From Bloomberg BNA: "Since 2013, the Organization for Economic Cooperation and Development [OECD] has been working on a 15-item BEPS action plan under Group of 20 authority with the aim of closing “loopholes” that allow multinationals to drastically reduce their taxes. Along the way, the project … [Read more...]

Archives for 2015

The Tax Justice Network Podcast, September 2015

In the September 2015 Tax Justice Network podcast: The next financial crisis? We look at offshore and the trillion dollar derivatives market. Plus: we discuss how Mexico's trying to force multinational companies to pay more tax, how recent market madness originating in China shows why we need a … [Read more...]

Links Sep 21

Singapore Urges Need For Tax Competition After BEPS Tax-News But tax competition, or rather tax wars, are harmful, see the Fools' Gold blog on What is (tax) competitiveness? Hunt for Tax Cheats Leads U.S. Government to Banks in Belize Bloomberg Apple Inc., Amazon See Mounting Tax … [Read more...]

The march of the international tax treaty arbitrators

From Martin Hearson, a (somewhat wonkish) post about tax treaties and developing countries, entitled The tax treaty arbitrators cometh: "There are lots of reasons why eliminating all forms of double taxation faced by cross-border investors is a sensible thing to try to do. It is what tax treaties … [Read more...]

Why a ‘competitive’ economy means less competition

From the Fools' Gold site: The 'competitiveness' of a country can be taken to mean many things. Many people, such as Martin Wolf or Paul Krugman, have argued forcefully that it is a meaningless or dangerous concept. On another level it's a question of language: you can make national … [Read more...]

Country by country reporting: lessons from Finland

A guest blog by Henri Telkki, Finnwatch. This concerns country-by-country reporting, a concept explained here. The CbCR piloting of Finnish state-owned companies – lessons to learn Finland acted as a front-runner in tax transparency by requiring those companies where the state holds more than a … [Read more...]

New Christian Aid poll: 70% believe ‘legal’ tax avoidance is wrong

From Business World in Ireland: "Only 36% of people trust multinational companies to provide accurate tax information, while 70% believe multinational tax avoidance schemes to be morally wrong even if they are legal according to a new . . . survey, conducted on behalf of the charity Christian … [Read more...]

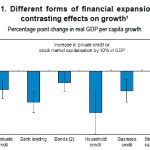

OECD: too much finance hurts growth — more on latest paper supporting Finance Curse thesis

From The Guardian: "Countries with bigger banking sectors suffer weaker growth and worse inequality, according to a report from the Organisation for Economic Co-operation and Development (OECD). After analysing 50 years of data across its 34 member-countries, economists at the Paris-based … [Read more...]

Links Sep 17

Bank lobby decries regulation “overload” swissinfo 'The Swiss Bankers Association has waded into the ongoing anti-tax evasion political debate' U.S. tax-evasion probe expands to Belize USA Today See also: IRS Hunts Belize Accounts, Issues John Doe Summons To Citibank, Band of America … [Read more...]

New report: Chevron’s Australian tax avoidance exposed

From Public Services International: "A report released today has revealed the extent of tax avoidance undertaken by US-based oil giant, Chevron, on its largest global project – the Gorgon LNG project in Australia. The report, Chevron’s Tax Schemes: Piping profits out of Australia?, was produced … [Read more...]

Juncker faces Euro tax committee: “disappointing and outrageous”

From Politico: "European Commission President Jean-Claude Juncker told a special parliamentary committee Thursday that as prime minister of Luxembourg he had no role in the country’s creation of special loopholes for multinational corporations." This was a hearing under an ad-hoc panel on the … [Read more...]

The G20/OECD BEPS Project on corporate tax: a scorecard

In 2013 the G20 world leaders mandated the OECD, a club of rich countries, for its Base Erosion and Profit Shifting (BEPS) project to produce reforms of international tax rules that would ensure that multinational enterprises could be taxed ‘where economic activities take place and where value is … [Read more...]

C20: new civil society policy paper on tax justice

Adapted from the Global Alliance for Tax Justice. Organisations from 91 countries from around the world, representing close to 500 civil society organisations and almost 5,000 individuals, have been working together for the last 18 months via the Civil 20 (C20) to engage with G20 governments on … [Read more...]

Links Sep 16

President Juncker must endorse public scrutiny of multinational tax payments Transparency International European Parliament tax investigation: Lobbyists from non-compliant firms to lose access to EU Parliament Sven Giegold Finland: Minister on board of tax haven firm YLE Minister of … [Read more...]

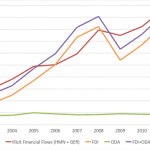

Report: Illicit Financial Flows Outpace Foreign Aid and Investment

Updated with new table: see below From Global Financial Integrity in Washington, D.C., via email: "Analysis of illicit financial flows (IFFs) by Global Financial Integrity (GFI) shows that in seven of the last ten years the global volume of IFFs was greater than the combined value of all … [Read more...]