Ten drivers of inequality in Africa Oxfam How tax inspectors could prevent the next Ebola outbreak The Conversation See also recent blog Tax Inspectors Without Borders – an update Argentina: Courts could dismiss Swiss bank data Buenos Aires Herald Swiss-Indian tax negotiations yield … [Read more...]

Archives for 2014

Fair taxes are key to a fair share for all

Guest blog from the Global Alliance for Tax Justice Growing inequality within and between countries has become one of the defining issues of our age. It seems a week cannot go by without another damning report looking at the size and harmful consequences of this pervasive problem. … [Read more...]

A reminder of why everyone is underestimating inequality

In 2012 we published a document entitled Inequality: you don't know the half of it, in which we made the fairly obvious point that studies estimating inequality almost always fail to take offshore wealth (and income) adequately into account, and thus get things wrong at the top end of the income … [Read more...]

Links Oct 16

Financing for development: What actions are needed on debt and illicit capital flows? Bretton Woods Project Debt and Development Coalition Ireland says government playing musical chairs on corporate tax and government failed to tackle bank debt See also: Ireland ends one era of abuse – and … [Read more...]

Quote of the day: City of London and financial fraud

One of a long line of "quotes of the day: this one from 2013, but still relevant today The “race to the weakest supervisor” did not occur only within the U.S. Brooksley Born and a former senior SEC official have confirmed to me that UK regulators directly pitched U.S. financial firms to relocate … [Read more...]

EU Savings Tax Directive to be repealed?

The EU Savings Tax Directive (EUSTD) has been the EU's flagship transparency initiative since its introduction in 2003, and we have written about it on many occasions. It complements another EU transparency scheme called the Directive on Administrative Co-operation, which was beefed up this week, as … [Read more...]

Bono: Tax Haven Salesman for the Celtic Paper Tiger

We've been (almost) biting our TJN tongues on Mr. Bono's latest outburst since the weekend. We were waiting for this to come out. Cross-posted from Naked Capitalism, with permission. We've tweaked a couple of words here and there. Bono: Tax Haven Salesman for the Celtic Paper Tiger By Nicholas … [Read more...]

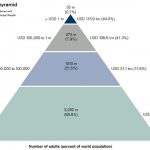

Picture of the day: the global wealth pyramid

Credit Suisse's new Global Wealth Report is out. As always, it contains a ream of useful data. For instance, it estimates that global household wealth reached US$263 trillion in mid-2014, up from $117 trillion in 2000: "Between 2008 and mid-2014, mean wealth per adult grew by 26%; but the same … [Read more...]

Tax haven Panama: it’s time for blacklists and sanctions now

Ten years ago Jeffrey Robinson published a book about tax havens called The Sink, where he quotes a U.S. Customs official as saying of Panama: "The country is filled with dishonest lawyers, dishonest bankers, dishonest company formation agents and dishonest companies registered there by those … [Read more...]

Tweet of the day: Bono and the “Double Irish” tax loophole

The (-ve) Value of Jersey to the UK Economy

The G20 summit meeting of world leaders in Brisbane next month will have corporate transparency on the agenda. Unsurprisingly, secrecy jurisdictions are working overtime to deflect attention away from their core activities, such as the provision of secrecy and facilities to escape tax, legally or … [Read more...]

African low income countries demand fair share of tax

From Tove Maria Ryding at Eurodad, via email: At a media event in Washington last week, finance ministers of francophone low-income countries (DRC and Cameroon) demanded a "fair share of global tax revenues" and a "high-level meeting under UN auspices". … [Read more...]

The Offshore Wrapper: a week in tax justice #35

Tax Justice Network Africa launches legal challenge on Kenya government The Tax Justice Network Africa has launched a legal challenge to the Kenyan government’s double taxation agreement with Mauritius. … [Read more...]

Guest blog: Tax and the social contract in Brazil

Guest blog: Tax and the social contract in Brazil By Marcus Melo, professor of Political Science at the Federal University of Pernambuco, Brazil, and Armando Barrientos, co-research director of the International Research Institute on Brazil & Africa. Internationally, debates on tax in … [Read more...]

TJN Africa takes Kenya government to court over Mauritius treaty

Kenya's Star newspaper is reporting that TJN-Africa has gone to the High Court in Nairobi to stop a double tax treaty between Kenya and Mauritius, which is supposed to come into effect in July 2015. Not only do tax treaties with tax havens like Mauritius often allow multinational corporations to … [Read more...]