In this article on why tax matters often need to be addressed at a global level, German finance minister Wolfgang Schäuble discusses the urgent need for new international rules to protect tax sovereignty and warns against the dangers of tax wars, commonly but misleadingly known as 'tax … [Read more...]

Archives for 2014

Who’s not coming to dinner? Some notes on the information exchange laggards

There's been a lot of news this week about a meeting in Berlin where finance ministers and tax bosses from 51 countries signed an agreement to implement automatic information exchange, a standard which we've been calling for for years and which is finally on the agenda. Germany's finance … [Read more...]

Links Oct 31

Capital Flight IV. Argentina, 2014: Manipulation of "Transfer Pricing" CEFID-AR (In Spanish) Transfer pricing: arms length alternatives needed European CEO See our page on Transfer Pricing here. Trial of former UBS executive dredges up Swiss banks' shady past Reuters … [Read more...]

New report: food speculation in poor countries, via tax havens

From the Financial Transparency Coalition, a blog by Naomi Fowler, entitled Feeding The 1%: New Report Exposes The Disturbing World Of Agricultural Investors, Financial Secrecy And Land Grabs. It looks at a report by campaign group GRAIN, which produces evidence indicating that an avalanche of … [Read more...]

How Europe’s Investment Bank flouts its own tax haven policies

The European Commission has launched a series of investigations into the tax structures of companies like Google, Apple and Amazon, for fear that they are siphoning off tax revenue from Europe. Far less attention has been paid to the role of institutions like the EU-backed European Investment Bank … [Read more...]

Links Oct 30

Cartoon of the day Alex / The Telegraph More Than 50 Countries Sign Tax Deal The Wall Street Journal See also: Automatic Info Exchange Moves A Step Closer Tax-News, Why Taxation Must Go Global Project Syndicate, Fifty-one countries sign OECD pact to tackle tax cheats Reuters, and our blog and … [Read more...]

Quote of the day: the London Black Hole and the Finance Curse

Our quote of the day comes from Tim Hames, director general of the British Private Equity and Venture Capital Association, via an excellent article on London by Charles Goodhart, which is well worth reading in its own right. ‘As far as the professional middle class is concerned London has become a … [Read more...]

UN Tax Committee meeting: dissenters absent?

We have often commented on the fact that the OECD, a club of rich countries, dominates rule-making on international tax while its much broader (and more legitimate) counterpart (perhaps one might say 'competitor'), the UN Tax Committee, has been left in the shade. Not only has the OECD (and its … [Read more...]

Brisbane G20 event: be part of the world’s biggest mock tax haven

From Micah Challenge in Australia, an event that comes ahead of the G20 world leaders' meeting in Brisbane due on November 15 and 16. They introduce it in their press release: "On Saturday 8 November, hundreds of concerned Australians dressed as corporate accountants will transform part of … [Read more...]

Links Oct 29

IMF calls for Caribbean tax changes Public Finance International IMF says tax competition (or "tax wars"), & tax incentives, are harmful. For the full speech by Min Zhu, Deputy Managing Director, IMF "Unlocking Economic Growth" see report by Eurasia Review here. Africa Must Better Target … [Read more...]

Are Kenyan tax holidays over?

Here's a headline (see picture) that should send ripples across the whole of Africa. Kenya's Business Daily reports that the Kenyan government is considering plans to withdraw tax exemptions granted to foreign investors, including ten year tax holidays on corporate profits and ten year withholding … [Read more...]

Links Oct 28

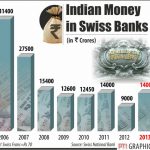

India: List of Black Money holders in Swiss Bank accounts leaked by WikiLeaks? India.com India: Black money disclosures may prove costly for banks Business Standard 'Differences with India on making public Swiss bank account information' The Economic Times 73 Of 100 Swiss Banks In Bed … [Read more...]

The Offshore Wrapper: a week in tax justice #37

China hits out against tax avoidance from multinationals The G20 Brisbane summit is just one month away. Two stories this week remind us that some of the fiercest critics of the offshore system are developing countries such as China and India. … [Read more...]

The End of Bank Secrecy? A new TJN report

A new (preliminary) report from the Tax Justice Network ‘The end of bank secrecy?’ Bridging the gap to effective automatic information exchange Leading finance ministers are meeting in Berlin this week to initiate a new global standard for the automatic information exchange of tax data. In … [Read more...]

Call for Papers: Women and Tax Justice Conference at Beijing+20, Ontario, March 2015

FEMINIST LEGAL STUDIES QUEEN’S and WOMEN FOR TAX JUSTICE and FEM TAX INTERNATIONAL CALL FOR EXPRESSIONS OF INTEREST IN PRESENTING PAPERS International Women’s Day Conference: Women and Tax Justice at Beijing+20: Taxing and Budgeting for Sex Equality … [Read more...]