A useful reminder about shadow banking from Anastasia Nesvetailova, Reader in International Political Economy at City University London. It begins like this: “It takes me about two hours to assemble a team of finance geeks and lawyers to devise a product or a transaction that would bypass any new … [Read more...]

Archives for 2014

Survey: the corporate tax debate is biting the corporations

From tax advisers Taxand, who have just conducted a global survey of corporate Chief Finance Officers (CFOs): 76% of survey respondents said that the exposure in the media of corporate tax planning activity has a detrimental impact on a company’s reputation 31% said that the intense media … [Read more...]

Income inequality leads to slower economic growth – IMF study

From Reuters: "Income inequality can lead to slower or less sustainable economic growth, while redistribution of income, when measured, does not hurt and can even help an economy, IMF staff found in a research study released on Wednesday." … [Read more...]

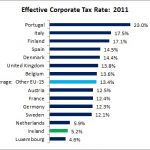

Read our lips: Ireland is a tax haven. Part xxvi

From Unite, Ireland (via Tax Research), a nice little graph showing effective corporate tax rates in Europe. We haven't seen this one before. Ireland, the Netherlands and Luxembourg - the Eurozone's three most notorious tax havens - are the clear abusers. … [Read more...]

The Credit Suisse scandal: echoes of Too Big To Jail

We've had a bit of time to look through the landmark Credit Suisse report from the U.S. Permanent Subcommittee on Investigations, outlining industrial-scale Swiss corruption. It contains some pretty instructive things about some of the ways banks use to get around international initiatives, and … [Read more...]

Tax havens and corruption: Lebedev and TJN in the NYT

From Alexander Lebedev in the New York Times: "According to the Tax Justice Network, an independent group promoting efforts to curb tax avoidance, crooked business people, working with corrupt officials, have embezzled $30 trillion over the last 15 years — or half of the world’s annual gross … [Read more...]

Credit Suisse: industrial scale corruption in Switzerland

From The Guardian: "Senators Carl Levin and John McCain had harsh words for the Justice Department and the Swiss government, too, as they released a 178-page permanent subcommittee on investigation (PSI) report into offshore tax avoidance. … [Read more...]

Guernsey milking and the offshore stock exchange

The International Advisor magazine has just reported: "Guernsey chief minister Peter Harwood resigned today, in the wake of publication of a critical article in the current issue of the British satirical and investigative publication, Private Eye." This refers to an excellent report entitled … [Read more...]

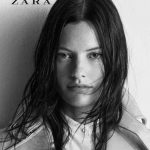

Fashion retailer’s tax dodges boost European inequality

Bloomberg tax star Jesse Drucker has another fine article out about the Spanish retailer Inditex, the parent of high street retail giant Zara. We would urge you to read it. Among many other things, it contains: "In the past five years, Inditex has shifted almost $2 billion in profits to a tiny … [Read more...]

Report: the Sorry State of U.S. Corporate Taxes, 2008-2012

A major new report from the indefatigable Citizens for Tax Justice in the U.S. The Executive Summary begins: The Sorry State of Corporate Taxes What Fortune 500 Firms Pay (or Don’t Pay) in the USA And What they Pay Abroad — 2008 to 2012 … [Read more...]

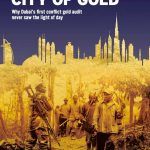

Ernst & Young: why Dubai’s first conflict gold audit was silenced

We have remarked before on Dubai's role as a particularly egregious and recalcitrant secrecy jurisdiction, harbouring some of the world's worst scoundrels and their money: the likes of Indian master criminal Dawood Ibrahim, the arms dealer Viktor Bout, and many others. Dubai ranks 16th in our … [Read more...]

Local innovators lament the City of London’s failure

Cross-posted from the Treasure Islands blog: From the Financial Times, a short video entitled Bright Future for British Engineering? It looks at some promising stuff going on in the Advanced Manufacturing Research Park, a collaboration between the University of Sheffield and Boeing Corp. The … [Read more...]

Automatic info exchange: will Europe’s spoilers soon play ball?

Recently we explored the welcome (if imperfect) news that the OECD had presented its report on a new global standard for countries and tax havens to exchange information with each other automatically: a brand new tool for fighting tax evasion. And a few days ago we reported on a European … [Read more...]

The Trans Pacific Partnership, economists, bozos and bamboozlement

We've been sent a nice cartoon about the Trans-Pacific Partnership trade agreement - which, while not an issue we're working on directly, is interesting. … [Read more...]

The offshore wrapper: a week in tax justice

Welcome to this week's Offshore Wrapper by George Turner: a look back over the past week in tax justice European Parliament backs crackdown on money laundering On Thursday the European Parliament took an important step towards ending financial secrecy and dodgy shell companies when a … [Read more...]