they hope will be countries of greater safety, opportunity and quality of life. Yet for others who are wealthy enough, the borders are open. For those who can pay, nationality, residency and freedom of movement are … [Read more...]

Faking residency: OECD’s Common Reporting Standard leaves the door wide open for fraud

The OECD’s Common Reporting Standard (CRS) for automatic exchange of banking information leaves the door wide open for fraud. The OECD has recently made available a form to report potential avoidance schemes of the CRS. While this form is a first useful step - we've been sharing with them the … [Read more...]

Campaign victory disarms big tobacco’s lobby front in developing countries

Update: the Financial Times has covered the great news. Below is a press release cross-posted from Tax Tobacco for Life, about a major campaign victory, which could save hundreds of thousands, even millions of lives in some of the poorest countries in the world. Here's the quick story. Big … [Read more...]

Evading Tax and Avoiding Tax Evasion: for decades British governments have shied away from tackling cross border crime

Guest blog authored by Dr Michael Woodiwiss (Arts and Cultural Industries, University of the West of England) and Dr Mary Alice Young (Bristol Law School, University of the West of England) In the 1920s, an embryonic tax collecting organisation was steadily growing in the US. The Internal … [Read more...]

Germany rejects beneficial ownership transparency

On 17 May 2017, the members of the Finance Committee of the Bundestag cast their votes for ultimate amendments to Germany's anti-money laundering law. The governing conservatives CDU/CSU and Social Democrats SPD rejected amendments supported by the left and Green party that would have remedied three … [Read more...]

Our May 2017 Spanish language Podcast: Justicia ImPositiva, nuestro podcast de mayo 2017

Welcome to this month’s latest podcast and radio programme in Spanish with Marcelo Justo and Marta Nuñez, downloaded and broadcast on radio networks across Latin America and Spain. ¡Bienvenidos y bienvenidas a nuestro podcast y programa radiofónica! (abajo en castellano). In this month’s … [Read more...]

Jainism and Ethical Finance

"The financial crisis of 2008 has led to a re-evaluation of the role of financial institutions and their relationship with the wider economy and society. There is an increased questioning of both the conduct of business itself and the principles behind commercial and financial activities. Yet … [Read more...]

The Achilles heel of effective beneficial ownership registration: Why is everyone fixed on 25%?

Civil society and allies are pushing for real (and useful) transparency when it comes to disclosing the beneficial owners (BOs) of companies, meaning the individuals who ultimately own and control the companies that operate in our economies, and that could be involved in illegal activities (e.g. tax … [Read more...]

The U.K. post-general election: strong, stable and still kind to criminals

The British Prime Minister Theresa May has called a snap general election. We'd like to share with you the thoughts of Dr Mary Alice Young (Bristol Law School, University of the West of England) and Dr Michael Woodiwiss (Arts and Cultural Industries, University of the West of England) on the … [Read more...]

Bbumba: I Signed $157M Tax Waiver to Oil Company Without Reading Agreement

From TJN's Department of 'You Couldn't Make This Up': the East African press is reporting that Uganda's former Energy Minister, Syda Bhumba, has confirmed that she signed a tax waiver agreement with UK company, Tullow Oil, without reading the document. The waiver, which exempted both income and … [Read more...]