From our colleagues at Kepa in Finland, describing the birth of a region-wide consolidation of the previously scattered tax justice movements in Asia. "Over 60 leaders of people´s movements, civil society organizations and trade unions came together in Bangkok and took up the task of building a … [Read more...]

Archives for 2014

Freeports: now Luxembourg adds to the sleaze

Update: fascinating article by The Independent on this freeport. In June we noted that France's Médiapart had done an excellent investigation into Freeports: special kinds of tax haven offerings that fill a particular niche in the grand, constantly mutating global offshore ecosystem. Before … [Read more...]

New book: fighting corporate abuse

A new book titled "Fighting Corporate Abuse: Beyond Predatory Capitalism" is to be published by Pluto. The authors include two TJN Senior Advisers, Prem Sikka and Sol Picciotto. The book offers public policies for tackling corporate abuses, as the blurb notes: … [Read more...]

The Taxcast, September 2014

The latest Taxcast: 'Unpatriotic corporate deserters'? We ask why so many US companies are relocating, and what we can do about it (update: as the Taxcast was coming to press, we have some news). Also, the less reported side of the Scottish vote on independence, the OECD's latest 'action' … [Read more...]

Links Sep 23

U.S. Treasury moves against tax-avoidance 'inversion' deals Reuters See additional links to press and blogosphere coverage via TaxProf Blog, and AstraZeneca shares fall as Obama thwarts tax inversion deals The Guardian U.S. Business Shows Continuing Concern Over BEPS Tax-News U.S. Business … [Read more...]

OECD again pretends it’s solved the problem of financial secrecy

The OECD seems to have learned from experience that if you make a grand, unsubstantiated claim in support of your work, half the world's journalists will cut and paste your statements without stopping to check how true they are. For example, in 2011, they grandly announced that The Era of Bank … [Read more...]

Don’t sign OECD tax treaties: the case of Uganda

Update, Dec 9: Martin Hearson adds his own updated analysis of Uganda's tax treaties in a Powerpoint presentation here. A while ago we quoted U.S. tax expert Lee Sheppard excoriating OECD model tax treaties, in a fiery presentation which included such gems as: For multinationals, "there are … [Read more...]

The Offshore Wrapper: a week in tax justice #32

Ali Baba and the Chinese princelings Alibaba, the Chinese online business, last week raised $25bn in what is now the world’s largest ever stock market flotation. This values the company at more than Amazon and Facebook. … [Read more...]

Links Sep 22

G20 countries agree to exchange tax information to stamp out evasion The Guardian See TJN commentary on the OECDs Automatic Information Exchange Standard here. See also: India: From today, a new beginning to end global bank secrecy: G20 The Economic Times Ireland: Pressure rises to close tax … [Read more...]

Cayman Compass: Public registers would foil tax criminals

Cayman Compass has just published the following letter from TJN and Transparency International in response to an article by Carlyle Roger: … [Read more...]

BEPS – minor victories but we risk losing the war

The following are detailed thoughts on the OECD BEPS year one outcomes prepared by friends and colleagues at Eurodad (the European Network on Debt and Development). … [Read more...]

Links – Sept 19

We've not had links for a week, for capacity reasons. Here is a somewhat quirky selection: Alibaba's corporate structure: just look at those British tax havens FT Alphaville The Life and Times of John Fredriksen - Putin's "Bagman" in London Fredriksen Watch Part 3. The first English … [Read more...]

OECD tax boss says OECD tax haven is a victim

Pascal Saint-Amans, the OECD's head of tax, has made some rather ill-advised comments in an otherwise interesting interview with the Irish Times. This concerns the OECD's so-called BEPS (Base Erosion and Profit Shifting) project to try and crack down on some of the more egregious loopholes in … [Read more...]

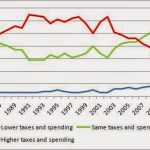

How many people in a democracy want lower taxes?

Well, that clearly depends on the country, and the time of day. Britain is reputed to be one of the more conservative, lower-tax ones, at least among OECD countries. But this graph, from Oxford economics professor Simon Wren-Lewis about UK attitudes on the size of the state, should certainly give … [Read more...]

Quote of the day: shareholder value and economists

From a fascinating long article about the genesis of high executive pay in the United States, a quote from French financial economist Jean-Charles Rochet: “Everyone knows that corporations are not just cash machines for their shareholders, but that they also provide goods and services for their … [Read more...]