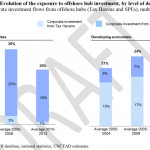

The UN Conference on Trade and Development (UNCTAD) has just published a major new study on corporate tax in developing countries, which contains a wealth of new information analysis as well as some important headline numbers: notably that developing countries lost around $100 billion per year in … [Read more...]

Archives for 2015

An African civil society perspective on Financing for Development

From the Uncounted blog, run by TJN's Director of Research, Alex Cobham The African regional consultation on Financing for Development (FfD) took place at the start of the week (like the European one). The submission from TJN-Africa puts particular emphasis on inequality, including women’s rights, … [Read more...]

Links Mar 25

New Swiss-EU treaty will replace Savings Tax Agreement STEP Mauritius promises India full-cooperation on tax treaty issues IBN Live Die Welt: The Greek Government Ignored 800 Bln In Black Money Transferred to Swiss Banks Greek Reporter … [Read more...]

Britain’s new company registry is a job half done

First, the good news: the UK government has committed to creating a central public register of company ownership following Parliament's approval of this crucial measure to tackle crime and tax dodging. … [Read more...]

Quote of the Day on Trickle-Down Economics

Economist John Kenneth Galbraith described trickle-down theory as "the less than elegant metaphor that if one feeds the horse enough oats, some will pass through to the road for the sparrows." Which pretty much summarises what has happened in practice over the past forty years as the theory has … [Read more...]

Links Mar 24

Tax transparency can work for companies if they do it right The Conversation Life After Loopholes Forces Luxembourg to Rethink Its Future Bloomberg Ex-Greek finance minister found guilty of tampering with tax list Reuters A tax haven crackdown would help the developing world Politics.co.uk … [Read more...]

What is competitiveness? #1 – Robert Reich

From the Fools' Gold blog, an article that speaks for itself What is Competitiveness? #1 Robert Reich This is the first in an ongoing series of articles we are planning, to explore what competitiveness is, from the perspective of particular public figures or intellectuals. For the first in this … [Read more...]

Links Mar 23

China steps up fight against tax evasion with new regulations on multinationals South China Morning Post See also recent blog: Developing countries and corporate tax – ten ways forward Demand for ‘equal’ tax regime for MNCs The Independent Bangladesh Development and Taxes, a Vital Piece of … [Read more...]

Meet TJN in Oxford to discuss the fallacy of tax “competitiveness”

The Tax Justice Network Podcast, March 2015

The Tax Justice Network Podcast, March 2015 In the March 2015 Taxcast: Democracy for sale - how our politics rely heavily on tax haven-friendly donors. Also, we ask: why is HSBC shutting down offshore accounts in Jersey? Are we in the final few years of the corporate income tax? Is Australia's … [Read more...]

Links Mar 19

New ruling highlights ongoing secrecy around Glencore tax case in Zambia Christian Aid The world can’t afford to exclude developing countries from new anti-tax evasion system Financial Transparency Coalition European Commission’s Tax Transparency Package keeps tax deals secret Eurodad See … [Read more...]

Tax haven Gibraltar sues newspaper for calling it a tax haven

Another story from TJN’s Department of You-Couldn’t-Make-This-Stuff-Up. News is coming out that the government of Gibraltar is planning to sue Spanish newspaper ABC for defamation. Apparently the Gibraltarians take exception to the British Overseas Territory being depicted as a tax haven. Here … [Read more...]

People’s Parliament to discuss How Corrupt is Britain?

On Thursday 26th March 2015, the People's Parliament will meet at Westminster in London to discuss a complex question, How Corrupt is Britain? British people have long prided themselves on having a relatively corruption-free liberal democracy. Corruption, as the old saying goes, is something … [Read more...]

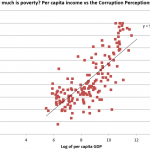

The UK’s money laundering rules support debanking of poorer countries

By Alex Cobham, TJN's Director of Research. Originally posted at his blog Uncounted. Poverty – a bad money-laundering risk factor The UK’s Financial Conduct Authority has revealed the basis on which it ranks jurisdictions as low or high risk for money laundering – and it seems inevitable that it … [Read more...]

New Report: Ten Reasons to Defend the Corporate Income Tax.

UPDATES 2018 - Tax incentives in mining: minimising risks to revenue, OECD/Intergovernmental forum on mining, minerals, metals, and sustainable development. "Tax incentives are costly, leading many countries to forgo vital revenues in exchange for often illusive benefits. . . there is little … [Read more...]