Switzerland, it seems, has rejected the OECD's new project on automatic information exchange, out of hand. … [Read more...]

Archives for 2014

Tax Justice Focus – now fully available

We have finally completed the full upload to our website of all our past editions of Tax Justice Focus, our inaugural newsletter. Please take a look. … [Read more...]

New TJN briefing: OECD’s BEPS project for developing countries

TJN is pleased to publish a new briefing paper looking at the implications for developing countries of the OECD's widely referenced Base Erosion and Profit Shifting (BEPS) project, which is designed to find ways to tackle the deficiencies in the international tax system. It is available in English … [Read more...]

Should donors boost aid to Pakistan if it won’t tax its élites?

The U.S.-based Tax Analysts has just published a fascinating article with the bland title Should Donor Countries Push Tax Reform? The answer, we think, is generally 'yes' - though it depends, of course, what we mean by 'reform.' The article notes: … [Read more...]

France’s CAC 40: over 1500 tax haven affiliates

From Le Monde: "The corporations in the CAC 40 [France's benchmark stock exchange index of the 40 biggest French stocks] have over 1,500 affiliates in tax havens, according to a study published on Thursday by the journal Project . . . cross-checked with authoritative studies data (the work of the … [Read more...]

Links Feb 13

OECD takes aim at tax anomalies across borders Irish Examiner OECD head Ángel Gurría said: "... the options are simple: If you cannot tax the big guys you are left with the little guys and middle class to tax, and even if you tax them up to their noses, it won’t be enough. And then politics … [Read more...]

BVI tax haven floats 20 years in prison for whistleblowers

From the ICIJ: "The British Virgin Islands have never been accused of taking financial secrecy lightly. But last week, members of the BVI legislature took a step toward raising the territory’s noted secrecy protections to new heights. … [Read more...]

TJN responds to new OECD report on automatic information exchange

PRESS RELEASE New OECD report on automatic information exchange: will developing countries be left out? … [Read more...]

Links Feb 12

BVI Considers Tough Prison Sentences For DataLeaks ICIJ Google Take Down Stuart Syvret Blogspot Rico Sorda "The Jersey oligarchs and their protectors in London think that they can do what no corrupt regime around the world had been able to do – and keep embarrassing exposures about them off the … [Read more...]

Your tax cuts at work

British prime minister David Cameron has announced that money is no object when it comes to tackling the floods now inundating towns to the west of London. … [Read more...]

Links Feb 11

Fragile States 2014: Domestic Revenue Mobilisation OECD A Solution for the Inequality Politics of Post-2015? Center for Global Development … [Read more...]

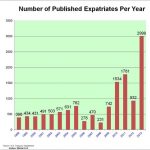

Number Renouncing US Citizenship rose 221% in 2013, in tax panic

That headline is at least what this contributor would have you take away from his latest column in Forbes. And of course the article speculates that it's all about tax, tax, and tax … [Read more...]

The Offshore Wrapper: the week in tax justice, Olympic edition

Welcome to the Olympic Edition of the Tax Justice Network’s Offshore Wrapper. … [Read more...]

London, the Great Sucking Sound, and the Finance Curse

From Aditya Chakrabortty in the UK's Guardian newspaper: some statistics that are classics of the "Finance Curse" analysis - where an oversized financial centre begins to weigh on the rest of an economy, rather than to support it. … [Read more...]

Why should tax havens insist on ‘reciprocity’ from poor countries?

One of the many devious ploys used by the Swiss financial centre to protect its often illicit gains is to insist on 'reciprocity' in the exchange of information. Along the lines of: "If we're going to share information with Nigeria, then they should share the same kind of information with us!" … [Read more...]