From Reuters: "Business may be about to look up for the [wealth management] industry helped by President Joko Widodo's tax amnesty plan that could encourage rich Indonesians to declare assets previously concealed from the authorities, either at home or abroad." So Indonesia is contemplating a tax … [Read more...]

Archives for 2016

Switzerland rejects request from Argentina on leaked HSBC accounts

From Argentina's La Nacion newspaper: "Switzerland has denied the Argentine judicial authorities information about 4,000 or so Argentine-owned bank accounts in Switzerland, saying that Argentina's request had no solid foundation." This concerns data revealed by an HSBC whistleblower, Hervé … [Read more...]

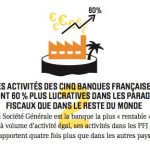

Following the Money: French Banks’ Activities in Tax Havens

Update: the English version is coming soon; the French version is here. The following press release is published by Oxfam France; CCFD-Terre Solidaire; and Secours Catholique-Caritas. The accompanying study uses the first fully available public Country-by-Country reporting data from French banks … [Read more...]

KPMG: are they really masters of the universe?

A guest blog by Atul Shah of Suffolk Business School. Also published at Tax Research. Are KPMG really masters of the universe? The growing size and influence of Big 4 global accounting firms, and their supermarket of business consulting and advisory services, is generating alarm among scholars … [Read more...]

The Multinational Enterprises (Financial Transparency) Bill

From the UK parliament, a motion that we noted in our previous blog on Oxfam's new UK tax havens report, and which we strongly support: Multinational Enterprises (Financial Transparency): Ten Minute Rule Motion Caroline Flint That leave be given to bring in a Bill to require certain multinational … [Read more...]

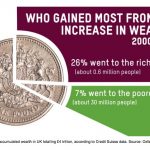

Oxfam report: Ending the Era of Tax Havens

Back in June 2000, three years before TJN's birth and at a time when nobody was talking about the issues, the charity Oxfam published a seminal document entitled Tax Havens: Releasing the hidden billions for poverty eradication. It was an important part of global tax justice history. We're … [Read more...]

Our corruption and tax havens workshop: new programme

We've updated the programme for our Corruption and Tax Havens workshop at City University, London, on April 28th and 29th. Great sessions in prospect including papers on the corruption driven by the UK's financial secrecy network, on gender and human rights impacts, and on the role of professionals … [Read more...]

Top rate income tax cuts: 89 percent go to men, 11 percent to women

From The UK's Mirror newspaper: "If George Osborne [the UK Finance Minister] slashes the rate further in the Budget – from 45p to 40p for those on £150,000 or more – will put even more money in men’s pockets. Analysis by the Tax Justice Network found there are 339,000 people (284,000 men and … [Read more...]

Why tax ‘competitiveness’ is like ice cream

From the Fools' Gold blog: One of the core arguments of our Fool's Gold project is that if you shower wealthy people and large corporations with goodies, two things happen. First, you may help them and you may be able to demonstrate some benefits, somewhere in the economy: such as improved … [Read more...]

“Squeaky clean” Cayman caught in the act – again

From the U.S. Department of Justice: "Cayman National Securities Ltd. (CNS) and Cayman National Trust Co. Ltd. (CNT), two Cayman Island affiliates of Cayman National Corporation . . . pleaded guilty to a criminal Information charging them with conspiring with many of their U.S. taxpayer-clients to … [Read more...]

Links Mar 9

You're A Rich Tax Dodger? No Problem, Says Canada Revenue Authority Canadians for Tax Fairness See also: Critics want public hearings into Canada Revenue amnesty for KPMG offshore tax dodgers CBC US and EU clash over tax practice clampdown The Irish Times "Washington urges Brussels to … [Read more...]

Tax haven Panama: giving the world the “middle finger”

Stephen Sackur and the BBC's Hard Talk programme have been talking to Panama's Vice President Isabel de Saint Malo de Alvarado. (It's only available to UK-based viewers, unfortunately.) She begins with a bout of self-congratulation about Panama, and Sackur responds with a wide number of … [Read more...]

Links Mar 8

Time To Kill Corporate Tax? Tax-News See also our report Ten Reasons to Defend the Corporate Income Tax ECOFIN agreement a missed chance, campaigners say Financial Transparency Coalition E.U. Ministers Agree to Share Tax Details on Multinationals The New York Times See also: European … [Read more...]

International Women’s Day: tax justice is a feminist issue, every day.

Women's Budget Group (UK): showing how gender issues can be addressed International Women’s Day: Tax Justice is a feminist issue, every day. By Liz Nelson On International Women's Day, let’s remember that tax justice is a feminist issue - every day. We’d like to use today to signal some … [Read more...]

How do top rate income tax cuts affect women?

On International Women's Day, this is the first of two blogs on the subject of tax justice and gender. The short answer to the question in our headline is that cuts to the top rate of income tax hit women particularly hard, not just because their disproportionate role in childcare and other … [Read more...]