A major new report written by civil society organisations in 14 countries across the EU, co-ordinated by Eurodad. Fifty Shades of Tax Dodging: the EU's role in supporting an unjust global tax system … [Read more...]

Archives for 2015

TJN unveils its new Financial Secrecy Index

Today the Tax Justice Network launches the 2015 Financial Secrecy Index, the biggest ever survey of global financial secrecy. This unique index combines a secrecy score with a weighting to create a ranking of the secrecy jurisdictions and countries that most actively promote secrecy in global … [Read more...]

Luxembourg – how’s that tax cleanup going?

NYT on The Price We Pay: exacting, disturbing, enlightening, must be heard

From the New York Times: “Throughout the world, inequality is soaring to new heights, and the wealth of nations, which once provided prosperity to the majority, has gone missing.” So begins the narration for “The Price We Pay,” Harold Crooks’s exacting and disturbing documentary about offshore … [Read more...]

Links Oct 29

Ten years in the campaign for tax justice - we have a long way to go Open Democracy By TJN Director John Christensen. See our recent blog New publication: The Greatest Invention – Tax and the Campaign for a Just Society Fighting tax evasion: EU and Liechtenstein sign new tax transparency … [Read more...]

Our 3rd Spanish Podcast: Nuestro Tercer podcast en Castellano

En la tercera edición de Justicia ImPositiva hablamos con Luis Moreno, economista y coordinador de la Red de Justicia Fiscal de América Latina y el Caribe y responsable del área de justicia fiscal del @latindadd sobre las reformas del sistema tributario mundial. Y despues ¿quién dijo que estaba … [Read more...]

How the wealth managers do it: an in-depth investigation

The Atlantic is carrying a truly fascinating article entitled Inside the Secretive World of Tax-Avoidance Experts. And this researcher, Brooke Harrington, went to town on it: "Given the little that is known about the profession and its role in global inequality, it seemed imperative to learn more … [Read more...]

Links Oct 26

Inside the Secretive World of Tax-Avoidance Experts The Atlantic Challenges for family offices in emerging markets IFC Review / Financial Times Reporting on a trend in developing economies - wealthy families setting up their own trust companies. Corruption and natural resources - A fight for … [Read more...]

The Tax Justice Network Podcast, October 2015

In the October 2015 Tax Justice Network Podcast: We look at the 'remittance cartel', their 'taxing of the poor' with monopoly prices in a juicy $450-500 billion market. Also: 'comfort letters' and the game changing European Commission ruling that the tax agreements between Luxembourg, the … [Read more...]

Links Oct 22

Video: Taxation (ICTD/UNU-WIDER Special Session) 1/5 - 30th Anniversary Conference Extracting minerals, extracting wealth: how Zambia is losing $3 billion a year from corporate tax dodging War on Want After Blow to Europe Tax Havens, Some Promise More Staying Power Bloomberg Large-scale … [Read more...]

Fiscal Policy and Human Rights in the Americas: mobilizing resources to guarantee rights

There is a new initiative emerging from the international strategy meeting, “Advancing Tax Justice through Human Rights,” held in Lima, Peru in April 2015: Via email from Niko Lusiani of the Center for Economic and Social Rights (CESR): The first-ever thematic audience of the Inter-American … [Read more...]

Links Oct 21

Starbucks and Fiat sweetheart tax deals with EU nations ruled unlawful The Guardian See also: Apple Stakes Raised as EU Orders Starbucks, Fiat Tax Repayments Bloomberg, and earlier blog European Commission determines state sponsored tax avoidance schemes illegal Switzerland Must Seize … [Read more...]

European Commission determines state sponsored tax avoidance schemes illegal

Today the European Commission is expected to announce that the 'comfort letters' signed between European tax havens and companies are a form of illegal state aid. … [Read more...]

Links Oct 19

Analysis: Can we beat tax avoiding multinationals? - Finance Uncovered/ Byline How to lose $4billion Global Witness New report, coming ahead of a pivotal meeting of the Extractive Industries Transparency Initiative (EITI). "Credibility test for global transparency standard as $4bn lost to … [Read more...]

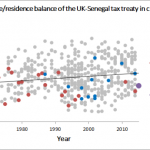

Will civil society shake up the world of tax treaties?

When a multinational company makes a cross-border investment, the relevant tax treaty between the two countries will generally sort out which country gets to tax which part of the ensuing activity and income streams. (Read more about tax treaties here.) A key question is this: how do the ensuing … [Read more...]