From Tove Maria Ryding and María José Romero, an article in The Guardian, looking at the UN's Finance for Development process, and a high-level conference set for Adis Ababa in July: "Finance for Development (FfD) is not a fundraising event. It focuses on systemic issues such as illicit financial … [Read more...]

Archives for 2015

Links Apr 17

Joint May Day statement: Working people pay taxes – corporations must pay their share! Global Alliance for Tax Justice Angola’s sovereign fund pays $100 million to a shell company index Commodity giants' Singapore trading hubs under fire in tax probes Reuters Christine Lagarde, scourge of … [Read more...]

Comedian Russell Brand doorsteps Lord Rothermere over his non-dom status

Michael Winterbottom's new film, starring Russell Brand and featuring us, gets its world premiere and goes on general release next week. Britain's role as a tax haven features prominently, and in the following clip from the film Brand doorsteps Lord Rothermere, owner of the stridently anti-tax … [Read more...]

Tipping the balance: new global corporate law

The Transatlantic Trade and Investment Partnership (TTIP) being secretly negotiated between the USA and the EU countries is widely criticised for opening the way for powerful corporations to challenge legitimate governments and use unaccountable arbitration processes to overturn democratically … [Read more...]

Links Apr 16

"Developing countries" Is it or isn’t it a spillover? Martin Hearson Too much focus on ‘spillover effects’ of tax policies might lead to an too-narrow analysis of the impacts of a jurisdiction’s tax policies on developing countries. America’s Most-Wanted Swiss Bankers Aren’t Hard to Find … [Read more...]

When a tax haven invokes the ‘level playing field’, run for the hills

From Canada's Globe and Mail: "The Minister of Finance for Luxembourg says his country – labelled by critics as a tax haven for multinational corporations – is committed to sweeping international tax reforms being pushed by the G20 and the Organization for Economic Co-operation and Development, as … [Read more...]

The Offshore Wrapper: a week in tax justice #57

The Offshore Game This week TJN released a major, ground-breaking study into offshore finance and sport. The report seeks to quantify the amount of money from offshore flowing into the UK professional football leagues. … [Read more...]

Links Apr 15

How anonymously owned companies are used to rip off government budgets Global Witness Taxing Multinationals: Is There a Pot of Gold of Finance for Development? Center for Global Development CSO Response to the Zero Draft of the Outcome Document of the Third Financing for Development … [Read more...]

What competition in the Offshore Game?

This week sees the launch of The Offshore Game, a project dedicated to looking at the role of offshore financial centres in sport. TJN has written about this here and here already. Now for a bit more of an overview of this emerging project. Our first report looks at the amount of finance from … [Read more...]

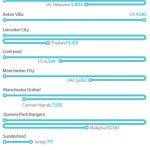

Veblen and Keynes comment on the UK Premier League

We've just written about the new Offshore Game report, covered extensively in The Guardian newspaper, and thought we'd note one of the nice little graphics about offshore ownership that The Guardian has created. … [Read more...]

Tax Justice: A Christian Response to a New Gilded Age

From the U.S. Presbyterian Church, a report written by a former World Bank economist entitled “Tax Justice: A Christian Response to a New Gilded Age”. As the summary notes, it "provides a framework for engaging in discussions about the large and growing concentration of income and wealth in … [Read more...]

The Offshore Game – new TJN report on offshore finance in football

From The Guardian, a major new story whose introduction runs as follows: "Research by the Guardian and the Tax Justice Network reveals 28 English clubs with substantial shareholdings overseas, opening up the football leagues to criticism for allowing ownership structures that could be used for … [Read more...]

New U.S. report: Offshore Tax Havens Cost Small Businesses $3,244 a Year

From the U.S. Public Interests Research Group (PIRG): As tax day approaches, it’s important to remember that small businesses end up picking up the tab for offshore tax loopholes used by many large multinational corporations. U.S. PIRG joined Senator Bernie Sanders, Bryan McGannon of the … [Read more...]

Quote of the day – tax avoidance as red flag for investors

From the Financial Times, our quote of the day: "investors were viewing the aggressiveness of a company’s tax planning as a proxy for accounting risks and the company’s broader management style." Which is just as we have always said. Tax avoidance is shortcut behaviour: the opposite of … [Read more...]

Links Apr 13

‘HSBC has specifically targeted Argentina’ Buenos Aires Herald "Tax Justice Network head John Christensen warns about the bank’s lobbying power" Getting the EU response to the tax dodging scandal right Eurodad See also: Corporate Tax Avoidance Crackdown, a Missed Opportunity for the EU … [Read more...]