The European Commission has just announced a formal investigation of the tax agreement struck between McDonald's and Luxembourg. Read the full press release here, also read the Unhappy Meals report on McDonald's tax avoidance schemes. There are many reasons to boycott McDonalds; add tax avoidance … [Read more...]

Archives for 2015

Links Dec 2

Art & Money Laundering in Switzerland - secrecy is weakening Bilan (In French) Article in English here. EAC states adopt new measures to curb tax loss The East African European Parliament tax investigation continued: Strong mandate for new committee to continue tax investigation Sven … [Read more...]

Ex-money launderer Kenneth Rijock offers tips for whistleblowers

In this article, first published in the Whistleblower Edition of TJN's newsletter, Tax Justice Focus, convicted money launderer Kenneth Rijock (author of The Laundry Man, Penguin, 2013) offers some practical advice to those who might be considering blowing the whistle on their employers. Helpful … [Read more...]

Links Dec 1

HSBC whistleblower given five years’ jail over biggest leak in banking history The Guardian See also: 'Sentencing Changes Nothing, Will Help Black Money Probe,' Says Herve Falciani NDTV, The Snowden Of Swiss Bank Accounts Is Sentenced To Prison While White Collar Criminals Go Free ThinkProgress, … [Read more...]

Kenya as a tax haven would be a ‘financial crime aircraft carrier’

Our quote of the day concerns a plan to turn Nairobi into a "regional finance hub" through the establishment of the Nairobi International Financial Centre (NIFC): "Anti-corruption campaigner John Githongo has warned that in this setting, the NIFC “would be like a financial crime aircraft … [Read more...]

New study: corporate tax cuts may have been ‘the greatest blunder’

The Canadian Center for Policy Alternatives has just published a new study entitled Do Corporate Income Tax Rate Reductions Accelerate Growth? It summarises: "This study examines the relationship between the Canadian corporate income tax (CIT) regime and various dimensions of economic growth. The … [Read more...]

John Christensen on rocking the boat in Jersey

In this blog, first published in the Whistleblower Edition of Tax Justice Focus (available here), TJN's director John Christensen, a former Economic Adviser to the island of Jersey, reflects on his experience of exposing a banking scandal, which involved him in a direct confrontation with senior … [Read more...]

Survey: corruption rife among accountants.

From Accountancy Age in the UK: "The research - by global job board CareersinAudit.com - quizzed 1696 accountants around the planet, including 400 in the UK, showed that 48% had either been pressurised (or knew of someone that had) by a manager or partner to ignore an adjustment that should have … [Read more...]

The private banking fairy tale: a whistleblower’s story

This article was originally published in the Whistleblower Edition of Tax Justice Focus (November 2015) Whistleblowing by finance professionals has begun to make significant inroads into the sector’s culture of secrecy and collusion. Here UBS whistleblower Stéphanie Gibaud describes the costs to … [Read more...]

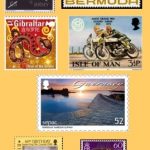

UK secrecy jurisdictions are still helping criminals the world over

30 November 2015 Despite real progress, UK secrecy jurisdictions are still helping criminals the world over, warns report. UK Prime Minister David Cameron has vowed to lead the global fight against corruption. But, a new assessment released today warns that the UK cannot credibly claim that it has … [Read more...]

Greek shipowners and the competitiveness threat

There's a threat hanging over the Greek government. And it's been hanging there for decades. An important new special report by Reuters' Tom Bergin contains this: "That's the way Greek shipowners like it. The magnates who run one of the biggest merchant marine fleets in the world have long … [Read more...]

Our Spanish podcast is out! Salió nuestro podcast en Castellano

Justicia ImPositiva, Edición 4. En la cuarta edición de Justicia ImPositiva revelamos cuáles son los proveedores más significativos en la actividad financiera mundial opaca, así como los impactos y las sorpresas de los resultados del nuevo Índice de Secreto Financiero 2015, publicado este mes … [Read more...]

How the U.S.A. became a secrecy jurisdiction

This month we published our fourth Financial Secrecy Index (FSI), complete with a series of reports about each of the biggest tax havens and secrecy jurisdictions, looking into the political and economic histories of how and why they went offshore, who was involved, and where the bodies are … [Read more...]

Links Nov 26

An uneven playing field: inequality, human rights and taxation inesc "The Latin American experience shows that progressive tax systems are crucial to reducing inequality." EU lawmakers step up pressure to tackle tax dodging Reuters See also: EP tax investigation: EP president Schulz blocking … [Read more...]

Reporting a crime is not a crime

UPDATE: Since publishing this blog on 26th November 2015 the Swiss Federal Court in Bellinzona has sentenced HSBC whistleblower Herve Falciani to five years in prison. Mr Falciani, who was tried in absentia, was charged with data theft, industrial espionage and violation of Swiss banking secrecy … [Read more...]