From the Daily Journal, an article by Rabbi Menachem Creditor in the U.S.: "I recently returned from Washington, D.C., where I joined the interfaith, bipartisan anti-poverty group Jubilee USA and other faith leaders and small-business owners from across the country to encourage our elected … [Read more...]

Archives for 2014

Quote of the day: coddling internet infants with tax subsidies

From Citizens for Tax Justice in the U.S. Dear Congress: The Internet Never Was an Infant Industry That Needed Coddling That's our quote of the day, from their headline. There's simply no reason to shovel subsidies at this fabulously wealthy (and increasingly politically powerful) sector. Yet … [Read more...]

Links Jun 19

G8 Has Yet To Live Up To Its Promises On Tax And Transparency Financial Transparency Coalition Blog Swiss Cabinet to examine tax deductible bank fines swissinfo … [Read more...]

Howard Davies: the banks that ate the economy

Update: another piece of research here. From Project Syndicate, an article with an identical headline to ours by Howard Davies, former Chairman of the UK's Financial Services Authority (FSA). The article focuses on what the iconoclastic economist Andrew Haldane of the Bank of England has … [Read more...]

Quote of the day: CEO narcissism and tax avoidance

From a new paper entitled CEO narcissism and tax policies (via TaxProf): "We document a positive association between CEO narcissism and various measures of corporate tax avoidance and tax risk." We haven't read the paper yet but the correlation, which may simply be a matter of amusement for some, … [Read more...]

Links Jun 18

The True Cost of Hidden Money - A Piketty Protégé’s Theory on Tax Havens The New York Times "What’s beyond question is that there is no economic, political or moral justification for tax evasion - it exists only because of the political influence that wealth buys. A society that fails to fight … [Read more...]

Big Bills: how our central banks nurture money launderers and kleptocrats

A question for our European readers. How many of you have ever spent or even seen a 500 Euro note? No, neither have we. Which is may seem odd, given that there are some 300 billion Euros' worth of these things out there, in circulation. Which raises the question: where are they all? … [Read more...]

Links Jun 17

Editorial - Corporations and their tax shell games: Time for a global crackdown Los Angeles Times Israel to tax Google and Facebook on profits i24 A lower rate of corporation tax – that’s what Japanese companies will get for not paying it The Independent … [Read more...]

London march: Join the new Tax Dodgers’ Alliance

From UK Uncut, a march planned for this Saturday (June 21): Come and join the newly formed 'Tax Dodgers Alliance'. Big businesses and the super wealthy are welcome. Bankers, lawyers, CEOs, new money, old money... What do we have in common? We're stinking rich & we don't want to share - our cash … [Read more...]

The Offshore Wrapper: a week in tax justice

The Offshore Wrapper is written by George Turner Football: a game of two halves - corruption and scandal The World Cup of scandal and corruption rolls on. This week Global Witness has exposed the role of the Brazilian Development Bank, Banco Nacional de Desenvolvimento Econômico e Social, in … [Read more...]

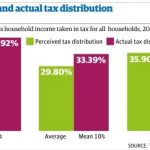

Unequal Britain: tax system is much less progressive than people believe

More evidence, if this was needed, that people can be fooled most of the time by the repetitive drip, drip feed of tax nonsense coming from much of the media, some parts of academia and think-tanks, and from far too many politicians. … [Read more...]

Islands (or how to play dirty and get away with it)

We are delighted to be associated with a new play by award-winning Caroline Horton called Islands (or how to play dirty and get away with it). In Caroline's words: "Islands will be an illuminating, absurd and powerful new show about tax havens, little empires, enormous greed and the few who … [Read more...]

From The Namibian: an open letter to De Beers on transfer pricing

FROM TODAY'S EDITION LETTERS AS NAMIBIAN political activists, we are writing to you because we are greatly concerned about your transfer-pricing methods. We know that transfer-pricing occurs when two companies from the same multinational corporation trade with each other. … [Read more...]

Insurance sector seeking to trick the OECD with giant secrecy loophole?

Update: with Gibraltar / Bermuda shenanigans. Last February the OECD, which has been mandated to set global financial transparency standards, presented a major report on a new global standard for transparency and to fight the scourge of tax evasion. We broadly welcomed the project, but noted … [Read more...]

Civil society letter to OECD on its corporate tax project

The OECD's so-called Base Erosion and Profit Shifting (BEPS) project which aims to reform the hopelessly outdated international tax system, has been progressing, and TJN and others have been monitoring it. Civil society organisations, including those coordinated through the Global Alliance for … [Read more...]