G20: what was achieved in 2014? Eurodad Where next for the EC tax probe? economia Green Party leader Eamon Ryan criticises Fine Gael for not backing Lux Leaks tax inquiry The Irish Times UBS France: again, the whistleblower faces her former employer Le Temps (In French) UBS whistleblower … [Read more...]

Archives for 2015

Who runs this place? ‘Policy development’ and the Big 4

We just wrote a blog about tech giants, via a Financial Times article suggesting that they risk suffering reputational damage that could eventually be as bad as the reputational damage suffered by big banks. Well, there's another category that risks suffering the same fate in future. The Big … [Read more...]

Austerity: the tax dodgers’ best friend?

One might think that if a government wanted to impose austerity, its appetite for tax collection would rise. But this may not be the case. Take a look at this study from the European Federation of Public Services Unions (ESPU,) which came out last October but remains relevant. It's called The … [Read more...]

Luxembourg, Amazon, and the State aid connection

Earlier this month Bloomberg reported that the European Union had stated that: "Luxembourg hastily approved a “cosmetic” tax deal with Amazon.com Inc. in 11 days, allowing the company to shift profits to a tax-free unit. The EU told Luxembourg officials in a letter that the deal, based on a … [Read more...]

On the historical absence of inequality and tax in the news agenda

This guest blog from Dr Jairo Lugo-Ocando comes just a couple of days after the UK commentator George Monbiot wrote a piece in The Guardian entitled Our ‘impartial’ broadcasters have become mouthpieces of the elite, mostly from a Canadian and British perspective, in which he noted the extent of … [Read more...]

Links Jan 22

How Country By Country Reporting Could Have Made LuxLeaks Unnecessary Financial Transparency Coalition / Transparency International Are anonymous companies a ‘getaway vehicle for corruption’? The Guardian European Commission explains how Amazon made $4.5 billion in ‘stateless’ profits … [Read more...]

The political mathematics of tech giants

Some political mathematics. A + B + C + D + E = F. Here's A: US tech giants launch fierce fightback against global tax avoidance crackdown. Reforms "must be resisted." Now B: The libertarian Cato Institute, funded by the billionaire industrialist Koch brothers, said it had received support from … [Read more...]

Quote of the day: offshore enforcement as a career killer

From Jack Blum, a Senior Adviser to the Tax Justice Network, testifying to the U.S. Senate Committee on Finance: "For years there has been very little offshore enforcement. There was a period in the 1970’s when IRS made some efforts in that direction. The cases were dismissed. The agents who … [Read more...]

Links Jan 21

The Business Case for Ending Anonymous Companies: a Collective Effort The B Team Transparency: Cracking the shells - New rules in the European Union take aim at corporate secrecy The Economist Kenya’s capital gains tax stirs uproar CNBC Africa … [Read more...]

Quote of the day: we are entering the age of tax wars

From Mark Textor, adviser to Australian Prime Minister Tony Abbott: "We are entering the period of tax wars instead of trade wars," he said. "People vote in governments to solve the problem, and giant multinationals not paying tax is a problem." One for the Tax Wars page. Hat tip: Mark … [Read more...]

Foreign exchange turmoil brings offshore centres into focus

Moves by the Swiss National Bank to remove the Swiss Franc's currency peg to the Euro has prompted a new round of turmoil in global foreign exchange (FX) markets. We've already written about this from a tax justice perspective, but here's something else. Quite a few currency brokers have gone … [Read more...]

Links Jan 20

BEPS Action 14: Make Dispute Resolution Mechanisms More Effective BEPS Monitoring Group Review of Islands at the Bush Theatre London Londontheatre1.com Corporate Tax Behavior Can Be Changed By Public Pressure [Study] ValueWalk Richest Russians Repatriate Assets as Putin Turns Tax Screw … [Read more...]

The Offshore Wrapper: a week in tax justice #47

Dodgy tax deals constitute illegal state aid? Even before the LuxLeaks scandal broke, the European Commission had been undertaking an investigation of advance tax agreements between companies and tax havens. … [Read more...]

Links Jan 19

Ex-Swiss banker found guilty in WikiLeaks trial, avoids jail Reuters See also recent blogs Will Antoine Deltour become a prisoner of conscience? and Tax haven whistleblowers: where are the human rights organisations? U.S. regulators question whether Credit Suisse has rule-breaking culture … [Read more...]

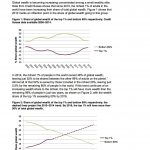

Report: will top 1% have more wealth than the 99% in 2 years?

From Oxfam, a new briefing, based on updated Credit Suisse estimates. It contains the following factoids: … [Read more...]