We've just written about the role of Goldman Sachs in distorting U.S. sports and harming smaller players via tax cheating. Well, here is yet another thing to make you choke on your cornflakes: FIFA hurting poor countries though what we'd describe as aggressive, idiosyncratic tax cheating. … [Read more...]

Archives for 2015

How Goldman Sachs distorts sports via tax cheating

As if the FIFA scandal weren't enough to be choking on. Quoted in the LA Times, an article about Goldman Sachs' role in financing large sports stadium: "Goldman Sachs' job is to use, if not disguise, every public funding tax shelter and loophole." Here is the (sour) juice of this particular … [Read more...]

Global Week of Action for #TaxJustice, June 16-23, 2015.

The Global Week of Action for #TaxJustice, which will take place in June 16-23, 2015, aims to encourage and cross-promote diverse activities that are initiated across our tax justice communities, to increase public pressure on governments across the world. Members and allies of the Global Alliance … [Read more...]

Stiglitz to tax haven UK: you are aiding and abetting theft

Our quote of the day, from Nobel prize winning economist Joseph Stiglitz, commenting in the wake of the UK election: “Some of these people are just using your rule of law to protect money they have stolen in other countries . . . From a global point of view, you are aiding and abetting theft.” … [Read more...]

The Offshore Wrapper: a week in tax justice #51

FIFA officials go down in a Chuck Blazer of glory FIFA executives gathering in Switzerland this week for the coronation of the Eternal Leader Sepp Blatter have had a nasty surprise. In a dawn raid Swiss and US police mounted a joint operation to arrest and deport several high ranking FIFA … [Read more...]

Amazon to curb Luxembourg tax schemes: a sign of things to come?

Last Saturday The Guardian broke a story about the U.S. multinational Amazon: "From the start of this month the online retailer has started booking its sales through the UK. . . The group made $8.3bn (£5.3bn) of worldwide sales from British online shoppers but for 11 years all these internet … [Read more...]

The Tax Justice Network Podcast, May 2015

In the Tax Justice Network's May 2015 Podcast: Do our politicians believe in the societies they serve or not? The Taxcast looks at making the tax returns of our elected representatives public and the inspirational achievement of award winning journalist Umar Cheema of the Centre for Investigative … [Read more...]

Links May 22

Special Report - Britain's home-grown tax haven Reuters Costa Rican bill would allow tax authority to seize assets without court order STEP See the article in Spanish here. Swiss Bankers Respond To Privacy Initiative Tax-News … [Read more...]

Justice, interrupted: will bankers get off the hook ever more lightly?

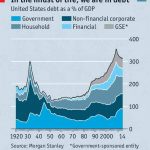

Two Economist blogs in a row: this time we've a fine excuse because their image comes from our TJN Senior Adviser, Jim Henry, who presented this data at the TJN-supported Illicit Financial Journalism Programme in London last week, and gave a preview last February in our Taxcast (see below): "just … [Read more...]

Economist: why it’s time to stop making debt tax-deductible

We've said this before, and we may have felt radical saying it at the time - but now it's The Economist saying it. It has an article entitled and subtitled A senseless subsidy: Most Western economies sweeten the cost of borrowing. That is a bad idea. Quite so. And the potential rewards it … [Read more...]

Links May 21

Alan Rusbridger: press can't afford to cover corruption and tax avoidance The Guardian "Guardian editor-in-chief says newspapers retain the power to hold companies to account, but their declining fortunes are making it difficult" Lux Leaks Scandal. Juncker Gets A Step Closer to Hot Seat … [Read more...]

Tax wars: seminar at European parliament

A seminar at the European parliament in Brussels, featuring TJN's Markus Meinzer: … [Read more...]

Farewell, Margaret Hodge

Margaret Hodge, the fiery head of the UK's Public Accounts Committee, has been hauling the bosses of large multinational corporations over the coals for their egregious abuses of the UK tax system. Now, post-election, she is stepping down. Many tax professionals in the UK dislike, hate, or even … [Read more...]

Bill Gates: corporate tax rates at 35% won’t stop the innovators

Via the Fools' Gold blog: A Bloomberg report on a Bill Gates interview: 'Gates scoffed at comparisons linking taxes and regulation to slower growth. “The idea that there’s some direct connection, that all these innovators are on strike because tax rates are at 35 percent on corporations, … [Read more...]

Financial Secrecy Index: new academic paper

Cross-posted with the Uncounted blog: a forthcoming paper in Economic Geography. The Financial Secrecy Index is the Tax Justice Network's flagship index of secrecy jurisdictions, or 'tax havens'. The idea emerged from discussions at the World Social Forum in Nairobi, in January 2007. In … [Read more...]