TJN’s Andres Knobel participated in a conference in Panama on February 18-19, hosted by the Inter-American Centre of Tax Administrations (CIAT) & the German International Cooperation Agency (GIZ), and involving tax administrations from Barbados, Bolivia, Brazil, Canada, Chile, Colombia, Costa … [Read more...]

Archives for 2016

On the closure of the Argentinian think tank Cefid-AR

TJN laments the closure of the Centro de Economía y Finanzas para el Desarrollo de la Argentina" (Cefid-ar), an Argentine organisation heavily involved in research on illicit financial flows. Their work has shed light on capital flight from Argentina, estimating the figures of hidden money held … [Read more...]

Links Feb 23

UN panel chief, Thabo Mbeki, urges action plans to tackle illicit financial flow from Africa UN News Centre Video: How to reform the global tax system Global Economic Governance Programme Wind of Change: IMF Chief Calls For New International Taxation System Sputnik International See also: … [Read more...]

Big bills: let’s recall them all

In June 2014 we wrote an article about Big Bills: those high-value cash notes that are primarily of use to the world's criminals (when was the last time you saw a 500 Euro note in the flesh, for instance?) The countries that print them can literally make a killing from so doing. Big bills have … [Read more...]

Links Feb 22

Tax Dodging MNCs to Lose Assets in Australia Australia Network News New Zealand Consults Public On Automatic Exchange Of Info Tax-News India: Government notice to HSBC for abetting tax evasion Times of India See also: HSBC’s Swiss, Dubai units under lens for abetting tax evasion by Indians … [Read more...]

Corruption and the role of tax havens: workshop programme

For our workshop on tax havens and corruption at City University, London, 28th – 29th April 2016, our draft programme is here. Please click here to register, and follow the links. … [Read more...]

Call for articles: corporate tax reform, value theory, post-capitalism

We are calling for expressions of interest in contributing to an issue of Tax Justice Focus, dedicated to exploring the relationship between corporate tax reform, value theory, and the global transition to a post-capitalist, post-patriarchal, post-work society. An introductory essay is available … [Read more...]

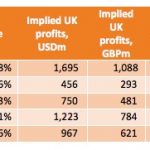

New analysis: why Google is paying just 2% tax rate in the UK

The Daily Mirror newspaper in the UK is running a story entitled Google is paying even LESS tax than thought as UK deal is just 2%. This is based on a new TJN analysis, based not on current tax rules but on what Google might pay if the UK were to adopt a fairer tax system that we've … [Read more...]

Global Tax Fairness: new book from Oxford University Press

This new book from Oxford University Press, edited by Thomas Pogge and Krishen Mehta, publishes fifteen chapters by leading tax justice scholars on different topics ranging from country-by-country reporting to unitary taxation, from automatic information exchange to tax wars, with clear and … [Read more...]

The Tax Justice Network February 2016 Podcast

In our 50th Taxcast edition: which country is the second easiest in the world after Kenya to set up an anonymous shell company? We shine the spotlight on tax haven USA and the lawyers secretly filmed by Global Witness advising a fake corrupt African government Minister. Also: we discuss Google's … [Read more...]

Links Feb 19

What really goes on inside the City of London? The Guardian Cites Nicholas Shaxson's Treasure Islands - Tax Havens and the Men Who Stole The WorldMbeki urges UN-AU cooperation over illicit financial flows SABC Swiss-Tunisian Diplomatic Accord Potential First Step in Recovering Ben Ali Millions … [Read more...]

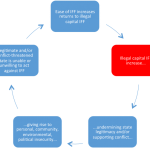

Illicit financial flows: the links to peace and security concerns

The UN Sustainable Development Goals (SDGs, the global framework guiding policy until 2030) include a target to reduce illicit financial flows (IFF), under SDG 16 on peace and security. Our research director, Alex Cobham, has written an article for the European Centre for Development Policy … [Read more...]

TJN in New York Review of Books: Missing Trillions

In the New York Review of Books: The Offshore Trillions John Christensen and James Henry, reply by Cass R. Sunstein MARCH 10, 2016 ISSUE In response to: Parking the Big Money from the January 14, 2016 issue To the Editors: … [Read more...]

Apply withholding taxes to tackle tax haven USA

We get a nice name check in an article in this week's Economist, which goes after a subject we've been particularly exercised about for some time: Tax Haven USA. It cites one player in the spreading game: “It’s going nuts. Everyone is doing it or looking into it,” says a tax … [Read more...]

Image of the day: IKEA

From the European Green Party: The full report finds that IKEA structured itself to dodge €1 billion in taxes over the last 6 years using onshore European tax havens. … [Read more...]