We welcome this latest research on the under-researched Cayman Islands, an Offshore Financial Centre (OFC) 'with foreign assets amounting to over 1500 times Cayman's domestic economy.' As we so often explain, while Switzerland currently tops our Financial Secrecy Index, if the UK and its Crown … [Read more...]

Archives for 2016

Press release: Campaign to expose big tobacco’s lobby front may save millions of lives in lower-income countries

Below is a press release published today, 6 November 2016, with a wide range of tramadol health and international development organisations. It may mark a turning point in the fight to weaken the influence of Big Tobacco over the tax policies which are critical to save millions of lives in … [Read more...]

Links Nov 3

Domestic Resource Mobilisation and Illicit Financial Flows Global Alliance for Tax Justice Hong Kong money laundering and terrorism financing reports hit record high South China Morning Post Ukrainians shocked as politicians declare vast wealth Reuters In 44 years, India lost at least Rs 17 … [Read more...]

Coming soon: Tax Justice Network Japan

Following extensive discussion among scholars, researchers and activists, Japanese civil society has given the greenlight for preparations to be made for the launch of Tax Justice Network Japan. … [Read more...]

Switzerland in the UN hot seat over impact of its tax policies on women’s rights

Switzerland—ranked number one in the Tax Justice Network's Financial Secrecy Index —faced tough questions from a U.N. human rights body in Geneva this week over the toll that its tax and financial secrecy policies take on women's rights across the globe. Prompted by a coalition of Swiss and … [Read more...]

Trial of whistleblower Rudolf Elmer breaks open Swiss banking secrecy at a new level

Swiss banking whistleblower Rudolf Elmer has done much to pierce the veil of banking secrecy that has protected financial criminal activity for so long. For that he has been imprisoned, victimised, and his family has been harassed. His reputation has been systematically ripped apart in a way that we … [Read more...]

The World Bank’s Dirty Finance

In 3 October 2016, following a months-long investigation, Inclusive Development International, a human rights organisation, in collaboration with three other NGOs, published a report uncovering coal projects financed by the World Bank's private-sector arm, the International Finance … [Read more...]

London and the Finance Curse: the view of a top development economist

The Globalist has just published an article by Helmut Reisen, former Head of Research at the OECD's influential Development Centre, in which he discusses the developmental impact of the recent fall in the value of sterling. He comes to similar conclusions to those we blogged last month; allowing … [Read more...]

The Netherlands comes out in support of public country-by-country reporting

Here’s some good news. Policy advisor on tax justice and economic inequality at Oxfam Novib, Francis Weyzig writes how the government in the Netherlands has come out in support of public country by country reporting. … [Read more...]

Links Oct 28

Tax Haven Free Zones in Spain Global Alliance for Tax Justice Aggressive tax avoidance raises risks for investors Financial Times (subscription) Is the Kenya Revenue Authority finally finding its feet on fighting tax evasion? Standard Media EY Created Facebook’s Tax Plan. And Lo, It Was Good, … [Read more...]

Creating an open CBCR database – your views please!

TJN has, since its establishment in 2003, led the way in developing and promoting the idea of public country-by-country reporting (CBCR) for multinational companies. Open Knowledge International, who partnered with TJN in establishing Open Data for Tax Justice (#OD4TJ), are pioneers in using open … [Read more...]

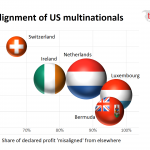

EU relaunches CCCTB: A step towards unitary taxation

This week saw the re-launch of the European Union's Common Corporate Consolidated Tax Base (CCCTB). The purpose of the CCCTB is to harmonise the rules around how multinational corporations are taxed across the European Union, and to switch from OECD tax rules to a unitary approach with formulary … [Read more...]

The Kleptocracy Curse and the threat to global security

This is well worth watching: journalist and author of Author of 'Fragile Empire' and 'This Is London' and Ben Judah presents his report at the Hudson Institute on how kleptocrats and what he calls the 'global wealth defence industry' (or the secrecy and tax avoidance/evasion industry) is wreaking … [Read more...]

Links Oct 26

Despite global efforts in fighting tax dodging: ever more money hidden in tax havens Sven Giegold Developing Countries and International Institutional Architecture on Financial Transparency: Global Forum on Transparency and Exchange of Information for Tax Purposes CBGA A Conversation with … [Read more...]

The OECD information exchange ‘dating game’

The automatic exchange of information between countries' tax authorities has been trumpeted as a game changer for the fight against tax evasion. But the publication of the latest data shows that many countries, including some tax havens, are being very selective about who they are choosing to share … [Read more...]