Offshore deals worth £80bn sealed in just three months New data from Appleby shows that offshore deals jumped in the last quarter making the three months to June one of the highest value quarters for offshore deals in the last ten years. In total US$80bn of mergers and acquisitions were … [Read more...]

Archives for 2014

No Role for Public Scrutiny in OECD Plan to Curb Corporate Tax Dodging

From the Financial Transparency Coalition, of which TJN is an active member: No Role for Public Scrutiny in OECD Plan to Curb Corporate Tax Dodging For Immediate Release September 16, 2014 WASHINGTON, D.C. — The Organization for Economic Cooperation and Development’s (OECD) new … [Read more...]

Petition: tell the UN to stop tax abuse

We recently noted an open letter to Ban Ki-Moon, by the group Academics Stand Against Poverty, calling on the United Nations to put an end to tax abuse. Now here's the Avaaz petition. Please sign, and pass it on. … [Read more...]

Anatomy of a tax haven: how the finance curse strikes Jersey

The investigative newspaper Médiapart, which is fast gaining a reputation in France for hard-hitting reporting, has a special report on Jersey, Britain's (and to a lesser extent France's) favourite tax haven. It is fascinating, not least because it explicitly references our work on the Finance … [Read more...]

Country by country reporting: here it comes

From Tax Research, reposted in full, with a few key links added: The era of country-by-country reporting is arriving The OECD has announced its 2014 outcomes from the Base Erosion and Profits Shifting process this afternoon. As far as I am concerned the key issue is country-by-country … [Read more...]

Quote of the day – on tax laws and corporate partners

From Marty Sullivan (pictured), a top U.S. tax expert, speaking last year: “What politicians keep forgetting is that you can’t ‘partner’ with the corporate community when it comes to writing the tax laws,” Sullivan explains. “They’re not partners — they are adversaries.” Someone ought to send a … [Read more...]

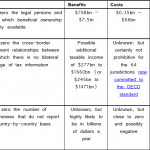

Three Illicit Flows Targets for the Post-2015 Framework

From Alex Cobham at the Center for Global Development, with hat tip to Tax Research. For an earlier article about the post-2015 framework, please click here. Three Illicit Financial Flows Targets There is broad consensus on the need for the post-2015 successor framework to the Millennium … [Read more...]

UNCTAD: the time for tax justice has come

A press release about the latest UNCTAD Trade and Development report 2014: "Governments, from rich and poor countries alike, should be able to finance the investment and other public spending required to meet the demands of their citizens for a more prosperous and secure life. Mobilizing domestic … [Read more...]

On the human rights of bad guys

There's been a lot of talk recently in the human rights field about tax justice issues - and rightly so. Now a new academic book to add to the collection, considering things from a different angle. It's called The human rights of bad guys: corruption, asset recovery, and the protection of property … [Read more...]

Links Sep 12

Tax justice – in it for the long haul Christian Aid Three Illicit Flows Targets for the Post-2015 Framework Center for Global Development How tax inspectors could prevent the next Ebola outbreak The Conversation See also recent blog: Tax Inspectors Without Borders – an update The … [Read more...]

Will the UN take serious action to stop the loss of trillions of dollars to tax abuse?

From Prof. Thomas Pogge: "Intense negotiations are going on at the United Nations about the formulation of the new sustainable development goals (SDGs) and the targets and indicators to be used for specification and measurement. Starting 11 September, the president of the general assembly will host … [Read more...]

Links Sep 11

Fiscal justice to reduce inequality in Latin America and the Caribbean Oxfam International Taxes: the structural reform pending in Latin America BBC World (In Spanish) Hat tip: Jorge Gaggero Swiss Minister’s offshore business to be re-investigated swissinfo … [Read more...]

Corporate Deadbeats: How Companies Get Rich Off Taxes

A nice cover story in Newsweek from David Cay Johnston, worth remarking on because it's written so clearly and is a powerful indictment of what's going on in the corporate U.S. at the moment. A sample from the article: "How can a tax burden become a boon? Simple. Congress lets multinationals … [Read more...]

Links Sep 10

The Creation of International Financial Centres in Africa: The Case of Kenya Anti-Corruption Resource Centre Elderly Lobbyist Always Droning On About How Little Legislation Cost In His Day The Onion A Made-in-America Offshore Tax Haven Newsweek Developing Countries Losing Billions To … [Read more...]

Basic income: the world’s simplest plan to end poverty

From an article on Vox, explaining the concept: "Basic income" is shorthand for a range of proposals that share the idea of giving everyone in a given polity a certain amount of money on a regular basis. A basic income comes with no categorical eligibility requirements; you don't have to be blind … [Read more...]