Our quote of the day comes from Jen Stout, from the Scottish Land Action Movement: "We have to ask how it can be possible that vast swathes of our land in Scotland are registered in secretive tax havens. Land is a fundamental resource, not some speculative asset for the super-rich." Which is a … [Read more...]

Archives for 2015

The Offshore Wrapper: a week in tax justice #69

Washington DC defines tax havens, then taxes them The city of Washington DC has become the latest US government to take on tax havens. The city will now directly tax the income of companies made in a number of tax havens. The legislation works by requiring companies that do business in the … [Read more...]

Links Sep 4

Antoine Deltour, the man who shook Luxembourg Le Figaro (In French) See also our blog: Will Antoine Deltour become a prisoner of conscience? Brussels Refusing to Hand Over Documents in European Tax Scandal Probe Sputnik UK company ownership register postponed until next June STEP See also … [Read more...]

Links Sep 3

Argentina Tells HSBC to Remove CEO in Tax Evasion Dispute Bloomberg Tax Evasion: Argentine Tax Authority Recruits Whistleblowers Falciani and Gibaud La Trbune (In French) See article linked earlier on the Falciani trial in Switzerland, and our recent guest blog How Switzerland corrupted its … [Read more...]

Civil society calls on G20 finance ministers to end fossil fuel subsidies

G20 finance ministers will be meeting in Ankara, Turkey, on 4th and 5th September 2015, under the Turkish G20 presidency. In a letter to finance ministers, TJN and over sixty other civil society organisations call upon them to meet their … [Read more...]

Selling England by the offshore pound: astonishing new interactive map

Britain's Private Eye newspaper has produced the most astonishing map of offshore landholdings in England. If you live in England, you can browse your local area and find out which properties near you are owned offshore. (Perhaps you might want to pop out and ask them why.) As Private Eye flag … [Read more...]

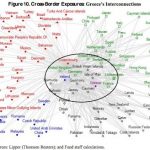

Why tax havens will be at the heart of the next financial crisis

Update: this has now been cross-posted at Naked Captalism This post examines another excellent in-depth investigation by Reuters into global financial stability issues, and the role of tax havens in this giant game of pain and plunder. The investigation uncovers, among other things, a whole lot … [Read more...]

As the murk grows, the UK rows back on money laundering checks

Updated with Cayman-related news. From Global Witness, a new report entitled Banks and Dirty Money: How the financial system enables state looting at a devastating human cost. It's got plenty of detail, but one eye-catcher is their look at the largest penalties given for money-laundering or … [Read more...]

New report: anticipating tax wars in Southeast Asia

From the Fools' Gold blog: We've sometimes used the term 'tax wars' instead of 'tax competition' to describe the process by which countries try to tempt mobile capital by offering tax breaks, prompting others to follow suit in a race to the bottom. Countries often do this in the name of 'tax … [Read more...]

Links Sep 1

The Role of Global Banks, Financial Asset Management by "Private Banking". Contribution for the Think 20. CEFID By Jorge Gaggero and Magdalena Belén Rua Spooked by black money bill, Swiss banks ask Indians to utilise 'compliance window' FirstPost Law firm defends use of charities to help … [Read more...]

Taxing Money Madness – now is the perfect time for FTT/Robin Hood tax

Taxing Money Madness -- Why This Is A Perfect Time for a Robin Hood Levy on Financial Transactions A guest blog for TJN by James S. Henry If ever there was a perfect time to revisit the proposal to adopt a so-called "Robin Hood tax” (AKA the "financial transactions tax," or the "Tobin tax") … [Read more...]

Links Aug 27

Denmark reveals €800m tax fraud – the country's biggest The Guardian Bangladesh: National Board of Revenue zeroes in on tax dodgers The Daily Star Making Pakistan’s target for education financing a reality Brookings Institution End corporate tax evasion - finance public services TJN-Latin … [Read more...]

No, tax isn’t lawful extortion (or theft)

Updated with Chris Giles' response. Sigh. If we had a penny for each time we heard this . . . This claim is often associated with the U.S. libertarians, but this time it's Chris Giles, a respected commentator in the Financial Times, in an article entitled How to be hard left without being … [Read more...]

Our Spanish language podcast: Justicia ImPositiva, Edición 1

Justicia ImPositiva, Edición 1 del nuevo podcast de Tax Justice Network/Red de Justicia Fiscal En este mes de agosto 2015: desvelamos las estrategias de los países poderosos para continuar manteniendo un sistema tributario que beneficie a las grandes corporaciones. ¿Sabías que al menos 26 bancos … [Read more...]

Jersey court may be ready to consider tax matters in future trust rulings

A recent judgement on an application to rectify a Jersey trust suggests that the Royal Court of Jersey may in future take account of whether a trust is being used for tax avoidance. Remarks by the island's Bailiff (high court judge) William Bailhache are being interpreted by some Jersey lawyers as … [Read more...]