Looted funds: Nigeria Labour Congress threatens protest in Switzerland Today "I think we must have a national day to demand for tax justice" Legislators introduce bill to shed more light on US multinationals Financial Transparency Coalition See also: U.S. Bill to require country-by-country … [Read more...]

Archives for 2016

Links Sep 22

Ecuador steps up campaign for a UN #Globaltaxbody Global Alliance for Tax Justice How to hide it: inside the secret world of wealth managers The Guardian "They know more about their clients than the clients’ own wives. They are loyal in the face of appalling behaviour. They are the brains behind … [Read more...]

The Tax Justice Network in Kenya and Israel

Two important events this month: Tax Justice Network Africa organised the 3rd International Tax Justice Academy on the 12th-16th September 2016 in Nairobi, Kenya. … [Read more...]

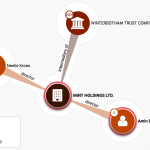

#BahamasLeaks: New Leak Rips Open Bahamian Secrecy

We just put out this press briefing in reaction to the leaks from the Bahamas. … [Read more...]

Report: new data disproves US corporations’ false narrative on taxes

From Americans for Tax Fairness, a major new report about corporate taxes in the United States. It's called Corporate Tax Chartbook: How Corporations Rig the Rules to Dodge the Taxes They Owe, and it contains many useful facts, such as this: Corporate profits are way up, and corporate taxes … [Read more...]

Our September Spanish language Tax Justice Podcast: Justicia ImPositiva, nuestro podcast de septiembre 2016

Welcome to Justicia ImPositiva, our third monthly podcast/radio show in Spanish. Bienvenid@s a Justicia ImPositiva, nuestro tercero podcast/programa radial mensual en castellano (abajo en castellano) … [Read more...]

Links Sep 16

Al Jazeera Investigates: Stealing Paradise Al Jazeera’s Investigative Unit has uncovered corruption in the Maldives. Secretly filmed interviews describe how men on mopeds carried millions in cash to the Maldives’ political elite. Gender & Tax, from a union perspective Global Alliance for Tax … [Read more...]

Apple’s tax affairs: a symptom of the robber-baron culture

Updated with further information about Brazil's decision - see below. Now also on Angry Bear, Middle Class Political Economist From the Financial Times: More precisely, a group of 185 American CEOs has sent letters, co-ordinated by the Business Roundtable lobby group, to the leaders of 28 EU … [Read more...]

Now Brazil puts Ireland on its tax haven blacklist

We have for years remarked that one of our informal markers of a tax haven is loud tax haven denials. See our 'we are not a tax haven' blog for more. There's probably no place more vocal than Ireland, where there seems to be a veritable industry of tax haven deniers, which specialises in … [Read more...]

Links Sep 14

An Intergovernmental UN Tax Body – why we need it and how we can get it Eurodad Taking action for tax justice at World Social Forum 2016 Global Alliance for Tax Justice New report reveals the "dark side" of European Investment Bank funds: How the EU's bank supports non-transparent investment … [Read more...]

Quote of the day – tax crimes and traffic offences

From Michael West, an Australian tax journalist: "In Australia, Part 4a of the Tax Act deems that the principal purpose of a transaction should be commercial (rather than tax driven). In light of the proliferation of tax haven activities by Australian companies this law, Part 4a, must be the most … [Read more...]

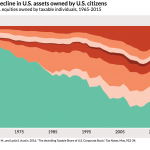

Report: why we need to tax corporations now, more than ever

Update: now on Naked Capitalism, where it's attracted a lot of interesting commentary Last year we published a document entitled Ten Reasons to Defend the Corporate Income Tax, outlining how the tax is under constant attack, in country after country, and explaining why it is one of the most … [Read more...]

Report: the investor case for country by country reporting

From the FACT coalition: New Report: Investors at Risk by Lack of Corporate Tax Disclosures September 12, 2016 Shareholders Increasingly Stymied by Opaque Corporate Tax Practices as Authorities Crack Down, Finds New FACT Analysis Apple Tax Ruling “Just the Tip of the … [Read more...]

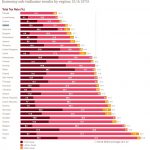

More evidence of the links between tax and inequality

The economists Thomas Piketty, Emmanuel Saez, Facundo Alvaredo and Anthony Atkinson have played a big role in helping analyse and popularise the role that tax rate cuts for wealthy folk play in fostering economic inequality, particularly the income shares of the top 1 percent of people compared to … [Read more...]

UK tax authority: too close to big business, too far from the public – report

The UK's tax collection agency is more secretive than MI6 and crippled by corporate interests according to a new report launched in the House of Commons yesterday. Corporate interests now exercise a significant amount of control over HMRC, it says - and it is hard not to agree. All of the … [Read more...]