G20 Committed To 'Global Response' To BEPS Tax-News See also: G20 Agrees on Automatic Tax Data Sharing, OECD Says Bloomberg, and Multinationals unfazed by G20 tax crackdown The Conversation … [Read more...]

Archives for 2014

New report: Growth in Africa fails to curb soaring inequality

From TJN-Africa and Christian Aid: February 24 2014 GROWTH IN AFRICA FAILS TO CURB SOARING INEQUALITY, SAYS NEW REPORT Unprecedented economic growth in a number of African countries is going hand in hand with soaring inequality, which national tax systems are failing to address, according … [Read more...]

Links Feb 21

Members of the European Parliament take their first step to curb corporate secrecy and phantom firms Eurodad See also: MEPs vote to name trust beneficiaries in public registries STEP … [Read more...]

Links Feb 20

What Russian money sloshing back to Cyprus teaches us about tax havens Quartz "Building a financial system to serve foreign clients first doesn’t necessarily improve a country’s fiscal condition, as fiscal collapses in places like the Caymans have shown before." See also this months Taxcast … [Read more...]

The Fair Tax Mark – coming to the UK

Richard Murphy and Ethical Consumer today launch the Fair Tax Mark: "The world’s first independent accreditation scheme to address the issue of responsible tax." … [Read more...]

European Parliament votes to end anonymous shell companies

From Global Witness, via email: European Parliament votes to end anonymous shell companies … [Read more...]

The February Taxcast: Bahamas and more

In the February 2014 Taxcast: Are European tax havens getting 'illegal state subsidies'? The European Union's Competition Commissioner thinks they may be. Are the world's tax havens really going to become more transparent? We analyse the OECD's automatic information exchange proposal, warts and all. … [Read more...]

Links Feb 18

Tax evasion controversy shifts east swissinfo See also our blog on the failed Swiss "Rubik" deals. … [Read more...]

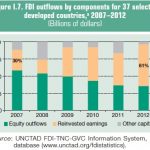

Foreign investment – smaller than you might believe

From Jesse Griffiths, Eurodad, with permission. Foreign investment – much smaller than you might believe You may have seen that foreign direct investment (FDI) was judged last month to have finally regained pre-crisis levels, and that a record percentage of all FDI – 52% - went to developing … [Read more...]

Australian tax office forced to pay Murdoch $880m over offshore scheme

From the Brisbane Times: "An $880 million payout to Rupert Murdoch's News Corporation has reignited the debate over whether global companies pay their fair share of tax in Australia. … [Read more...]

Swiss “Rubik” secrecy deal – let’s make sure those nails stay in that coffin

A nice article from the UK's Independent newspaper: "On Tuesday I had breakfast with a top team from the Swiss Bankers Association, who talked about what had happened since the signing of an agreement with Britain … [Read more...]

Links Feb 17

Tax havens: 'Why do we tolerate this?' devex Interview with Eva Joly, chair of the Committee on Development at the European Parliament … [Read more...]

The offshore wrapper: a week in tax justice

Welcome to this week’s Offshore Wrapper, by George Turner: a look back over the last week in tax justice. … [Read more...]

The UK Gold film: now available online

From Brass Moustache productions: "Where is the gold buried when crisis is looming and society begins to demand its share? With eloquence and polite mutual support, the British business establishment elegantly winds its way out of society's demands of accountability and community, and vast … [Read more...]

Links Feb 14

Tackling tax evasion: First Standard Automatic The Economist See also: Global tax standard attracts 42 countries Financial Times (paywall) - reports cite TJN's response to the new OECD report on automatic information exchange … [Read more...]