Dodgy tax deals constitute illegal state aid?

Even before the LuxLeaks scandal broke, the European Commission had been undertaking an investigation of advance tax agreements between companies and tax havens.

Well last week the Commission published its preliminary ruling on Amazon’s secret deals with the Luxembourg tax authorities.

The Commission’s views are set out in a 23 page letter, which says that the tax deal appears to constitute illegal state aid.

In other words, Luxembourg provides Amazon, a company with a €13.5bn turnover, a harmful competitive advantage over its rivals. So much for free market economics, it seems.

The letter is well worth a read. It lays bare the anatomy of an international tax avoidance scam.

One nugget is that Amazon’s tax adviser (PWC) wrote to the Luxembourg tax authorities seeking agreement on the prices paid between Amazon companies for services.

These, the tax adviser said, were calculated on an arms length basis, as if they were unrelated companies trading within a free market. The European Commission says that prima facie this is not the case and wants to investigate further.

Will the EU judge Amazon’s tax avoidance advisers to have acted illegally when it makes its final judgement? We can hardly wait to find out.

Oh and in case we forget: all of these rulings happened while Jean-Claude Juncker was prime minister of Luxembourg.

Why do Socialists support Jean-Claude “paradis fiscaux” Juncker?

We may never know why Europe’s heads of state and the European Parliament, in full knowledge of Luxembourg’s tax haven status thought that it would be a good idea to appoint Jean-Claude Juncker as president of the European Commission. But they did.

As reported previously in the Wrapper, far right-wing and populist MEPs tried to launch a motion of censure against Juncker, saying he was unfit to lead the European Commission.

Bizarrely, left-wing MEPs, Liberals and Greens joined the centre-right to support the Commission president.

The Greens then called for a committee of inquiry, which finally got enough signatures to get off the ground last week.

Sven Giegold, a German MEP, has published an analysis of the 188 signatories by political group and country.

It seems that Europe’s tax havens are none too pleased with the European Parliament looking into Juncker.

None of Malta’s MEPs signed, only 13% of the Netherland’s MEPs and a mere 10% of the UKs.

The big question however, is why the European centre-left remains such a big supporter of financial secrecy and Luxembourg’s tax deals, when all the evidence suggests that these deals serve no useful purpose and simply benefit powerful companies.

Only 16% of the main European Socialist group signed the call for the committee of inquiry, more than Europe’s main Conservative group, but far fewer than even the Eurosceptic group led by Nigel Farage from the UK’s UKIP.

So what on earth were the remaining 84% of the European Socialist group thinking?

Is Banco Penta “benta”?

Banco Penta, a Chilean corporate lender, is facing financial difficulty due to an ongoing corruption and tax evasion scandal. The two founders of the bank have been accused of using false receipts from family members to reduce their tax bill, and paying off politicians.

One of the pair has admitted to committing “tax infractions” but not crimes. So that’s probably alright then.

“Political donations”, by the way, went to former members of the regime of Augusto Pinochet.

With this kind of financial management it is not surprising that many are pulling their money out of the bank, with Bloomberg reporting a sharp drop in the price of Penta bonds.

Never mind the inequality, feel the power

This week, world leaders and billionaires fly in by private jet to an exclusive ski resort in the Alpine tax and secrecy haven of Switzerland to discuss the world economy.

A key issue on the agenda will be global economic inequality. Oxfam has just released figures which show that by next year the top 1% will own more than the rest of the world combined.

As world leaders try to see past the ski lifts, champagne and oysters to focus on issues facing the poor, it is worth reminding ourselves how we got here.

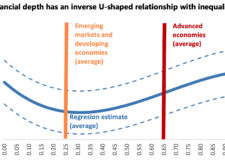

Tax havens play a big if not fundamental role according to Credit Suisse, and they should know a think or two about tax havens.

According to the bank’s wealth report, one of the main drivers of wealth inequality in the long term has been the erosion of inheritance tax through the use of tax avoidance structures.

Leaders may well then want to ponder whether Davos is an appropriate place to be discussing these issues.

Oil be needing a favour

The global oil price has crashed so its every oil company for themselves. That seems to be the attitude of some of the voices coming out of the UK at least.

The lobby group, Oil and Gas UK takes the view that every crisis presents an opportunity and has called for the UK rate of corporation tax rate on oil companies to be reduced from its current level of 80% to 30%. They want the oil industry to be treated just like any other business.

Except of course oil isn’t just like any other business. Oil companies extract a valuable natural resource from the ground. Ground belong to the citizens of the countries where the resources is located. For a licence to pump money, they pay a hefty fee involving both royalty payments and a higher tax rate on profits.

Changing that tax rate will have little impact on the cost of production. The tax is only paid if the company is making profits. If low oil prices mean no profits, than no tax is paid.

The high tax rates paid by oil companies in oil rich countries such as the UK and Norway mean that the their natural resources are divided somewhat more equitably than has been the case in some other palaces… places.

Leave a Reply