EU must force more transparency from companies in Africa - Piketty Reuters Event: Gabriel Zucman presents “Hidden Wealth of Nations: The Scourge of Tax Havens” Washington Center for Equitable Growth Taxing Africa’s richest and poorest Ventures Africa Swiss firms avoiding tax on gold, says … [Read more...]

Archives for 2015

Holes in new OECD handbook for global financial transparency

The OECD, a club of rich countries that dominates rule-setting for global financial transparency standards, recently published a Handbook for implementing its new global tool for countries to co-operate in fighting tax evasion, known as the Common Reporting Standard (CRS). The new handbook is part … [Read more...]

Country by Country Reporting: lobbyists eviscerate OECD project

From the Uncounted blog: "The governments of G8 and G20 countries gave the OECD a global mandate to deliver country-by-country reporting, as a major tool to limit multinational corporate tax abuse, and with particular emphasis on the benefits for developing countries. New evidence shows that – … [Read more...]

Links Sep 11

Greens call for stronger recommendations to fight corporate tax avoidance in Europe The Greens / European Free Alliance in the European Parliament Transparency & the State of the Union Transparency International On Jean-Claude Juncker giving his first annual ‘State of the European Union’ … [Read more...]

Tax Haven Germany – New TJN Book

Today TJN’s Markus Meinzer publishes a book (in German) whose translated title is “Tax Haven Germany – why many rich don’t pay tax here.” Listen here to a German national radio interview this morning with the author today; also read about it in Der Spiegel (or in web English here.) The official … [Read more...]

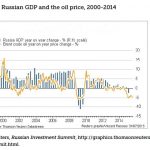

Russia’s offshore financial nexus, threatening financial stability and security

We have for years remarked on the role of the offshore system in promoting financial instability, not least for its propensity to enable financial players to get out from under financial regulations they don't like, then taking the cream from risky activities and shifting the risks onto others. … [Read more...]

Offshore whistleblowers Deltour, Gibaud, nominated for Sakharov prize

From the European Parliament: "Three whistle-blowers: Edward Snowden, a computer expert who worked as a contractor for the US National Security Agency and leaked details of its mass surveillance programmes to the press; Antoine Deltour, a former Price Waterhouse Coopers auditor who revealed … [Read more...]

Links Sep 10

Poor countries worry that developed nations drive tax agenda Business Day Live UK: Revenue & Customs 'winding down' inquiries into HSBC Swiss tax evaders The Guardian "After reopening investigation into HSBC clients hiding money in Switzerland, HMRC admits it has still only prosecuted one … [Read more...]

Tax havens and Promontory Financial Group: a “safe pair of hands?”

Now this presumably relates at least in part to this recent episode: what the New York Times calls: … [Read more...]

Will Brazil’s “CPMF” financial transactions tax live another day?

For the decade that lasted up to 2007, Brazil levied a tax on financial transactions called the CPMF. It was a biggy: this tax raised nearly $20 billion in its last year of operation before it was killed off by a coalition of people opposed to it, some of whom are in this photo. The tax had two … [Read more...]

Links Sep 9

EU tax haven blacklist—a misguided approach? LexisNexis TJN's Markus Meinzer and Andres Knobel on the misleading nature of the EU tax haven blacklist, and why blacklists might not be the right approach to tackle tax dodging. (This article was first published on Lexis(r)PSL Financial Services on 7 … [Read more...]

Urry: “offshoring and democracy are in direct conflict.”

From a useful long review of John Urry's book Offshoring, which was published a year ago and tackles issues close to us: "Whether it is the work of capital or governments, ‘offshoring and democracy are in direct conflict’ . Urry wisely refuses to entertain the idea that offshoring’s antipathy to … [Read more...]

Quote of the day: a tectonic shift in accounting standards

Yesterday we received an email containing our quote of the day: "this decades-overdue accounting rule is a historic development of tectonic proportions. It will enable analyses never before possible and vividly tie the opportunity costs of economic development to other public priorities." Our … [Read more...]

Congratulations to Professor Richard Murphy

TJN is delighted to hear that Richard Murphy, a long-standing senior adviser who has given enormous amounts of time to the tax justice movement since its founding in 2003, has been appointed as Professor of Practice in International Political Economy at the Department of International Politics at … [Read more...]

Links Sep 7

New FTSE100 survey should boost moves towards corporate tax transparency Christian Aid International taxation: if the rules of the game were changed? EurActiv (In French) Paying tax, a patriotic act: South African Revenue Service SABC Dubai courts Greek shipowners and operators Seatrade … [Read more...]