Below is the text of the offshore wrapper, a weekly roundup of news from the world of tax justice sent out to our mailing list.

If you haven’t signed up yet and would like to receive the wrapper in your inbox every week – you can do so here.

The threat of tax haven UK recedes

Back when the UK was more confident about Brexit, the UK government issued a threat. Give us what we want, or we will slash corporate tax rates, and turn ourselves into a giant offshore tax haven, sucking the life out of the European economy. The Europeans shrugged, and told the Brits that if they wanted to walk down that road they would do so without a trade deal with the EU. Perhaps the EU negotiators realised that the biggest losers from the UK adopting a Cayman style economy would not be Europe, but the British public, who would be starved of public services.

Now the UK government appears to have understood that its bluff has been called, with the Chancellor of the Exchequer this week stating that the UK would not be changing its economic model after it leaves the European Union and will remain ‘recognisably European’.

Those hoping that the UK’s exit from the EU might lead to an even lighter touch regulatory regime for the finance sector were also dealt a blow by the Governor of the Bank of England. Mark Carney in a speech marking 10 years since the last financial crash warned banks that the country simply could not afford to become the lowest common denominator in terms of regulation with an industry which is ten times the country’s GDP. The governor noted that the kind of light touch regulation seen before 2007 provides a serious risk to the entire economy with a sector that is so large.

Still, for individuals wanting to minimise their tax bill, the UK apparently still appears to be an attractive option. This week it was reported that Christiano Ronaldo told the judge in his tax fraud trial “In England, I never had these problems, that’s why I want to go back there.

“I always paid my taxes, always. In England and in Spain. And I always paid. As you know, I cannot hide anything, it would be ridiculous on my part to do such a thing. I am an open book. You don’t need to do anything but type my name into Google and everything about Cristiano comes out. For example, Forbes magazine releases all of my earnings.”

Kiwi Crackdown

A new crackdown on tax avoidance in New Zealand is estimated to yield $200m. The announcement of the new figures is particularly important as it demonstrates what can happen when countries take action against tax avoidance.

Previously the New Zealand government had doubts that anything could be achieved in this area by the country acting alone.

HSBC in $700m of trouble

The latest accounts of HSBC reveal some interesting insights into the ongoing tax haven related criminal issues facing the company. Bloomberg BNA reveal that in June the company was placed under a formal criminal investigation by the Belgian authorities, in relation to revelations from the Swiss-leaks case.

In total the bank has set aside the best part of one billion dollars to deal with tax-related investigations, and the bank is also being investigated for its role in the Panama Papers. In total 2,300 companies in the data leak were under the control of HSBC.

Speaking of the Panama Papers, this week it was revealed that the company at the centre of the leak, Mossack Fonseca, has been all but wiped out by the scandal. The company has had to close the vast majority of its offices, and has just 6 left, as opposed to the 45 it had before the leak started.

Tax havens become data havens

New data from the World Bank reveals how tax havens might be adapting to the digital era. Some well known tax havens are home to the largest number of secure internet servers. Countries like Monaco, the British Virgin Islands, Gibraltar and the Isle of Man have more secure servers per head of population than anywhere else.

Why would anyone want access to a secure offshore server? There can be tax advantages to locating digital services offshore. But the bigger draw is of course secrecy. Under US law any data owned or managed by a US company can be seized by the authorities on production of a warrant. This includes anything hosted on a .com domain.

By locating data outside of the jurisdiction of the US these rules can be evaded. Certain tax havens’ jurisdictions, with their somewhat relaxed attitude to laws of all kind, are the perfect places for people to hide their data. These services are often marketed as a way to prevent governments from snooping on your every click. But of course, these services can also be used by the world’s terrorists, drug dealers and child pornographers to keep their data, with some providers based offshore guaranteeing that their clients will never have their data handed over to law enforcement.

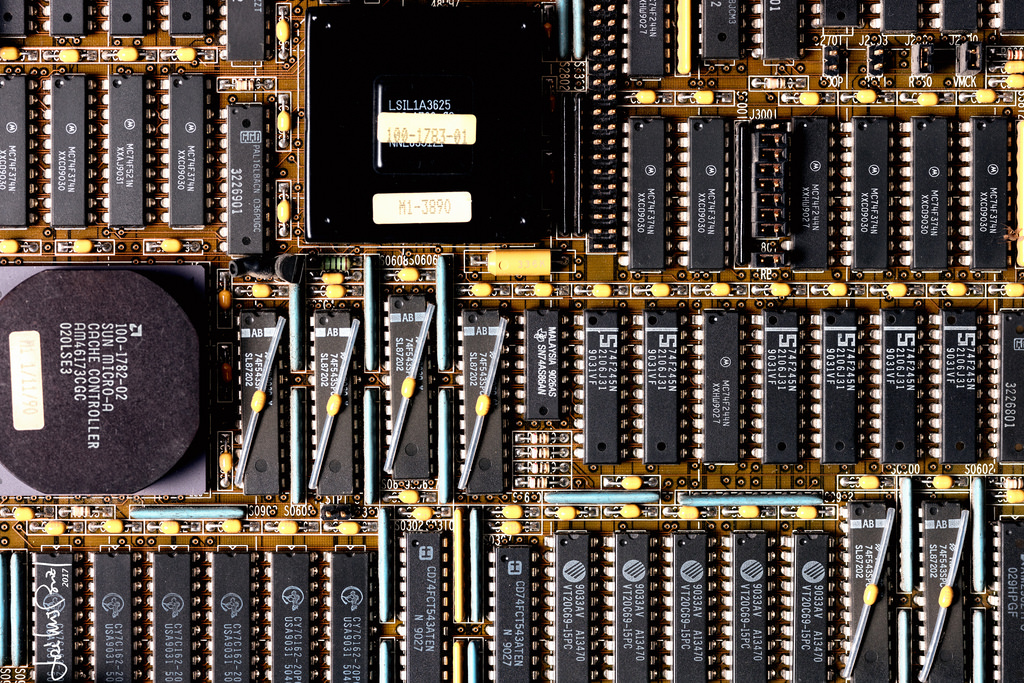

Photo credit: Gorgeous Computer Fixings by Jose Luis Briz, available under the creative commons license on Flickr

Leave a Reply