In this excerpt from an interview recorded in June 2015, Ross Ashcroft talks with film-maker Harold Crooks (The Corporation, Surviving Progress, The Price We Pay) and TJN's director, John Christensen, about the threat posed by tax havens to parliamentary democracy. … [Read more...]

Archives for 2015

Links Jun 22

The parallel financial universe of the Cayman Islands Cayman Reporter "...the people of these islands are waking up to the reality that has been kept masked under many shrouds for decades." US official says British government undermined progress on tax avoidance The Guardian See also: Could UK … [Read more...]

New IMF research: tax affects inequality; inequality affects growth

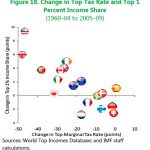

This new graph from the IMF is just the latest piece of research that follows on from the in-depth work of Thomas Piketty and others looking at the relationship between top income tax rates and inequality. The graph here makes the point adequately. Put crudely, the lower the top tax rate, the more … [Read more...]

The Tax Justice Network Podcast, June 2015

June 2015 Tax Justice Network Podcast: … [Read more...]

Links Jun 19

Follow the money: inside the world's tax havens The Guardian Global Week of Action for #TaxJustice: coming events Global Alliance for Tax Justice The BEPS Monitoring Group - Comments on BEPS Action 8: Hard-to-Value Intangibles Tip of the iceberg: the role of the banks in the FIFA story … [Read more...]

New OECD report backs TJN’s Finance Curse research

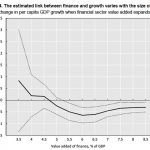

A new report from the OECD (hat tip: Dan Hind) contributes to what is now accepted wisdom in finance-and-growth circles: too much finance is bad for you. Our Finance Curse analysis explores this in detail. This blog is merely a pointer to the OECD study published a few days ago, which states: "The … [Read more...]

Exposed: $43 million tax dodge in world’s poorest country

From ActionAid, another excellent investigation into a corporate tax dodge in Malawi, which on some measures is the world's poorest country: Today [June 17] we’ve released an investigation into an Australian mining company called Paladin, operating in Malawi – the world’s poorest country. We … [Read more...]

10 Reasons Why an Intergovernmental UN Tax Body Will Benefit Everyone

We have written for years about how the OECD, a club of rich countries has dominated the international tax system and that this inevitably skews the system in the favour of, well, rich countries. A potentially far more representative body exists -- the UN Tax Committee -- but the OECD and its member … [Read more...]

Sign on! Lima Declaration on Tax Justice and Human Rights

Via the Global Alliance for Tax Justice: Organisations are now invited to endorse the Lima Declaration on Tax Justice and Human Rights. … [Read more...]

Links Jun 18

Exposed: the million tax dodge ActionAid See the report: An Extractive Affair: How on Australian mining company's ax dealings are costing the world's poorest country millions Nigeria: Remedy for a Trillion Dollar Problem? allAfrica Africa: How everybody holds the continent back New … [Read more...]

Juncker’s hidden hand? EU tax haven blacklist omits Luxembourg

We have often remarked how international tax haven blacklists generally reflect the political powers and influence of nation states; as a result they tend to include 'minnows' but not the big fish. (Among other things, this means a lot of econometric studies resting on a baseline of nonsense.) … [Read more...]

Indonesia: Financial Transparency Conference, Jakarta, October

From the Financial Transparency Coalition, of which TJN is a member: Register and FAQ here. … [Read more...]

Agreement in Buenos Aires on need for public registries of beneficial ownership

From Andres Knobel Buenos Aires - On June 10th and 11th, Tax Justice Network together with Argentina’s General Prosecution Office (Ministerio Público Fiscal), Argentina’s Central Bank and other NGOs including Fundación SES, Latindadd and CIPCE hosted a two-day event involving … [Read more...]

European Commission half measures will exacerbate profit shifting

17th June 2015 - for immediate release European Commission half measures will exacerbate profit shifting Today’s Action Plan on Fairer Taxation sees the European Commission stall on transparency while giving tax sweeteners to multinational companies … [Read more...]

Hey Walmart, it’s time to pay your taxes

A groundbreaking report released Wednesday, June 17 (12:01am) by Americans for Tax Fairness (ATF), and researched by the United Food & Commercial Workers International Union (UFCW), reveals that Walmart has built a vast, undisclosed network of 78 subsidiaries and branches in … [Read more...]