End transnationals' 2 billion tax dodge on poorest countries The Ecologist Legal but secret: the story of tax rulings Europarl TV See also: Eurodad: Statement to the European Parliament’s Special Committee on Tax Rulings and Other Measures Similar in Nature or Effect Blowing the whistle on … [Read more...]

Archives for 2015

OECD country-by-country reporting: Strangled at birth

Sigh. Country-by-country reporting, an idea first mooted and pushed by Richard Murphy for TJN - is making slow but steady headway, in various fora internationally. The OECD, which only relatively rarely fails to disappoint, has been weighing in on this weighty affair. We now report on the latest … [Read more...]

TJN in The Economist: on the precious corporate income tax

Recently, we wrote an article welcoming a major intervention by The Economist magazine, which was arguing that rules allowing people and corporations to set interest payments against their tax bills is a historical anachronism whose time has now gone. … [Read more...]

Australia may try to exempt wealthy via scaremongering

The Sydney News reports: "The Australian government has produced draft legislation to classify the financial accounts of private wealthy families, in order to deter kidnappers." and there's more, summed up by The Guardian: … [Read more...]

Links Jun 5

Tax haven: Belgium to blacklist Luxembourg Luxemburger Wort Belgium targets £390m in unpaid tax as HSBC considers job cuts The Guardian How the Cayman Islands Became a FIFA Power The New York Times See also: A U.S. Tax Investigation Snowballed to Stun the Soccer World The New … [Read more...]

Norwegian Parliament votes for public registry of ownership

Guest blog from Sigrid Klæboe Jacobsen of TJN Norway On the 5th of June, a unanimous Norwegian Parliament voted for establishing a beneficial ownership registry. … [Read more...]

HSBC, money-laundering and Swiss regulatory deterrence

Number-crunching, à la Private Eye: the case of HSBC and its Swiss fine for “organisational deficiencies” in relation to money-laundering. $42.8 million Fine imposed on HSBC by Geneva authorities for "organisational deficiencies" related to money-laundering uncovered in … [Read more...]

Did KPMG spot anything amiss at FIFA?

From Francine McKenna: "Of all the individuals and firms tied up in the scandal over bribery and corruption at FIFA, scrutiny has so far largely escaped KPMG, the soccer association’s external auditor." That's the summary, and our quote of the day. The article continues: … [Read more...]

Links Jun 3

Support-antoine.org - newsletter: We support Antoine Deltour, the whistleblower of the Luxleaks revelations! Your can donate to the Support Committee for Antoine Deltour here. Luxleaks whistle-blower Deltour wins broad support in European Parliament European Parliament News Luxleaks … [Read more...]

International commission calls for corporate tax reform

When we look back, might today be the day that momentum swung decisively against current international tax rules? An independent commission made up of leading international economists, development thinkers and tax experts (see the graphic) has called for a radical overhaul of international … [Read more...]

The Offshore Wrapper: a week in tax justice #62

Europe: the final countdown…? A series of news stories came out this week about European Union proposals to tackle tax avoidance by multinational companies and secret offshore banking. Is this one reason why that well known tax haven the United Kingdom seems desperate to leave? … [Read more...]

Tax Justice Research Bulletin 1(5)

May 2015. Welcome to the fifth Tax Justice Research Bulletin, a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international taxation. This issue looks at a fascinating thesis on the different people and organisations that influence the … [Read more...]

Quote of the day – tax incentives as official tax evasion

This headline may seem odd. Conventionally tax evasion involves cutting taxes by breaking laws; using tax incentives is a different creature altogether: it involves cutting taxes by using the law. But this useful new report from the European parliament contains a twist on the conventional … [Read more...]

World No Tobacco Day: Marching to Big Tobacco’s tune?

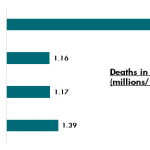

Cross-posted with the Uncounted blog, by TJN's research director Alex Cobham. World No Tobacco day was on Sunday (yesterday.) World No Tobacco Day: Marching to Big Tobacco’s tune? Has World No Tobacco Day 2015 – this Sunday – been manipulated by Big Tobacco’s lobbying agenda? Where the tobacco … [Read more...]

Links May 29

How to tackle tax evasion and tax avoidance? The case for tax transparency to contain and end tax wars Presentation by TJN's Markus Meinzer at the ALDE seminar: How to tackle tax evasion and tax avoidance? Paving the way for fair tax competition in Europe. Reflecting on Progressive Realisation … [Read more...]