From the U.S. Institute on Taxation and Economic Policy (ITEP), the 5th edition of Who Pays, its signature report that examines tax systems in all 50 states and the District of Columbia. Now get the highlights:

From the U.S. Institute on Taxation and Economic Policy (ITEP), the 5th edition of Who Pays, its signature report that examines tax systems in all 50 states and the District of Columbia. Now get the highlights:

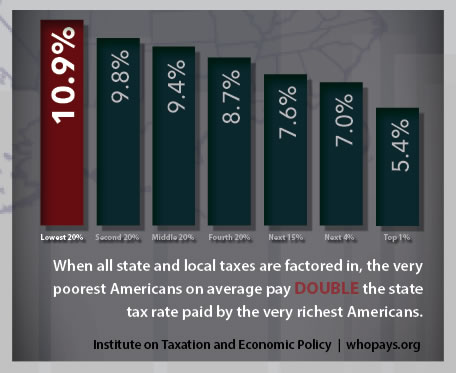

- Every state tax system (Washington D.C. excepted) taxes its poorest residents at significantly higher rates than the very wealthiest 1 percent of tax payers.

- The nation’s lowest-income 20 percent of taxpayers pay an average state tax rate of 10.9 percent v. 5.4 percent for the top 1 percent of taxpayers.

In the “Terrible 10” – the 10 states with the most regressive tax structures, the bottom 20 percent pay up to seven times as much of their income in taxes as their wealthy counterparts. Washington State is the most regressive, followed by Florida, Texas, South Dakota, Illinois, Pennsylvania, Tennessee, Arizona, Kansas, and Indiana.

States commended as “low tax” are often high tax states for low- and middle-income families. The 10 states with the highest taxes on the poor are Arizona, Arkansas, Florida, Hawaii, Illinois, Indiana, Pennsylvania, Rhode Island, Texas, and Washington. Seven of these are also among the “terrible ten” because they are not only high tax for the poorest, but low tax for the wealthiest.

Gosh. As they note:

“There are moral and practical reasons that state policymakers should address this gaping disparity. Unfair, regressive state tax systems not only exacerbate widening income inequality, they also make it more difficult for state tax systems to raise enough revenue to pay for priorities, from education to infrastructure, public safety and health.”

It is no coincidence that U.S. state tax systems are more regressive than the federal tax system, overall. Summing up perhaps the main reason, in two words: Tax Wars.

And if that stuff isn’t eyebrow-raising enough, try this.

This is truly a helpful article that provides insight about the tax economy nowadays. It is undeniable that their has been an aggressive change in the economy and a lot of people are being affected. Their should really be a clear explanation regarding how the taxes are distributed, and given this a lot of people are going around and worrying about their taxes. This article is helpful for businesses as well as accounting firms that handles tax preparation like VJN Associates.

shameless advertising . . . but just good enough to get through. Sorry but I took out the link though